The volume of incoming huge news stories these days is getting to be as overwhelming as it was during the Trump years. But it's also a reminder to anyone who has deluded themselves into thinking that the Trump Era is over, it is anything but. We were planning on covering ProPublica's blockbuster bombshell exclusive this week on today's BradCast --- and we still do --- though it has been somewhat eclipsed by last night's New York Times blockbuster bombshell exclusive. We do our best to cover both today. [Audio link to full show follows below this summary.]

The volume of incoming huge news stories these days is getting to be as overwhelming as it was during the Trump years. But it's also a reminder to anyone who has deluded themselves into thinking that the Trump Era is over, it is anything but. We were planning on covering ProPublica's blockbuster bombshell exclusive this week on today's BradCast --- and we still do --- though it has been somewhat eclipsed by last night's New York Times blockbuster bombshell exclusive. We do our best to cover both today. [Audio link to full show follows below this summary.]

First, the remarkable news broken by the Times late on Thursday is that Donald Trump's wildly corrupt Dept. of Justice was a whole lot more corrupt than we have all yet fully appreciated. As it turns out, in an unprecedented move, his DoJ secretly subpoenaed phone, email and text message data of Democratic members of Congress on the House Judiciary Committee. But it wasn't just members that Trump saw as political enemies, including top Judiciary Dem Adam Schiff and Rep. Eric Swalwell. It was also their staff and even their children, one of whom was a minor, according to the Times' blockbuster.

All of that, even as the Trump Administration spent years blocking Congress from lawful subpoenas for testimony and documents from the White House itself and virtually every Executive branch agency, under the false premise that it would violate the Constitution's Separation of Powers, granting co-equal powers to both the Legislative and Executive branches. All the while, the Trump Administration was actually --- literally --- spying on members of the Legislative branch, while claiming (disingenuously) that Congress was overstepping its bounds by issuing lawful, public subpoenas for testimony to members of the Executive branch.

The stunning news comes after a week in which we previously learned that the Trump DoJ also secretly obtained phone, email and text records of journalists at the Washington Post, New York Times and CNN. Democrats claim to be outraged by it all, and vow to investigate. But without real legal consequences, accompanied by sweeping reforms by both Congress and, most immediately, Merrick Garland's Dept. of Justice, the appalling and outrageous and unlawful acts carried out during four years of the Trump Administration will absolutely be carried out again --- and even worse next time --- in the very near future.

Speaking of much-needed, long-overdue action from Congress, the ProPublica bombshell this week revealed that --- based on a "vast cache of IRS information" somehow obtained by the non-profit media outlet on the nation's wealthiest men --- American billionaires have been allowed to avoid almost all federal income taxes for years on their accumulated and still-surging wealth. As the media outlet reports in their jaw-dropping, nearly 6,000 word exclusive this week, "billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing."

Their months-long analysis of the data "demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can --- perfectly legally --- pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year."

The raw IRS data show that billionaires like Bezos (the world's wealthiest man), Musk, Buffett and the others often pay zero in federal income taxes. Overall, the nation's top 25 wealthiest --- whose fortunes increased collectively by $401 billion between 2014 and 2018 --- paid a tax rate on that accumulated wealth of just 3.4% on average. That, compared to a median tax rate of 14% paid by regular, middle-class Americans, as the U.S. tax code rewards wealth over labor.

The New York Times explains in its own coverage of ProPublica's scoop, that even as Congress and President Biden bicker over tweaks to marginal tax rates, the ultra-wealthy avoid such trivialities all together. "The ProPublica revelations got to a widely understood issue: that the superrich earn virtually all their wealth from the constantly rising value of their assets, particularly in the stock market, and that the sales of those assets are taxed at a lower rate than ordinary income from a paycheck...But the analysis also revealed a less recognized strategy employed by the superrich: taking huge loans, using their assets as collateral. It allows them to avoid selling their assets and facing taxation, and even to write off some lending costs. In that way, Mr. Bezos and Mr. Buffett were able to show yearly income losses even as their wealth grew by billions of dollars."

Mother Jones' Senior Editor MICHAEL MECHANIC joins us today with a great deal of context and perspective on this long running, if legal, scam, after spending a couple of years hanging out with the ultra rich while researching his newly published book, Jackpot: How the Super-Rich Really Live --- and How Their Wealth Harms Us All.

Mechanic underscores the scam revealed by ProPublica: "As we've seen from the way the tax code works, wealth begets wealth, and we reward capital over wages. If you make a fortune on a stock, you pay a maximum of 20% when you sell that stock. In the meantime, when you hold it, you don't pay any taxes at all --- it's called 'unrealized gains.' What these billionaires have done is they just borrow against that. They never have to sell, so they never even pay the capital gains tax. Meanwhile, you and I are getting a paycheck. If we made as much as they did, we'd be charged 37%. So it's 37% versus 20% for assets, but they're not even paying the 20% because they're not selling the assets. They're taking out low-interest loans, paying a few percent, living on that money." And, yes, even as the cost of the interest would be less than they'd have to pay in taxes if they sold assets to live on their own money instead, they actually get to deduct the cost of those loans from their income taxes!

We discuss, among other things, how all of this actually hurts average Americans; how, because of it, trillions of dollars are not available to the government to spend on healthcare, schools, climate change, infrastructure and other public services; what, if anything, can or will be done about it by Congress --- where Republicans (and too many Democrats) seems to be just fine with a system that rewards wealth over work; whether proposals like Elizabeth Warren's wealth tax of .02 cents on every dollar of wealth by those worth more than $50 million could ever be adopted in Congress or is even Constitutional; and how all of this wealth doesn't even get taxed upon death when it's passed from generation to generation, as Mechanic reports at MoJo today.

"There's always been this argument, from the very beginning, that if you tax investors and business people, those people then won't invest, won't create jobs," Mechanic observes. "It's a spurious argument. If you have $100 million and somebody raises the capital gains rate, does that mean you're not going to start a company? You're not going to put it into the stock market? No, of course not. What else are you going to do with your money, put it under your mattress?!"

And, yes, we also discuss his new book (highly lauded by the legendary Bill Moyers!), which Mechanic describes as "not a polemical book. It's a funny, entertaining, and enraging character-driven narrative, in which I basically hang out with super-wealthy people and their minions. I interview researchers, I talk to a woman who trains billionaires' nannies in physical combat, [and] a guy who builds luxury safe rooms. It's a journey of the American wealth fantasy and how it's gone off the rails."

So, hey, if you're not already enraged enough by today's program, please buy Mike's book! It's out just in time to enrage Dad for Father's Day!

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

Repub Support for Immigrants Skyrockets Amid Trump's Crackdown: 'BradCast' 7/14/25

Repub Support for Immigrants Skyrockets Amid Trump's Crackdown: 'BradCast' 7/14/25  Sunday 'Totally Predictable' Toons

Sunday 'Totally Predictable' Toons Democracy STILL Our Best Way Out of This Mess -- And Repubs Know It: 'BradCast' 7/10/25

Democracy STILL Our Best Way Out of This Mess -- And Repubs Know It: 'BradCast' 7/10/25 'Green News Report' 7/10/25

'Green News Report' 7/10/25

'Mass Shooter Subsidy'?: More Dumb, Deadly Stuff in Trump's New Law: 'BradCast' 7/9/25

'Mass Shooter Subsidy'?: More Dumb, Deadly Stuff in Trump's New Law: 'BradCast' 7/9/25  Trump's New Law Supersizes ICE, Mass Detention, Militarization: 'BradCast' 7/8/25

Trump's New Law Supersizes ICE, Mass Detention, Militarization: 'BradCast' 7/8/25  'Green News Report' 7/8/25

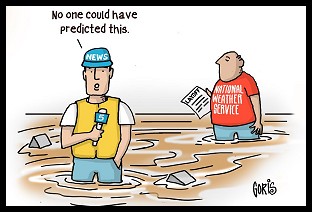

'Green News Report' 7/8/25 Texas Flooding Tragedy Was Both Predictable and Predicted: 'BradCast' 7/7/25

Texas Flooding Tragedy Was Both Predictable and Predicted: 'BradCast' 7/7/25 Sunday 'Big Billionaire Bonanza' Toons

Sunday 'Big Billionaire Bonanza' Toons Sunday 'Total Obliteration' Toons

Sunday 'Total Obliteration' Toons 'Green News Report' 6/26/25

'Green News Report' 6/26/25 Thank You For Your Attention to This Matter:

Thank You For Your Attention to This Matter: Mamdani Primary 'Win' Augurs New Era of Rising Progressives: 'BradCast' 6/25/25

Mamdani Primary 'Win' Augurs New Era of Rising Progressives: 'BradCast' 6/25/25 U.S. Authoritarianism Under-way (But We're Still Here to Fight It): 'BradCast' 6/24/25

U.S. Authoritarianism Under-way (But We're Still Here to Fight It): 'BradCast' 6/24/25 'Anti-War' Trump Attacks Iran on False Claims About WMD: 'BradCast' 6/23/25

'Anti-War' Trump Attacks Iran on False Claims About WMD: 'BradCast' 6/23/25 Senate Health Care Cuts 'More Extreme' Than House Version: 'BradCast' 6/19/25

Senate Health Care Cuts 'More Extreme' Than House Version: 'BradCast' 6/19/25 What 'Anti-War President'? MAGA Civil War Over Trump, Iran: 'BradCast' 6/18/25

What 'Anti-War President'? MAGA Civil War Over Trump, Iran: 'BradCast' 6/18/25 Trump's 'Remigration' is Code for 'Ethnic Cleansing': 'BradCast' 6/17/25

Trump's 'Remigration' is Code for 'Ethnic Cleansing': 'BradCast' 6/17/25 Last Weekend Today: 'BradCast' 6/16/25

Last Weekend Today: 'BradCast' 6/16/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL