Guest: Jay Willis of Balls and Strikes; Also: Trump's vindictive plan to shutter nation's 'crown jewel' of atmospheric climate, weather science...

On today's BradCast: Our final round-up of the Gerrymandering Wars at year's end, as we head into the critical 2026 election year following a big, disturbing, redistricting ruling by the corrupt Republican SCOTUS majority. Also today, similarly disturbing news regarding our petty President's latest scheme to undermine life-saving climate science. [Audio link to full show follows this summary.]

On today's BradCast: Our final round-up of the Gerrymandering Wars at year's end, as we head into the critical 2026 election year following a big, disturbing, redistricting ruling by the corrupt Republican SCOTUS majority. Also today, similarly disturbing news regarding our petty President's latest scheme to undermine life-saving climate science. [Audio link to full show follows this summary.]

FIRST UP... News broke last night that Donald Trump has ordered the dismantling of the world-renowned National Center for Atmospheric Research (NCAR) in Boulder, Colorado, due to what the fossil-fueled Administration ridiculously describes as "federal climate alarmism".

NCAR was created by the National Science Foundation in 1960 as an independent executive agency funded by Congress, as global warming caused by the burning of fossil fuels was already becoming an increasing concern. Even one of the few climate scientists known for his climate change skepticism described NCAR today as a "crown jewel" for the study of atmospheric chemistry and physical meteorology.

The climate science community is, as Hill Heat journalist Brad Johnson reports, "in complete shock" about this "insane move" to undermine science and put millions of lives at risk.

But, believe it or not, while shuttering the 65-year old institution will certainly serve the White House's fossil fuel industry masters well enough, the move actually seems to have as much to do with Trump's twisted vendetta against Democratic Colorado Gov. Jared Polis on behalf of brain-poisoned former MAGA County Clerk Tina Peters. She is currently serving 9-years in prison related to breaking into and making unlawful copies of voting system hard drives in a failed attempt to prove fraud during the 2020 election.

Yes. It's all as ridiculous and self-defeating as it sounds. But, that's Trump. Scientists vow to fight the move, even as Trump will likely have to count on his corrupted SCOTUS to allow him to force his will on yet another federal agency created by Congressional mandate to be independent from the Executive Branch.

THEN... As you know by now, afraid of being seen as a loser yet again next year, our corrupt President began ordering Republican-controlled states earlier this year to take the virtually unprecedented step of redistricting U.S. House maps mid-decade in order to try and gerrymander seats held by Democrats out of existence.

The multi-state effort had largely been a wash for the GOP to date, as "blue" states pushed back to try and balance the scales in response. It might have even resulted in a loss for Republicans next year, thanks to a ruling by a three-judge federal panel --- led by a Trump-appointed judge(!) --- after a 9-day hearing of evidence and witnesses, finding that Texas' attempt to gerrymander five Democratic seats in largely majority-minority districts amounted to an unlawful, unconstitutional racial gerrymander.

But, after the briefest of reviews over the Thanksgiving holiday, the corrupt Republican SCOTUS majority issued a terse, unsigned "shadow docket" ruling that allowed the unlawfully gerrymandered Texas map to be used in next year's critical midterms anyway. The 6 to 3 Republican majority said it was just too late and too confusing to use the House maps that used over the past two elections in the Lone Star state.

Citing the "Purcell Principle", another one of the Roberts Court's made-up use-if-and-when-necessary legal doctrines, the majority gave Texas the green light to use its new, unconstitutional, Republican-friendly map next year because the lower court "improperly inserted itself into an active primary campaign, causing much confusion and upsetting the delicate federal-state balance in elections."

Try not to laugh. That "active primary campaign" the lower court "improperly inserted itself into" would be the midterm primaries scheduled for next March in Texas, to determine candidates for the ballot in November of 2026. While few realized it was an "active" campaign at this point, it could have been, as our guest today notes, moved back by the court, if necessary. Though it is hardly necessary, being months away and, until the new ruling, run on a map that voters have been using without a problem since 2022.

All of that, is ridiculous enough. But, as Justice Elana Kagan noted in her dissent on behalf of the Court's three liberals, the majority ruling now offers a clear roadmap for how states may unlawfully gerrymander at will, in a way that will prevent any court from blocking them, as long as they time their legislation just right.

We're joined today by JAY WILLIS, former attorney, now editor-in-chief at the great legal website Balls and Strikes. He explains that the Court's "Purcell Principle", originally invented in 2006 to avoid chaos at the polling place by a court ruling just days before an election, is now being abused to prevent anything that Republican Justices simply don't like.

"The Purcell Principle has gotten stretched to the point of meaninglessness, where anytime the Justices decide that we are too close to an election in a way where changing the rules would hurt Republicans, they just say, 'No, no! Purcell Principle! Can't do that!,'" Willis tells me. "The Court described the Purcell Principle as forbidding changes on the 'eve' before an election. Now, that Principle is almost an entire calendar year in the hands of this court."

"What this rule amounts to," he argues, "is a free pass for Republican officials to conduct elections outside the scope of the law, as long as they basically get the timing right."

"As Kagan points out in her dissent, you don't have to have a law degree to understand that a racially gerrymandered map is illegal and unconstitutional unless the legislature that passes it waits until close to an election," he says, adding, "That can't be how the law works, a law that allows racial gerrymanders to remain in place in an election, as will be the case in Texas in 2026. That's just not a law that functions. That is not a tenable status quo."

Apparently, it is now. Much more on all of this, and how SCOTUS plans to make things even worse next year, on today's BradCast...

CLICK TO LISTEN OR DOWNLOAD SHOW!...

CLICK TO LISTEN OR DOWNLOAD SHOW!...

* * *While we post The BradCast

here every day, and you can hear it across all of our great affiliate stations and websites, to automagically get new episodes as soon as they're available sent right to your computer or personal device, subscribe for free at iTunes, Pandora, TuneIn, iHeart, Amazon or our native RSS feed!

* * *

Some of the weirdness has been completely predictable, if not to many of his duped supporters. Some of it is a surprise. All of it underscores, yet again on today's BradCast, that we have a full-blown loser serving as President of the United States. [Audio link to the full show follows this summary.]

Some of the weirdness has been completely predictable, if not to many of his duped supporters. Some of it is a surprise. All of it underscores, yet again on today's BradCast, that we have a full-blown loser serving as President of the United States. [Audio link to the full show follows this summary.]

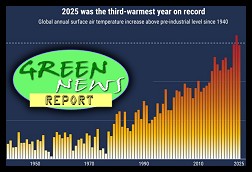

'Green News Report' 1/15/26

'Green News Report' 1/15/26

'This Isn't Close to Over': Mad King Trump in Venezuela (and Beyond): 'BradCast' 1/14/26

'This Isn't Close to Over': Mad King Trump in Venezuela (and Beyond): 'BradCast' 1/14/26 Things Getting Weirder

Things Getting Weirder 'Green News Report' 1/13/26

'Green News Report' 1/13/26 After ICE Murder in MN, Local Cops Disowning Fed Policing Practices: 'BradCast' 1/12/26

After ICE Murder in MN, Local Cops Disowning Fed Policing Practices: 'BradCast' 1/12/26 Sunday 'Ice Age' Toons

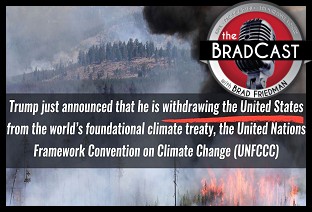

Sunday 'Ice Age' Toons Trump to Congress, Climate, U.N., Rule of Law, World: DROP DEAD - 'BradCast' 1/8/26

Trump to Congress, Climate, U.N., Rule of Law, World: DROP DEAD - 'BradCast' 1/8/26 'Green News Report' 1/8/26

'Green News Report' 1/8/26 'Nonsense': Trumpers Claim 315k Fraudulent GA Votes in 2020: 'BradCast' 1/7/26

'Nonsense': Trumpers Claim 315k Fraudulent GA Votes in 2020: 'BradCast' 1/7/26 Jack Smith Testimony on Trump J6 Crimes, DOJ Weaponization: 'BradCast' 1/6/26

Jack Smith Testimony on Trump J6 Crimes, DOJ Weaponization: 'BradCast' 1/6/26 'Green News Report' 1/6/26

'Green News Report' 1/6/26 Trump's War on Venezuela is About Ego, Power, Creation of 'Alien Enemies': 'BradCast' 1/5/26

Trump's War on Venezuela is About Ego, Power, Creation of 'Alien Enemies': 'BradCast' 1/5/26 Sunday 'Peace President' Toons

Sunday 'Peace President' Toons Sunday 'Many Happy Returns' Toons

Sunday 'Many Happy Returns' Toons Have a Holly Jolly Somehow

Have a Holly Jolly Somehow Old Man Shouts at People from WH for 20 Minutes: 'BradCast' 12/18/25

Old Man Shouts at People from WH for 20 Minutes: 'BradCast' 12/18/25 SCOTUS' How-To on Gerrymandering on 'Eve' of Election Year: BradCast' 12/17/25

SCOTUS' How-To on Gerrymandering on 'Eve' of Election Year: BradCast' 12/17/25 Bricks in the Wall: 'BradCast' 12/16/25

Bricks in the Wall: 'BradCast' 12/16/25 'This One Goes to 11': Weekend of Violence, Murder of Rob Reiner: 'BradCast' 12/15

'This One Goes to 11': Weekend of Violence, Murder of Rob Reiner: 'BradCast' 12/15 Trump Now Losing One Battle After Another: 'BradCast' 12/11/25

Trump Now Losing One Battle After Another: 'BradCast' 12/11/25 Dems Continue Stunning 2025 Election Streak: 'BradCast' 12/10/25

Dems Continue Stunning 2025 Election Streak: 'BradCast' 12/10/25 Petrostates and Propa-gandists Undermining Climate Science: 'BradCast' 12/9/25

Petrostates and Propa-gandists Undermining Climate Science: 'BradCast' 12/9/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL

His pathetic lies about the 2020 election will apparently never end. He's a loser and can't get over it. Even now. But, as a longtime expert in election transparency, security and integrity --- and, specifically, Georgia's unverifiable touchscreen voting system --- explains on today's

His pathetic lies about the 2020 election will apparently never end. He's a loser and can't get over it. Even now. But, as a longtime expert in election transparency, security and integrity --- and, specifically, Georgia's unverifiable touchscreen voting system --- explains on today's  It's five years to the day since January 6, 2021, when the then President of the United States got away with one of the most audacious crimes ever attempted in the U.S.: a failed attempt to have his own supporters violently overthrow the U.S. Government in order to help steal a Presidential election. Today on

It's five years to the day since January 6, 2021, when the then President of the United States got away with one of the most audacious crimes ever attempted in the U.S.: a failed attempt to have his own supporters violently overthrow the U.S. Government in order to help steal a Presidential election. Today on  My ears are still ringing after the President of the United States spent about 20 minutes barking at me last night. But the show --- in this case, the final

My ears are still ringing after the President of the United States spent about 20 minutes barking at me last night. But the show --- in this case, the final  On today's

On today's  Today on

Today on  It's difficult to fathom. But, we've got hard evidence on today's

It's difficult to fathom. But, we've got hard evidence on today's

Today on

Today on

Yikes. Quite a news day. We do our best to keep up on today's

Yikes. Quite a news day. We do our best to keep up on today's  Not that I hope to tip off our degenerate authoritarian oligarchy on today's

Not that I hope to tip off our degenerate authoritarian oligarchy on today's  It's no easy feat getting caught up on

It's no easy feat getting caught up on  It's our last

It's our last  As we head toward the holidays, some helpful advice on today's

As we head toward the holidays, some helpful advice on today's