READER COMMENTS ON

"Case for Impeachment of Judge Martin Feldman Strengthened by New Details on Oil Firm Holdings"

(80 Responses so far...)

COMMENT #1 [Permalink]

...

Phil N deBlanc

said on 6/26/2010 @ 4:41 pm PT...

come on, that's a reach.

breaking news, "Judge Feldman got to work today in a car. That's right, a car, using oil-based gasoline to power an internal combustion engine lubricated by an oil-based oil. Other grease points, including the front end, were queried at length. The rear end was interrogated as a hostile un-indicted co-conspirator. The rear end was heard sobbing "Yes, I helped him get to work, I was just doing as ordered, the torque made me do it."

Clearly, Judge Feldman should have recused himself because he is not Amish, and drives a horse and buggy to work everyday.

COMMENT #2 [Permalink]

...

Ernest A. Canning

said on 6/26/2010 @ 5:06 pm PT...

Oh, come now, Phil N deBlanc @1. Is that really the best you can do?

COMMENT #3 [Permalink]

...

Jeannie Dean

said on 6/26/2010 @ 6:38 pm PT...

Solid reporting from Rachel n' all, but I wish she and/or her guests had read Ernest's previous piece, "Should Judge Martin Feldman be Impeached?", or the L.A. Times, because they seemed unaware of the stats re: the number of available justices in the district without ties to the oil industry...

..."Seven of the 12 federal judges of the Eastern District of Louisiana already have cited potential conflicts of interest in bowing out of cases brought by fishermen, charter operators, tourist services and families of those killed in the April 20 explosion of the Deepwater Horizon rig in the Gulf of Mexico."

...they just seem so very uber-stymied by the tip of the iceberg.

So, there ya go. Up with people-corps! Right #1?

(Brad ~ did Malkin link to you again? ... Only the Malkin pinheads could be shit-bombing us with so many defenses of the the indefensible. No offense intended to Malkin pinheads since they exhibit the kind of denialist shame that eats you up from within.)

COMMENT #4 [Permalink]

...

Phil N deBlanc

said on 6/26/2010 @ 9:29 pm PT...

Boy, two sheads for the price of one.

Ernest A. Canning said on 6/26/2010 @ 5:06 pm PT...Oh, come now, Phil N deBlanc @1. Is that really the best you can do?

Jeannie Dean said on 6/26/2010 @ 6:38 pm PT...

(Brad ~ did Malkin link to you again? ... Only the Malkin pinheads could be shit-bombing us with so many defenses of the the indefensible. No offense intended to Malkin pinheads since they exhibit the kind of denialist shame that eats you up from within.)

-----------------------------

Dear Earnest and Jeannie, first Earnest, no, that's not the best I can do, I just wanted to see if your head filled a 12 size sh_t bucket.

second, Jeannie, who is this man Malkin you are so obsessed about? Is this a hetero-thing?

I hang out with a bunch of people who have drilled a lot of hole. I've drilled a lot of holes, usually hot, because my office chair sitting bosses hoped I would die. Didn't happen zit-butts.

Y'all have a splendiferis time.

COMMENT #5 [Permalink]

...

Annie

said on 6/26/2010 @ 9:32 pm PT...

First, where is the anger about what Salazar pulled? If you're upset at the Judge you should be enraged at Salazar.

You need to really think about conflicts of interest and what we have here. From the Huffington Post:

"Federal judicial rules require judges to disqualify themselves from hearing cases involving a company in which they have a direct financial interest.

However, financial conflict rules have some leeway. For example, a judge does not have to step aside if investments are part of a mutual fund over which they have no management control.

Further, mere ties to companies or entities in the same industry, no matter how extensive, do not require disqualification."

COMMENT #6 [Permalink]

...

Steve

said on 6/26/2010 @ 9:45 pm PT...

I want to know where the investigative reporting is about our congress critters, invested in "green" tech stocks and companies, and pushing legislation favorable to their investments. I suppose Ernest isn't too concerned about that

COMMENT #7 [Permalink]

...

colinjames

said on 6/26/2010 @ 10:30 pm PT...

Oh man where the hell are all these trolls coming from? Dude, Steve, our entire Congress- Democrat and Republican- is beholden to corporate interests, like, um, BIG OIL. You should WISH there were "Big Green" companies getting the tax breaks and subsidies Big Oil gets. We'd all be driving around in solar powered cars, NOT polluting the environment, producing middle class jobs out the wazoo in every state, and our soldiers would NOT be dying for oil overseas. FAUX NEWS is bad for your brain, bro.

COMMENT #8 [Permalink]

...

Bamboo Harvester

said on 6/27/2010 @ 4:40 am PT...

a very close friend of supreme court justice Tony Sfcheem speaks volumes.......

COMMENT #9 [Permalink]

...

Dan-in-Pa

said on 6/27/2010 @ 5:44 am PT...

Seeing as Phil is employed in the industry, he appears to have a conflict of interest and should probably recuse himself from discussions about the legitimacy of this judge's decision that directly affects his employment.

The presence of the trolls is a good sign. It shows the impact of the reporting that takes place here. You make "them" nervous Brad and Earnest. Well done!

COMMENT #10 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 7:20 am PT...

Ditto what Big Dan said @9...

The presence of corporate apologist trolls only means that they come to muddy the waters of this thread...which means that Brad and Ernest have driven the truth too close to the corporate lair...

Good thing Bradblog readers are too knowledgeable to buy the weak attempts to obfuscate.

Great piece again Ernest

COMMENT #11 [Permalink]

...

Ernest A. Canning

said on 6/27/2010 @ 8:34 am PT...

So we have the uninformed Phil @4, who doesn't know that Michelle Malkin is a female, stooping to expletives and Annie "what about Salazar?" @5 & Steve "what about Congress critters" @6 who seem to have lost sight of the fact that two wrongs do not make a right.

If either had studied my writings, or those of Brad Friedman, that are available at this blog, they would realize that both of us have criticized individuals in the Executive and Legislative branches, and especially election officials, for conflicts irrespective of whether they place a "D" or an "R" at the end of their names.

This particular article addresses the actions of a single, ethically-challenged member of the federal judiciary.

On the topic at hand, and within the realm of the cannons of judicial ethics, Annie, I'd recommend that you consider the colloquy between Keith Olbermann and former White House Counsel to President Nixon, John Dean:

John Dean: "He [Judge Feldman] held that [Exxon-Mobil] stock at the time the complaint came in. And it wasn’t until the complaint came in that he unloads it, and it looks to me that he had made the decision that while I better get rid of this because I’m going to rule in favor of the oil companies, because this is going to look pretty conspicuous if I’ve got this stock. So it’s very troubling…because even that is a violation of the canons of ethics for the judiciary."

Olbermann…"selling the…relevant stock in the middle of the hearing…is that not worse than not recusing yourself to begin with?"

Dean: "Well, it’s a little bit like telegraphing where you’re going to come out; that he knew…if he ruled against the oil companies, he would have no conflict…So, the fact that he sent this letter amending this financial disclosure statement just before he had this hearing is very troubling-—very troubling."

Dean said this without a realization that Judge Feldman actually did not unload the Exxon stock until after the June 21 hearing on the motion for a preliminary injunction.

My complaint about Judge Feldman goes beyond his willful failure to recuse himself upon recognition of a conflict of interest. It entails his having engaged in a deception in order to cover-up the fact that the conflict existed at the time he heard arguments on the motion before him; a deception that is exposed only by carefully parsing Judge Feldman's June 22 decision in which he reveals that the hearing on the motion took place on June 21!

Anyone who would engage in such deceptive conduct is unfit to be a member of the judiciary at any level. Indeed, the deception raises serious questions as to whether Judge Feldman should still be licensed to practice law.

Finally, the above-cited segment of Countdown raises another disturbing fact. The Supreme Court Justice charged with ruling on requests for emergency stays for the 5th Circuit is none other than Justice Antonin Scalia, whom Dean states, "has gone out of his way to praise Judge Feldman. He’s written articles in a law review to honor him. They are tennis partners when they get together…Justice Scalia has never met a conflict of interest that he was troubled by."

COMMENT #12 [Permalink]

...

colinjames

said on 6/27/2010 @ 10:34 am PT...

Given that the conflict-of-interest in this case was so obvious, and a lot of good things have been said about this judge by ideological opponents even, I have to wonder if he was pressured by someone or some group to make this decision. Just a thought. Not much really surprises me anymore.

As for the presence of trolls being a good thing #10... if you say so, I'll go with it. You're right in that readers he aint buyin what they're sellin, not a chance. And of course, another top-notch post by Mr. Canning. You'd be hard-pressed to find another piece on this that so clearly illustrates the issues of this whole sordid affair. Hats off to you, Ernest.

My problem with trolls is that they'll never concede a single thing, despite all the facts and evidence you can possibly throw at them. I just read a great comment on that very thing somewhere else, answering another who offered advice on speaking to the willfully misinformed conservative:

"Your logic guns won't work on them." Classic.

COMMENT #13 [Permalink]

...

camusrebel

said on 6/27/2010 @ 10:35 am PT...

i love me some trolls! what a hoot! a couple boot licking sycophants can really liven things up and provide needed comic relief. Keep em coming Malkin or whoever. Love the smell of dead troll roadkill in the morning, yee-ha!

And Bluehawk, I may be wrong but I think you are conflating 2 seperate Dans as one.

COMMENT #14 [Permalink]

...

Grung_e_Gene

said on 6/27/2010 @ 10:50 am PT...

It's not Judicial Malfeasance when it aids republican causes.

COMMENT #15 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 11:21 am PT...

CAMUSREBEL @13... Yes I did...thanks for the correction.

COMMENT #16 [Permalink]

...

SreeBee

said on 6/27/2010 @ 12:44 pm PT...

Hi Ernest,

Excellent article... As always, youre writing is informative, insightful and wise.

Dont let Phil get to you... since he understands that he cannot (as Jeannie Dean rightly said) "defend the indefensible", he's just trying to get under your skin. His venom comes from the painful unconscious realization of just how far on the wrong side of history he truly stands.

that being said, I'd like to offer a blessing---,

I WOULD LIKE TO WISH EVERYONE AT BRADBLOG (BOTH LGBT PEOPLE AND OUR HETERO SISTERS AND BROTHERS... even sour old Phil) THE HAPPIEST OF HAPPY PRIDE WEEKENDS!

MAY MUCH PEACE, PROSPERITY AND JOY FOLLOW YOU AND YOURS, AND MAY THE SPIRIT OF STONEWALL BRING US ALL TO A BETTER PLACE!!

NEVER FORGET THE LEGACY OF BAYARD RUSTIN!! HUMAN RIGHTS ARE RIGHTS FOR US ALL!

COMMENT #17 [Permalink]

...

Steve

said on 6/27/2010 @ 1:52 pm PT...

I do agree that both sides are owned and operated by whichever big business interest happens to pay the highest price, which is why we need finance reform.

But as Ernest said at #11, two wrongs don't make a right. Calling for the impeachment of a judge because he owns shares in a mutual fund is a bit ridiculous. Especially given that (I'll say it again and still expect no answer) several people in the congress have a significant conflict of interests in that legislation they are pushing will enrich them if enacted. I have never seen a bradblog story about that.

COMMENT #18 [Permalink]

...

Jeannie Dean

said on 6/27/2010 @ 2:07 pm PT...

RE: These trolling flash-mobs of pimple-twits we've been getting FOX-bombed with here, lately...

...their density coinciding non-coincidentally with Karl Rove's recent, openly self-touted 'Twittter-outed' interest in Brad's work (tho' I'm sure he's been lurking here for years, dispatching his Dark Army of Pay-Roll Trolls & Hicky-Dick Henchmen since sometime between Sibel n' Siegelman - maybe even circa Curtis.)

Just like Dan-in-PA points out: they're on the clock, you can tell! Their posts lack all courage of conviction, all moral center, they read hollow souled and empty-binned. They're self-interest is self-evident. And they pick stupid names.('Phil N deBlanc'?! Puh-leeze. Didn't we use to get a 'Phil N DaOval' who was a touchscreen voting machine apologist?)

Funny how they never seem to make it back to the thread in question to respond to the smart, fact-based responses their regurgitation of talking points, mis-placed wrath, and intentionally confused rhetoric has inevitably seeded. Nope. (They're professionals - they LOVE a good drive-by.)

I think we can assume this is going to be the "new normal", around here. But yea, O, tho' I walk through the Valley of 'Duh' - Victory always rides in on the heels of the bottom-feeders' nastiest passes. Indeed, Brad's and Ernests' star must (finally) be on the Big-Time rise.

This means we have to work harder to circulate / digg / reddit / tweet / retweet / whizzy-whir sack-rate / buzz-top / intra-kick their articles to what's left of the normal minded folk while we still can, while our internets tubes are not yet tied. It may be the one thing that has stood in the way of the mean n' lean 1% of American wealth objective; the only way to battle back at their attempts at subplanting, subverting and slowly killing off the rest and best of U.S.

...

Proof of concept as beta-test: This country is not a majority of crazy, reckless, retarded assholes - we're a MINORITY of crazy, reckless, retarded assholes.

COMMENT #19 [Permalink]

...

Brad Friedman

said on 6/27/2010 @ 2:09 pm PT...

Unfortunately, Steven, as suggested by the answer you were previously given on this question, there is no law against a lawmaker voting in favor (or against) a bill which they may end up making money on, in some fashion.

Unfortunately, that happens every single day, with virtually every single vote, by virtually every single lawmaker who have --- virtually to a man/woman --- become wholly dependent/compromised by the need for corporate campaign support. That should end immediately, as we need to remove ALL corporate funding from campaigns (and, hopefully, move to a fully publicly funded election system to remove the poisonous influence of corporate money in public campaigns).

As to the larger conspiracy I sense that you're asking about (a grand scheme for lawmakers to enrich themselves via new green technology), sorry, I don't see it. There are far smarter, and indeed, actually ongoing, schemes for lawmakers to enrich themselves via legislation in existing industries, rather than speculative emerging ones.

As is, an absurd number of lawmakers, on both sides of the aisle, are fully in the clutches of the unparalleled strength and corruption of the fossil fuel industry. If you have any doubt of that, check the amount of $ the fossil fuel industry earmarks for lobbying/campaign contributions, the amount of $ in pure profit they have available to do that, and the amount of absolutely shameful sops and tax-payer subsidies to that horrible industry which have been included in ALL versions of the proposed climate and energy legislation in both houses of Congress.

COMMENT #20 [Permalink]

...

Jeannie Dean

said on 6/27/2010 @ 2:13 pm PT...

Sree Bee (#16) - Love your post. Thank you. I needed a blessing. M'wa! xoxo.

COMMENT #21 [Permalink]

...

Steve

said on 6/27/2010 @ 2:27 pm PT...

Senate and house ethics rules forbid conflict of interest or even the appearance of conflict of interest. Those rules should be strictly enforced. Just as with the GOP several years ago and their majority, the democrats and their majority will look the other way to protect their own. Especially when no one in the media pays any attention.

COMMENT #22 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 2:47 pm PT...

Steve...all valid points.

But the topic here is a Judge ruling on a case where he has financial interest...Isn't it efficient to deal with the conflict of interest in our face ? ie, Judge Feldman...if not impeachment then his ruling should be set aside and he face censure for his klutzy actions here...

Come on...this is just to flat out wrong

COMMENT #23 [Permalink]

...

Jeannie Dean

said on 6/27/2010 @ 2:49 pm PT...

...see what I mean? BP *buys* search engine prominence:

http://www.nola.com/news...rch_engines_top_spo.html

"Concerned citizens looking for more information on the ongoing Gulf of Mexico oil spill may notice their Internet searches turning up some unexpected results...

"...BP has paid search engines like Google to prominently feature links to the company's website. And, according to one online marketing expert, lawyers and other parties with work tied to the spill will likely fight for prominent links of their own...

"...Late this week, a Google search for "oil spill" delivers as its top-ranking link a BP website subtitled "Info about the Gulf of Mexico spill; learn what BP is doing to help." The same link appears when that term is searched in Bing and Yahoo..."

2 Billion for PR not only buys Google / Yahoo / Bing top linkage, but I bet it keeps a LOT of 'Phil N deBlanc's' and 'URSheep's in ramen noodles & sour cream.

COMMENT #24 [Permalink]

...

Steve

said on 6/27/2010 @ 3:31 pm PT...

BlueHawk, I agree if there was a conflict of interest with the judge then his ruling should be set aside. As I understand it he owns shares in a mutual fund which owns shares in oil companies which drill for oil. If that's the gist of the problem I question whether it's a problem. Most of us here have a 401k or other mutual fund investments, I do. Possibly my Vanguard fund or my Prudential fund has some shares in an oil company, I'm really not sure. If that's going to be the foundation for a judge recusing himself or herself from a trial we may have trouble finding a judge to try any case. But if that's going to be the standard then we need to set it and move forward. Again, if he's crooked then buh bye.

But to your question "Isn't it efficient to deal with the conflict of interest in our face ?" I say no. We have for years let our congress get away with looking out for their own good at the expense of us folks who pay their salaries. My question about the "green" technology was asked because it's all related to the broad topic.

COMMENT #25 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 3:43 pm PT...

Steve...from Ernest's article above

Exxon-Mobil Stock Sold on Day of Ruling

As reported Friday by Bloomberg Businessweek, on June 22 --- just last Tuesday --- the very day that he issued his extraordinary decision, Judge Feldman's stock broker, under his direction, sold off the judge's investment in shares of Exxon-Mobil. As Businessweek observed, "Exxon, who was not a party litigant in the moratorium case, nevertheless had one of the 33 rigs in the Gulf..." which would have been directly affected by Judge Feldman's decision.

You can't see the HUGE issue with that ?

Or it gets worse...again from the article above...

It gets worse. As Maddow reported on Friday, Judge Feldman remains "significantly invested" in several funds managed by the investment firm BlackRock, far and away BP's largest single shareholder.

In covering the new "bombshell", Maddow notes a June 17th New York Times report finding that "No single institution has more money riding on BP than BlackRock, the money management firm that is BP’s largest shareholder."

BlackRock holds "more than one billion shares of BP's stock," explains Maddow. "When BP's financial future is at stake in the Gulf of Mexico, so is BlackRock's."

This wasn't some hidden stock in a mutual fund Steve...the Judge had to know BlackRock's financial future depended on BP's success...I haven't even touched the Judge's holdings in Transocean....

Steve please go read Ernest's article...then comment. You're minimizing this.

COMMENT #26 [Permalink]

...

a j weishar

said on 6/27/2010 @ 4:05 pm PT...

It looks like you are getting hit by the teams of writers paid by the government, political organizations, and corporations. Corporations hire "clean up" crews to spin public opinion after bad press. BP probably has more people working or the media and internet than on the Gulf.

COMMENT #27 [Permalink]

...

Steve

said on 6/27/2010 @ 4:11 pm PT...

I'm not minimizing it. If the guy's guilty he deserves to be censured at the very least.

BlackRock is a huge investment firm. Just because he owns shares of a fund at BlackRock, which also happens to have funds heavily invested in Oil Companies, doesn't mean that he owns shares of funds invested in the oil companies. I think if that were the case the Maddow report would have said he owned shares of a particular fund invested in oil. It implies that, but doesn't say it. As one who's distrustful of media I believe that the implication, which leaves truth to the imagination of the reader, is possibly (or even likely) not true.

The Exxon mess is a different story. He did apparently unload it before issuing a ruling so it can't be said he profited from his ruling. But it should be investigated, how it all unfolded.

COMMENT #28 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 4:19 pm PT...

Steve @27 what part of...

BlackRock holds "more than one billion shares of BP's stock," explains Maddow. "When BP's financial future is at stake in the Gulf of Mexico, so is BlackRock's."

do you not understand ?...or are you purposely ignoring the pertinent facts.

I'm done...you obviously didn't read the entirety of Ernest's article...

COMMENT #29 [Permalink]

...

Ernest A. Canning

said on 6/27/2010 @ 4:52 pm PT...

Steve, where do you get the notion that Judge Feldman's only investments are in mutual funds? Link?

The fact that he directed his broker to sell off his shares in Exxon-Mobil belies your claim that Judge Feldman's investments are limited to mutual funds.

You do not sell interests in a specific stock when you sell off your interest in a mutual fund. The point of a mutual fund is to spread the risk by permitting an investment manager to invest the mutual fund in multiple stocks.

So it appears that you are flat out wrong when you say his investments were only in mutual funds.

Moreover, I am disturbed that you would choose to ignore the other salient point--that in an effort to cover-up the conflict of interest which existed by reason of his Exxon-Mobil stock, Judge Feldman, in a letter revising his financial statement, said that he "sold" the stock "prior to the opening of a court hearing" when, in truth, the only relevant hearing took place on June 21--one day before Judge Feldman dumped the Exxon-Mobil stock.

Did you miss the point that Judge Feldman's deceptive cover-up provides an independent ground for impeachment? Or have you deliberately decided to ignore the point because you know full well that there is no valid defense to it?

COMMENT #30 [Permalink]

...

Ernest A. Canning

said on 6/27/2010 @ 5:16 pm PT...

Oh, one more point in responding to Steve @27 wherein he states, "If the guy's guilty he deserves to be censured at the very least."

First, the remedy spelled out by the Constitution is "impeachment," not "censure." And it is a remedy which does not require a finding that the individual to be impeached is "guilty" of a crime.

From the 1995 Hastings Law Review article I quoted in my original piece:

"The impeachment process was instituted to remove 'fallen' federal civil officers. Although the Constitution limits removal by impeachment to actions of 'Treason, Bribery, or other high Crimes and Misdemeanors,' scholars have noted that impeachment proceedings may be instituted for offenses outside the criminal realm. Such offenses include acts that undermine public confidence in the judiciary or compromise the integrity of the judicial branch. Thus, one aim of impeachment proceedings is to shield the judiciary from any appearance of impropriety."

Under the facts before us, no reasonable person could conclude that Judge Feldman's actions did not "undermine public confidence in the judiciary or compromise the integrity of the judicial branch."

I am not so naïve as to believe that the impeachment of Judge Feldman will end the corrupting influence of corporate monies in our political and legal institutions, but that is beside the point.

Impeachment of Judge Feldman is vital if we are to preserve the integrity of our judicial system.

Irrespective of where one stands on the substantive issue of the moratorium, I believe it abundantly clear to all reasonable minds that a failure to impeach in this case would serve as a dangerous precedent that would give license to corrupt judicial decisions and an undermining of the confidence that the American people must have in the judiciary if the words above the entry to the Supreme Court--"Equal Justice Under Law"--are to have any meaning.

COMMENT #31 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 5:26 pm PT...

Ernest...Steve was going with my call to at least set aside the verdict and censure Feldman....but then that's what you're the lawyer and I'm not.

COMMENT #32 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 5:27 pm PT...

COMMENT #33 [Permalink]

...

Steve

said on 6/27/2010 @ 6:50 pm PT...

I'm not overlooking anything Ernest, in your zeal to criticize someone who may have a different view than yours you have chosen to overlook that I said the Exxon event should be investigated.

I get that the judge holds mutual funds from your story, which cites Maddow's report that "Judge Feldman remains "significantly invested" in several funds managed by the investment firm BlackRock". It doesn't mention stocks, it mentions "funds".

And BlueHawk, the BlackRock group offers 70 different mutual funds across a wide array of investment options. An investor can choose to invest in any of the funds within that group. So again I'll say that just because he owns fund shares from that group doesn't necessarily mean he's invested in oil interests. He could be invested in a European Bond fund. All I'm saying is don't hang the guy based on a Maddow report, maybe a little investigation is warranted first.

COMMENT #34 [Permalink]

...

BlueHawk

said on 6/27/2010 @ 7:33 pm PT...

None are so blind as those who refuse to see...

COMMENT #35 [Permalink]

...

Brad Friedman

said on 6/27/2010 @ 7:38 pm PT...

Steve @ 33 said:

All I'm saying is don't hang the guy based on a Maddow report, maybe a little investigation is warranted first.

That's what an impeachment is, Steve.

COMMENT #36 [Permalink]

...

Steve

said on 6/28/2010 @ 7:15 am PT...

LOL! Yeah, no sense wasting time and getting all the pertinent information Brad. Better to just immediately begin impeachment proceedings against a sitting federal judge based solely on a hard hitting political piece by Rachel Maddow!

COMMENT #37 [Permalink]

...

Ernest A. Canning

said on 6/28/2010 @ 8:15 am PT...

Steve @36. With all due respect, you simply do not understand how impeachment works.

One or more members of the House of Representatives must introduce articles of impeachment. That is referred to a committee which investigates the matter, and then the committee, based on the investigation, votes to either refer the matter to the full House of Representatives for impeachment or rejects them.

If the matter is referred to the House and a majority vote to impeach, the case is transferred to the Senate for an impeachment trial where the individual subject to the impeachment is provided due process.

COMMENT #38 [Permalink]

...

Steve

said on 6/28/2010 @ 8:40 am PT...

How in the world do you get from my previous post that I don't know how impeachment works? I think that there should be a little more proof of wrong doing, true. But I understand very well how it works. What you have is a couple minutes of implied criminal activity from an agenda driven left wing pundit, and then a very hard hitting piece from you regurgitating the same information. If that were all we need to impeach, then every judge who rules unfavorably to your point of view would be impeached.

I replied to your question from one of your previous posts, "Steve, where do you get the notion that Judge Feldman's only investments are in mutual funds? Link?" that my information came from your story above. Perhaps you should pay better attention to what you write and I'll take care of my knowledge of impeachment rules.

COMMENT #39 [Permalink]

...

BlueHawk

said on 6/28/2010 @ 9:22 am PT...

Steve is just being obtuse...

First Steve says why not investigate before going straight to impeachment.

Brad then explains to Steve that impeachment is an investigation.

Steve then gives a hearty LOL and while fully ignoring the pertinent facts presented to him.

Ernest then lays out the whole impeachment process for Steve, prefacing his comment with all due respect.

Steve then disrespects Ernest and Brad by laughing off their well thought out work and patience with him while asking

How in the world do you get from my previous post that I don't know how impeachment works?

.

While by Steve's own previous comments (read any comment by Steve) he obviously has no idea what impeachment is or how ther process plays out...

yep; obtuse is the word that comes to mind when considering Steve.

Steve also ignores that the BlackRock mutual fund Feldman was invested in had a BILLION of shares in BP stocks; which may translate to $10s or maybe $hundreds of billions of dollars of cash value...yet Steve wants us to believe that Feldman had no idea where his BlackRock mutual fund was heavily invested in.

yeah obtuse

COMMENT #40 [Permalink]

...

Chris Hooten

said on 6/28/2010 @ 9:32 am PT...

Steve, how do you sell just your Exxon-Mobil interests from a fund? Like someone else mentioned, you don't get to decide the buying and selling of specific stock in a "fund," it would defeat the whole purpose of the fund. And then the fact that he sold them the day after his decision, but he made a very misleading statement making it appear that they were actually sold before the hearing (they were indeed sold before *a* hearing, but not before *the* hearing. I"m not sure what it takes for you to see impropriety here.

COMMENT #41 [Permalink]

...

Jeannie Dean

said on 6/28/2010 @ 9:33 am PT...

'Obtuse' is kind, BH.

"BlackRock group offers 70 different mutual funds across a wide array of investment options. An investor can choose to invest in any of the funds within that group."

For someone who has shown he knows diddly about the impeachment process, he sure does know his BlackRock stock options.

COMMENT #42 [Permalink]

...

BlueHawk

said on 6/28/2010 @ 9:37 am PT...

Obtuse...that is a troll tactic...crank up the merry go round and demand that everything be spelled out in intricate detail (hence the obtuse act)...ignore all pertinent facts that torpedo his faulty logic and reasoning. And whenever possible go back to issues already explained and settled, to start from square one all over again...it's a tactic used to frustrate an "opponent".

All of Steve's questions are answered in the article...yet he wants Brad and Ernest to hold his hand through this pretty easy to read material, while at the same time ignoring anything he may not like about it.

COMMENT #43 [Permalink]

...

Steve

said on 6/28/2010 @ 9:40 am PT...

BlueHawk, you see what you want to see and believe what you want to believe.

So, a piece by Rachel Maddow is all that's needed to begin impeachment proceedings. That's what you're saying correct? Because that is what Brad and Ernest appear to be saying. So we should abuse the impeachment process, which is very serious business, any time Rachel Maddow thinks it's appropriate correct?

Try to get your mind around the fact that BlackRock offers many many funds only some of which are invested in the BP company. Can you at least try to understand that? Do you have any idea how investment firms and mutual funds work?

COMMENT #44 [Permalink]

...

BlueHawk

said on 6/28/2010 @ 9:49 am PT...

Steve...if it was so obvious that Rachel Maddow can investigate it and report it...then I'm sure the proper authorities could do the same.

I see you have presented nothing to refute Rachel Maddow's reporting...you just smear her like if she said then it must be trivial. Another troll tactic.

By the way...your obtuse (feigned ignorance) act isn't something I believe...it's what I see...you know, like the sun is yellow and the sky is blue.

COMMENT #45 [Permalink]

...

Ernest A. Canning

said on 6/28/2010 @ 10:33 am PT...

I think BlueHawk @44 pretty much nailed it.

The one thing I'd add is that my piece is not derived from "the implied criminal activity from an agenda driven left wing pundit."

I provided a Rachel Maddow video, linked to a wide variety of sources, including Judge Feldman's own words in his 06/22 decision and in his 06/22 letter revising his financial statement, because they are "fact driven."

Contrary to popular wing-nut belief, the "truth" is not the exclusive province of the Left, Right or Center.

Steve's remarks call to mind President Truman's response to "Give 'em Hell, Harry!"

"I just give them the truth and the Republicans think that’s Hell."

Unable to challenge the accuracy of any of the "facts" presented in this article, Steve writes as if the filing of articles of impeachment amount to conviction for impeachment.

When Brad and I patiently explain that the investigative role of a House committee once an impeachment resolution is introduced, he attacks the messenger--in this case, Rachel Maddow, by suggesting that her "factual presentation" is but a Leftist agenda.

Steve's post are reminiscent of an old saw I heard in my first year in law school.

If the facts are with you, argue the facts. If the law is with you, argue the law. If you have neither, attack your opponent.

Steve, your disingenuous comments might work at a tea bagger convention, but they fall woefully short at a site that serves the intelligent members of the public.

COMMENT #46 [Permalink]

...

colinjames

said on 6/28/2010 @ 11:08 am PT...

Ooh I wanna chime in! Let's just lay out the facts:

A Judge made a ruling on a case that very directly affects his income. Many reports have been circulated about this. There are public documents that are the basis of the story. It is an EXTREMELY high profile case. The question of why he did not recuse himself is valid. Because the ruling favored the Judge's bottom line, and due to questions surrounding the timing of his sale of affected stock and an apparent attempt to mislead on that issue, their is prima facie evidence that this judge failed to recuse himself despite knowing he had a very serious conflict-of-interest in this case. This can be interpreted as "acts that undermine public confidence in the judiciary or compromise the integrity of the judicial branch", which is grounds for impeachment.

Now, speculation on someone's "agenda" as a basis for why the judge should NOT be impeached- that's an example of reasoning that is INVALID. Also, if you read the article closely, you'll notice that Mr. Canning uses phrases like "new evidence now suggests" and "Those new revelations support" as opposed to assertions of opinion which would imply an ideological agenda in the first place.

COMMENT #47 [Permalink]

...

Steve

said on 6/28/2010 @ 12:11 pm PT...

There are no facts presented in the article pertaining to the topic at hand, which is his apparent ownership of fund shares within the BlackRock group of funds and whether that constitutes a conflict of interests. Following the logic of Ernest, if this judge owned shares of funds from ANY investment firm it would be a conflict of interest. Because all of the investment firms are invested in oil as well as a multitude of other things. All of them. And the article doesn't say, I'm being redundant here but that's apparently necessary, that he owns shares in a fund which is invested in BP. If he did own those shares then I would think Ernest would have reported as much. So following Ernest's logic basically any judge who invests in a mutual fund or has a 401k would have to recuse himself. Because if that fund was with Vanguard, guess what they own shares of oil stock. The same with Prudential, JP Morgan etc.

It's funny how easy it is to get a small group of people so fired up by merely suggesting that further investigation may be warranted. To Ernest, it's a slam dunk I suppose. Because there is a question about conflict of interest with the judge it means congress should file articles of impeachment. If it turns out there's nothing there I suppose you just forget about it. But the judge will always be the judge who had articles of impeachment filed against him, regardless of the outcome.

I laughed at Brad because I disagree with his answer to "more investigation is required" with that "that's what an impeachment is". I would hope that an impeachment would be taken a bit more seriously and that ducks would be in a row before filing the articles rather than after.

Last but not least thank you folks for resorting to name calling and baseless accusation. You perfectly illustrate your point Ernest "If the facts are with you, argue the facts. If the law is with you, argue the law. If you have neither, attack your opponent." You can't point out one factually incorrect statement I made so you attack the messenger.

COMMENT #48 [Permalink]

...

BlueHawk

said on 6/28/2010 @ 12:46 pm PT...

Steve further blabbers...

There are no facts presented in the article pertaining to the topic at hand, which is his apparent ownership of fund shares within the BlackRock group of funds and whether that constitutes a conflict of interests.

Steve that's only because you refuse to acknowledge them...I'm not even gonna re-quote the above article for you yet again.

Again Steve presents zero evidence for his assertations.

Steve just tries to tell us that the solid evidence reported here actually doesn't existence or it's spurious...or it's trivial because a liberal reporter revealed it...or whatever... Just because he says so.

COMMENT #49 [Permalink]

...

Steve

said on 6/28/2010 @ 12:58 pm PT...

I'll play your game again hawk. What solid evidence is there that he owns stock, or mutual fund shares, in any oil company? Please provide that evidence from the above story. You can't, because there is none. Person A owns shares from an investment firm B. Investment firm B owns shares of oil company stock. Therefore Person A is invested in oil companies. You should go back to high school if you don't understand why that reasoning is flawed. If BlackRock ONLY invested in BP it would be a different story, but they don't.

COMMENT #50 [Permalink]

...

karenfromillinois

said on 6/28/2010 @ 1:12 pm PT...

Judge Feldman's statement that "the Exxon stock…was sold at the opening of the stock market on June 22, 2010 prior to the opening of a court hearing" is so disingenuous as to amount to a deception. The only pertinent hearing took place one day before Judge Feldman sold his stock. He used the words "prior to the opening of a court hearing" rather than "prior to the announcement of the court's decision" to hide the basic reality that the "hearing" was a sham; a facade erected only to hide the venality that formed the basis for a pre-determined decision.

COMMENT #51 [Permalink]

...

BlueHawk

said on 6/28/2010 @ 1:17 pm PT...

Steve the obvious illiterate

The fact that Feldman divested himself of Exxon just as he was to render a decision for one...a fact mind you that signaled his cronies what his decision would be before he rendered it. That has to be illegal as bank robbery.

There's also the fact as quoted in the article above that BlackRock owned a billion (with a B) shares of BP stock...shares that has to worth maybe 100s of billions of dollars, there is the fact that the judge was also invested in Transocean...

I find it amusing that Steve seems to be commenting for 2-3 days on an article he apparently never read...if Steve had read the article his questions (which are fundamental to said article) would be useless...I'm not gonna hand walk you through the article again Steve.

You may continue to demonstrate ignorance or fake ignorance ....

COMMENT #52 [Permalink]

...

Jeannie Dean

said on 6/28/2010 @ 2:29 pm PT...

...they NEVER read the article.

COMMENT #53 [Permalink]

...

colinjames

said on 6/28/2010 @ 3:08 pm PT...

For f*cks sake, I don't know how this guy even figured out how to post comments. Dude- if you can't follow Canning's clear, simple, fact-based and factually supported arguments, I certainly can't help you. And if you insist on repeating falsehoods that a quick re-reading of the article will clear up for you, you're helpless. I'm done on this thread. Gotta get back to banging my head on the wall. I'm making more progress with that than here apparently.

COMMENT #54 [Permalink]

...

Ernest A. Canning

said on 6/28/2010 @ 3:08 pm PT...

Steve @47 writes:

"There are no facts presented in the article pertaining to the topic at hand..."

Fact #1: According to Judge Feldman, as of 05/14/2010 he "owns stock in Ocean Energy, Inc. which is owned by Transocean, Inc."

Fact #2: Judge Feldman recognized that this fact was relevant to whether he should recuse himself in the case of Williams vs. Transocean, Ltd., which is the reason why Judge Feldman directed counsel to ascertain whether there was a relationship between Transocean, Inc. and Transocean, Ltd.

Fact #3: Transocean, Inc. is the owner of the Deepwater Horizon rig which exploded.

Fact #4: Judge Feldman's 05/14/2010 order does not state that his ownership in Ocean Energy, Inc. is solely by way of a mutual fund.

Fact #5: On 06/21/2010 Judge Feldman owned stock in Exxon-Mobil.

Fact #6. Exxon-Mobil owns one of the 30 deep water drilling platforms that has been affected by the order.

Fact #7. Judge Feldman ordered that the motion for a preliminary injunction be heard on an expedited basis on Monday, June 21. (Ordinarily, motions are heard on Wednesdays in that particular court).

Fact #8. At all times between the time the Hornbeck case was filed and the day in which Judge Feldman issued his formal ruling granting the prelimary injury, Judge Feldman owned Exxon-Mobil stock.

Fact #9. Judge Feldman's broker sold the Exxon stock on the morning of June 22.

Fact #10. Judge Feldman submitted a letter amending his financial statement in which he represented that the Exxon stock was sold "prior to the opening of a court hearing" in Hornbeck.

Fact #11. The only relevant hearing took place on June 21--prior to the time that Judge Feldman unloaded his Exxon stock.

Fact #12. Since Judge Feldman directed his broker to specifically sell the Exxon stock, that stock could not possibly be part of his mutual fund portfolio.

Fact #13. Judge Feldman owns extensive shares of Blackrock, which is by far BP's most prominent investor.

Fact #14. Judge Feldman knew full well that his ruling would have a direct impact on the value of his investments in Ocean Energy (Transocean), Exxon and Blackrock.

The facts show a patent conflict of interest and an effort to conceal a part of that conflict by (a) dumping the Exxon stock on the day of the decision, (b) deceptively stating that he was unloading the stock prior to a hearing, when in truth he unloaded it after he had already decided.

Those are the "facts," Steve.

You are entitled to your own opinion. You are not entitled to your own "facts." Ignoring them, distorting them, and twisting them will not make them go away.

As John Adams observed, "Facts are stubborn things."

COMMENT #55 [Permalink]

...

Ernest A. Canning

said on 6/28/2010 @ 3:20 pm PT...

Oh, and Steve, I neglected to add fact #15--You are in over your head and out of your league.

COMMENT #56 [Permalink]

...

Ernest A. Canning

said on 6/28/2010 @ 5:46 pm PT...

For the benefit of those who may be interested, here's the relevant provisions of the U.S. Code.

§ 455. Disqualification of justice, judge, or magistrate judge

a) Any justice, judge, or magistrate judge of the United States shall disqualify himself in any proceeding in which his impartiality might reasonably be questioned.

b) He shall also disqualify himself in the following circumstances:

(4) He knows that he, individually or as a fiduciary, or his spouse or minor child residing in his household, has a financial interest in the subject matter in controversy or in a party to the proceeding, or any other interest that could be substantially affected by the outcome of the proceeding;

(c) A judge should inform himself about his personal and fiduciary financial interests, and make a reasonable effort to inform himself about the personal financial interests of his spouse and minor children residing in his household.

(4) “financial interest” means ownership of a legal or equitable interest, however small, or a relationship as director, adviser, or other active participant in the affairs of a party, except that:

(i) Ownership in a mutual or common investment fund that holds securities is not a “financial interest” in such securities unless the judge participates in the management of the fund...

COMMENT #57 [Permalink]

...

CambridgeKnitter

said on 6/28/2010 @ 7:58 pm PT...

Actually, Rachel Maddow's report lists exactly which Black Rock funds the judge is invested in and what the biggest holdings of some of them are. She also refers to his individual stock holdings. All of this is taken from his financial disclosure forms, which are public records, so her assertions can be confirmed by looking at information that was provided by the judge himself. None of this looks like opinion to me.

COMMENT #58 [Permalink]

...

Ancient

said on 6/29/2010 @ 9:03 am PT...

All I can say is I want to see legislation that puts every GOD DAMNED Politicians financial holdings and investments on the TOOBZ!

COMMENT #59 [Permalink]

...

Ancient

said on 6/29/2010 @ 9:13 am PT...

An oh yeah, I'm taking my money out of pnc bank which I believe is the construct of black rock... not because of all this shit, but because I was told they'd get right back to me on my little chunk of investment that they have FAIL to do so... so my investment ability languishes to their advantage without my direct involvement in this odious investment! Hey there, MOTHER FUCKER!

COMMENT #60 [Permalink]

...

Ancient

said on 6/29/2010 @ 10:46 am PT...

Where can one find an intelligent, competent, investment firm in these corrupted dayz?

And then, a collective real peoples movement to support The Brad Blog for election integrity? THE FOUNDATIONAL PROBLEM.

COMMENT #61 [Permalink]

...

Ancient

said on 6/29/2010 @ 11:00 am PT...

We are mere mortals baptized by our presence on this BEAUTIFUL Earth as we are taught to be.

COMMENT #62 [Permalink]

...

Ancient

said on 6/29/2010 @ 11:35 am PT...

The us and switzerland... let them go it alone banking-wise...and let the rest of us invest to the whole's future, without their shortsighted program in fear's front.

COMMENT #63 [Permalink]

...

Ancient

said on 6/29/2010 @ 11:47 am PT...

Hey, could someone please knockoff the bold by me? I like disemination of info but..happenstance and info disem are not the same thing.

COMMENT #64 [Permalink]

...

Ancient

said on 6/29/2010 @ 11:57 am PT...

...that would be dissemination above. Watch LINK TV!

COMMENT #65 [Permalink]

...

Ernest A. Canning

said on 6/29/2010 @ 3:19 pm PT...

Ancient. You didn't close the bold @60, which is why all the other comments were bold. I've now done that for you.

COMMENT #66 [Permalink]

...

alan m dransfield

said on 6/30/2010 @ 10:25 pm PT...

Ernest, you realy have opened a hornets nest here with the comments about Judge Feldman. I for one, agree with you 100% and we now have only one week to go before the White House appeal against Judge Felman.

I am some what surprised and disappointed my previous 2 comments have been removed from your blog Earnest, why??!!

Unfortunately, we might have to wait until next years financial records to see HOW MANY Judges invested heavily in Boots and Coots, whom, are a subsidary of Haliburton.

COMMENT #67 [Permalink]

...

alan m dransfield

said on 7/1/2010 @ 12:52 pm PT...

Exxonmobil purport to be the best oil company in the world and the deepwater horizon incident would NOT have happened under their supervision(their words not mine).

Exxonmobil are the operators of the Chad/Cameroon Pipeline(CCP) which has been operating illegally for 7years which does not have any oil spill plans or environmental protection plans.

Words are cheap Ernest, cheap as chips.

COMMENT #68 [Permalink]

...

alan m dransfield

said on 7/1/2010 @ 1:08 pm PT...

The Deepwater Horizon rig is/was under a flag of convenience order from the Marshall Islands,hence, the safety,of the rig,personnel and the environment are NOT under the remit of the US Government.

I guess the US Government have shot themselves in the foot on this one Ernest.

Howmany other FOC rigs and ships are operating in US Waters .

Judge Feldman should be put on a FOC vessels and left on the high seas,ideally off the coast of Somalia??!!

COMMENT #69 [Permalink]

...

alan m dransfield

said on 7/1/2010 @ 10:33 pm PT...

INSURANCE COMPANY FAILURES ON THE DEEPWATER HORIZON (DH).

There is compelling evidence that the particular insurance company on the DH has failed its duty of care by paying out the POLICY to Transocean for the rig loss and raises the questions about VALID insurances polices for the Oil Industry.

Any Insurance Broker has a duty of Care to ensure that, BEFORE they pay any loss adjustment for policy that the VESSEL is safe.

The anology is, having a Car without any Valid MOT Certificate,bald tyres,no wing mirrors, driving whilst banned, under the influence of alchol and driving in thick fog at 100MPH.??!!

It is consistently obvious that the MAJOR Oil Players dont give a damn for health and safety or the environment BUT their Insurance Companies, are, in essence conniving and colluding to cover-up serious crimes.

Transocean's Insurance Company paid out the Insurance within a matter of a few weeks, which, might appear to be VERY professional but under the circumstances is appalling when prima facie evidence indicates culpable homicide,criminal negligence ,etc.

Insurance Companies have a duty of care to ensure that Oil Rigs/Tankers/Pipelines etc ARE compliant to the latest safety and environmental regulations.

Let me give you another clear example of Insurance Company failures in the Oil Industry,i.e. the Chad/Cameroon Pipeline (CCP) which has been operating in a legal void for 7 years by virtue of non-existant Oil Spill Plans and Environmental Protection Plan,inter alia. The CCP is dejavu of the Deepwater Horizon.

The MAIN reason why BP are acting with such arrogance and disdain is they KNOW their Insurance Ceiling for any event is 75 million dollars.

Whilst Obama purports to have his "FOOT ON THE BP THROAT" the Insurance Companies are laughing their heads off.

In contrast to BP, workers lives have been lost, companies are and will go bankrupt, environmental ruin for the Gulf states and I bet the OTHER insurance Companies are NOT being SO cooperative as the RIG Operators.

COMMENT #70 [Permalink]

...

alan m dransfield

said on 7/1/2010 @ 10:49 pm PT...

Next Thurs is the date for the White House Appeal against Judge Feldmans decison to reject a 6 month drilling ban.

I wonder what will happen if Judge Feldman wins the next hearing and is subsequently IMPEACHED.

Happy days are coming??!!

COMMENT #71 [Permalink]

...

alan m dransfield

said on 7/3/2010 @ 1:36 am PT...

TOTAL NUMBER OF GALLONS OF OIL.

There are numerous reports on the total number of GALLONS of oil spill and whilst I appreciate that BP have not been entirely truthful with their estimates and government authorites are ALSO unable to report reliable estimate.

What is worrying me is the recent reports from a few days ago that the Deepwater Horizon (DH) had surpassed the Exxonvaldeez .

Personally, I think the Exxonvaldeez GALLONS was surpassed sometime ago.

Unless my maths are SO bad, lets do a simple calculation of the 5oKbarrels per day.

1.1barrel of oil =42US Gallons.

2.73days of oil spill@ 50kbarrels per day =3.650.000 (MILLION) BARRELS

3.42×3.650.000=153.300.000 MILLION GALLONS

That means the DH has surpassed the Valdeez by 13 times.

One of the lessons learned from this debacle is for oil companies to install a FLOW METER as an integral part of the Blowout Preventer Valve (BPV) and then at least all parties would have better knowledge of the oil spill.

In actual fact NO-ONE knows the true extent of the DH oil spill and it might be 50 or 100 times the size of the valdeez as we speak.

COMMENT #72 [Permalink]

...

alan m dransfield

said on 7/3/2010 @ 10:42 am PT...

The attached website is information on the subject title and I bet my bottom dollar that INTRINSICALLY SAFE EQUIPMENT (ISE)WAS NOT USED on the BP Deepwater Horizon Rig.It is CERTAINLY NOT used on the Chad Cameroon Pipeline (CCP) and is WELL covered in the HAZARD AREA EQUIPMENT(HAE)of the CFR US Standards.

How can this be proved or disproved?. I would expect at sometime in the near future the Deepwater Horizon rig will be brought up to the serface and this would be a good time to reconcile if INTRINSICALLY SAFE equipment was used. It could also be proven by reconcilation of the Operations Maintainance Manual (OMM). The original OMM is currently lying on the seabed but a MASTER COPY will be held in the Transocean/BP HQ??!!.

Intrinsically safe equipment is VERY costly and is the one of the MAIN shortcuts in the Oil Industry.

How can we prove if ISE was/is used on the CCP, firstly by a simple ocular inspection of the Tanker and the Pumping Stations

http://www.omega.com/techref/intrinsic.html

COMMENT #73 [Permalink]

...

alan m dransfield

said on 7/4/2010 @ 6:25 am PT...

IS THE US GOVERNMENT CONNIVING AND COLLUDING WITH BP TO COVERUP SERIOUS CRIMES.

Please see this website video which purports there is a GREAT possibility of a SUPER TSUNAMIA as a consequence of this oil spill. It also states the real dangers of GAS POISONING .

Now we know why thousand of US Troops have been brought in because they ARE expecting further and worse disasters.

http://www.bpcomplaints....mi-and-poison-gas-alert/

COMMENT #74 [Permalink]

...

chabuka

said on 7/6/2010 @ 11:51 am PT...

I have read that over half of the Judges in the Gulf States are recipients of "oil money" in one form or another....especially in Texas...there is a wonderful article on Bobby Jindals defense and ties to the oil companies, in particular the two companies that sued to lift that moratorium, that ended up in Judge Feldman's court...coincidence....? Only if you consider the money directly paid to Judges, Courts and Governor's (politicians) for a "favorable" outcome on rulings...is coincedental...or you are a right-wing Corporate/government fascist supporter (they doesn't seem to understand that the of merging Corporations and Government is the very definition of Fascism)...who would rather have Corporations such as BP, Xe, KBR, Goldman-Sachs and military contractors controlling and owning "the people's" government", while "having their unregulated Corporate way" with the citizens, the environment and the judicial/law systems of this country

COMMENT #75 [Permalink]

...

alan m dransfield

said on 7/7/2010 @ 9:42 pm PT...

Todays court appeal hearing Judge Feldman V White House will be VERY interesting. Can't wait for the result.

COMMENT #76 [Permalink]

...

alan m dransfield

said on 7/7/2010 @ 10:34 pm PT...

The Republicans have blocked an inquiry into the BP oil spill. Surprise surprise??!!

COMMENT #77 [Permalink]

...

alan m dransfield

said on 7/8/2010 @ 10:04 pm PT...

Judge Feldman won his appeal yesterday and the Oil Companies have won their court appeal to block the White House drilling ban.

Yesterdays court decision 2-1 in favour of Judge Feldman comes as no surorise to me.

I wonder how many Oil shares the appeal court judges hold??!!

This oil spill debacle jst got worse.

COMMENT #78 [Permalink]

...

alan m dransfield

said on 7/9/2010 @ 11:34 pm PT...

Please see the attached website which gives details ref BP 2# relief well swhich they have been digging for weeks. One relief well is nearly completed and the releif well #2 is several weeks away.

One thing that bothers me from this sketch is WHY did they drill the oill relief wells SO CLOSE to the oil reservoir. They could have intercepted the leaking oil well (original shaft) say 100 foot below see bed level.

Driling relief wells so close to the oil reservoir must surely present further leak potential??!!.

These guys are supposed to be "experts" but why spend time and effort digging releif wells which take weeks when the same results could have been achieved in days.

Just a thought.

kind regards

Alan

http://news.bbc.co.uk/1/hi/business/10556039.stm

COMMENT #79 [Permalink]

...

alan m dransfield

said on 7/10/2010 @ 12:34 am PT...

It would appear that 5th Circuit Appeal Court Judges WITHOUT Oil Ties are as rare as rocking horse shit and to prove the point the decion by the 5th Circuit Appeal Judges on Thur 8th July clearly shows CONFLICT OF INTEREST BY US JUDGES.

At least two the Judges should have recused themselves because of conflict of interest.

Unfortunately, it might take a Tsunami to wakeup the Americal People.

COMMENT #80 [Permalink]

...

alan m dransfield

said on 7/10/2010 @ 1:13 am PT...

I am gobsmacked at the consistent lies and bullshit spouted by BP ref the deepwater horizon debacle.

Their latest statement is the DEEPWATER HORIZON was an "EXPLORATORY RIG" which is absolute BULLSHIT.

The DH rig was drilled with the FULL KNOWLEDGE of the Worlds 2nd Largest Oil Reservoir, hence, how the hell can it be an EXPLORATORY RIG

The DH rig was NOT recovering Oil from the Oil Reservoir, it's sole job was to drive the shaft into the "KNOWN Reservoir" temporay plug the well and move onto the next well. But under NO CIRCUMSTANCE can the DH be called an EXPLORATOY RIG.

This is yet another attempt to pervert the course of justice with the assistance of the 5th Circuit Judges.

On Thursday The BRAD BLOG posted an article in which I offered the legal underpinnings supporting the case for the impeachment of U.S. District Court Judge Martin Feldman in light of his failure to recuse himself due to conflicts-of-interest in Hornbeck Offshore Services vs. Salazar [PDF].

On Thursday The BRAD BLOG posted an article in which I offered the legal underpinnings supporting the case for the impeachment of U.S. District Court Judge Martin Feldman in light of his failure to recuse himself due to conflicts-of-interest in Hornbeck Offshore Services vs. Salazar [PDF].

A Pretty Weak 'Strongman': 'BradCast' 10/30/25

A Pretty Weak 'Strongman': 'BradCast' 10/30/25 'Green News Report' 10/30/25

'Green News Report' 10/30/25

Proposal for 'First Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29/25

Proposal for 'First Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29/25 Monster Storm, Endless Wars, Gamed Elections:

Monster Storm, Endless Wars, Gamed Elections: 'Green News Report' 10/28/25

'Green News Report' 10/28/25 Let's Play 'Who Wants

Let's Play 'Who Wants Sunday 'Cartoonists Dilemma' Toons

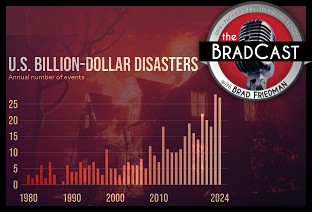

Sunday 'Cartoonists Dilemma' Toons Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25

Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25  'Green News Report' 10/23/25

'Green News Report' 10/23/25 Trump-Allied GOP Partisan Buys Dominion Voting Systems: 'BradCast' 10/22/25

Trump-Allied GOP Partisan Buys Dominion Voting Systems: 'BradCast' 10/22/25 Trump, Republican Law(lessness) & (Dis)Order: 'BradCast' 10/21/25

Trump, Republican Law(lessness) & (Dis)Order: 'BradCast' 10/21/25 'Green News Report' 10/21/25

'Green News Report' 10/21/25 Celebrating 'No Kings': 'BradCast' 10/20/25

Celebrating 'No Kings': 'BradCast' 10/20/25 Sunday 'How It Started' Toons

Sunday 'How It Started' Toons SCOTUS Repubs Appear Ready to Gut Rest of Voting Rights Act: 'BradCast' 10/16/25

SCOTUS Repubs Appear Ready to Gut Rest of Voting Rights Act: 'BradCast' 10/16/25 'Green News Report' 10/16/25

'Green News Report' 10/16/25 The 'Epstein Shutdown' and Other Autocratic Nightmares: 'BradCast' 10/15/25

The 'Epstein Shutdown' and Other Autocratic Nightmares: 'BradCast' 10/15/25 Group Vows to Block MO's GOP U.S. House Gerrymander: 'BradCast' 10/14/25

Group Vows to Block MO's GOP U.S. House Gerrymander: 'BradCast' 10/14/25 Trump Labor Dept. Warns Trump Policies Sparking Food Crisis: 'BradCast' 10/9/25

Trump Labor Dept. Warns Trump Policies Sparking Food Crisis: 'BradCast' 10/9/25 Trump's Losing Battles: 'BradCast' 10/8/25

Trump's Losing Battles: 'BradCast' 10/8/25 Trump, Roberts and His Stacked, Packed and Captured SCOTUS: 'BradCast' 10/7/25

Trump, Roberts and His Stacked, Packed and Captured SCOTUS: 'BradCast' 10/7/25 Trump Attempting His 'Invasion from Within': 'BradCast' 10/6/25

Trump Attempting His 'Invasion from Within': 'BradCast' 10/6/25 Biden Budget Expert: Mass Firings in Shutdown 'Illegal': 'BradCast' 10/2/25

Biden Budget Expert: Mass Firings in Shutdown 'Illegal': 'BradCast' 10/2/25 Why is DOJ Suing 'Blue' States for Their Voter Databases?: 'BradCast' 10/1/25

Why is DOJ Suing 'Blue' States for Their Voter Databases?: 'BradCast' 10/1/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL