READER COMMENTS ON

"Holder Pretends to be 'Concerned' About 'Too Big to Jail' Banks; Sen. Warren Raises Hell About It"

(20 Responses so far...)

COMMENT #1 [Permalink]

...

WingnutSteve

said on 3/11/2013 @ 9:38 pm PT...

COMMENT #2 [Permalink]

...

Kenneth Fingeret

said on 3/12/2013 @ 3:58 am PT...

Hello Brad,

Yeah! Lets hear it for the "Amerikkan Injustice System". The only good news from this is we are one more step closer to imploding (see the end times of the Roman Empire for a preview of what we will be going through).

COMMENT #3 [Permalink]

...

dixie blood

said on 3/12/2013 @ 4:45 am PT...

Eric "Place" Holder is dead wrong. First, he is not sanctioned or tasked with the business of making economic decisions. It's not his job. Obama should tell he so. Of course, Obama is corrupt too.

Second, one could just as likely be correct by making the judgement that prosecuting these banks would improve the world economy and put more trust back into the system.

Place Holder is guessing at what might happen. His guess is not anymore likely to be correct than my guess. But, his job is to prosecute and uphold the laws of the United States of America. If he can't do that then he has an ego to big to remain employed at DoJ.

COMMENT #4 [Permalink]

...

Ernest A. Canning

said on 3/12/2013 @ 9:04 am PT...

Leave it to a blindly partisan ideologue like Steve Snyder aka WingnutSteve @1 to attempt to reduce the across-the-board abandonment of Equal Justice Under Law in terms of a political issue that is somehow limited to Democrats.

The plain and simple fact is that giant banks poured funds into the Presidential campaigns of both Mitt Romney and Barack Obama. While HSBC was pouring money into Obama’s campaign, the scandal-tainted Barclay’s Bank poured money into the Romney campaign.

The one race that was lopsidedly funded by Wall Street and the banks was the Brown/Warren contest. Where Warren, a people’s candidate, has now used her position on the Senate Banking Committee to highlight the inequity of our two-tiered system of justice, Brown joined the government affairs department of a giant multinational law firm that services Wall Street giants like Goldman Sachs.

The one area in which Mr. Snyder and I do apparently agree concerns the corrupting influence of campaign contributions via Citizens United which has led to an elite consensus on what amounts to an abandonment of the rule of law.

COMMENT #5 [Permalink]

...

sunnysteve

said on 3/12/2013 @ 9:18 am PT...

Read this link to see how Dept of Treasury can, indeed, bring sanctions against any foreign bank or individual. The Treasury official responding to Warren is apparently ignorant of his agency's authority?

Even if it would be too disruptive to ban HSBC's transactions with U.S. businesses and individuals, I doubt that banning its executives from such transactions would have any effects except on them personally. And would that not be justified?

http://www.treasury.gov/...leases/Pages/jl1876.aspx

COMMENT #6 [Permalink]

...

moplus

said on 3/12/2013 @ 3:19 pm PT...

Just before the beginning of this second term, it was rumored that holder would resign as did other who had served in the first, ever wonder why he did not. He and you know who are protecting the crooks

COMMENT #7 [Permalink]

...

WingnutSteve

said on 3/12/2013 @ 3:59 pm PT...

Leave it to the blindly partisan ideologue ernie to change the subject away from what's important. There is an important story here:

A bank with well documented criminal offenses manages to escape federal prosecution for their criminal activity. The President who has determined not to pursue charges against the criminals happens to be the same person who received major campaign contributions from said criminals. THAT is the story.

Changing the subject to Romney received contributions from the same people has ZERO, NADA, ZILCH, NUTHIN' to do with the story, it's a moot point because guess what? Romney can't prosecute them....

I will give you this ernie; had Romney won the election and had Romney's AG done the same tap dance before congress you would see a different story on bradblog. Because what Brad felt was insignificant enough to not merit any mention in this piece would have been the headline in a Romney piece. "Major Romney Donor Escapes Prosecution!".

This story defines what's wrong with journalism today, not what we get told but what the journalist decides we don't need to know. It also proves that the statement "It's not about right vs. left, it's about right vs. wrong" carries about as much weight as Fox News "Fair and Balanced" claim...

COMMENT #8 [Permalink]

...

Brad Friedman

said on 3/12/2013 @ 5:32 pm PT...

Seriously, Steve? In the comment thread of a story in which I bash the hell out of the Obama Administration, you're honestly comparing me to Fox "News"? Really?

Look, you are welcome to enjoy your bickering with Ernie as you like. But when you pull that shit outta your ass --- with absolutely no evidence to support it, and much more to counter it --- you do little more than help him make his points. Not only was I not aware of the alleged donations from HSBC to Obama (your link to an article republished from a different RW website doesn't offer actual evidence, it just makes the charge and I haven't had time to go digging for confirmation in the meantime, and the story wasn't even about that!), but even if I take it on faith that the original charge you cite is correct, there is almost zero actual evidence to support the overall case you are trying to make here.

Let's review:

+ You are suggesting that for $75k in two different elections, the Obama Admin was willing to NOT look the other way, but force HSBC into the largest single settlement ever with any bank ($1.2 trillion, as I recall.)

+ You are suggesting that Obama --- not Holder (or underlings) --- is personally responsible for HSBC not being prosecuted, though I'm aware of no evidence to support that charge.

+ I suppose that would also mean that all of those other banks, who have similarly gotten off the hook (and the oil companies, and the coal companies, etc. etc. who received similar treatment) were also let off the hook thanks to donations made to the Obama campaign. Even those who didn't make any. And you are doing that w/o actual evidence to make that case (and much that actually counters it, eg. the corporations who have gotten off the hook but who didn't donate to Obama.)

+ And, to reiterate, in the comment section of a story in which I blast the Admin --- its AG, its Dept. of Justice and its Treasury Dept. --- for "illustrat[ing] the very heart of the most broken part of our broken government", in which I charge Obama's AG with pretending to give a damn, calling his claims "bullshit" and describing him as an "embarrassment", that is just like what Fox "News" does as you see it.

While I often feel that Ernie is actually way too hard on you here, you then go and post horseshit like the above and remind me that he must be letting you off the hook way too easily. It's ridiculous, Steve. Not to mention completely wrong and obnoxiously insulting.

But, of course, feel free to let me know where Fox "News" ever went up against the Bush Administration, two of it's top agencies, and its top law enforcement official in the way I have above (and many other times in the past), and I'll be happy to issue an apology.

COMMENT #9 [Permalink]

...

David Lasagna

said on 3/12/2013 @ 6:55 pm PT...

wingnutsteve,

Would you consider doing most of us here a favor and changing your "comment" name to "pleasedisregardthispostnotlikelytobe muchrightinitbuticanthelpmyselfsteve"?

thanks, in advance.

COMMENT #10 [Permalink]

...

WingnutSteve

said on 3/12/2013 @ 8:26 pm PT...

I didn't choose to bicker with ernie. I made a valid point, he chose to call names and attack me personally as a retort per his SOP.

HSBC made campaign contributions to both candidates, somewhat more to Obama, in 2012. That's real money by people to candidates, it doesn't include donations to PACS or fundraising dinners etc. HSBC banking also owns HSBC Global Research, a company heavily invested in Green technology which even published a point paper in January 2012 outlining among other things the importance of Obama's reelection.

http://thehill.com/image...te_investment_update.pdf

I can find no record of personal or corporate campaign contributions from HSBC Global Research although looking at the list of personnel involved in the point paper they all seem to be foreign. Those are contributions we won't ever hear about. Bottom line: campaign donor which is also involved in research near and dear to Obama's heart gets off with a mere fine? Please...

Ernie's not harsh, personal attacks mean little coming from a random internet guy. I resolve to no longer get into little pissing matches with him however. When his comments towards me are worth nothing I'm going to try to just let it go.

And REALLY??? You knew nothing of HSBC donating to the Obama campaign? As soon as I saw the piece I thought "campaign donor" googled it, and there it is.

I'm sorry about the Fox slam, that's hitting below the belt

COMMENT #11 [Permalink]

...

Ernest A. Canning

said on 3/12/2013 @ 8:50 pm PT...

Nice try, again, Mr. Snyder, aka WingnutSteve.

It was you who changed the subject by trying to pervert an article in which Brad had leveled a blast against AG Eric Holder for accepting "too big to jail" while, at the same time, Brad linked to an article by me in which I cited the "two-tiered" system of injustice that entails near complete elite impunity as it related to the ethically-challenged, GOP appointed Supreme Court Justices Thomas & Scalia.

The essence of Brad's article is that America's bi-partisan political and economic elites have abandoned Equal Justice Under Law.

But, once again, you just couldn't resist trying to turn this into a partisan issue in which you weakly tried to dump the entire mess onto campaign contributions that were made to President Obama.

You may think it a personal attack when I point out that your vision is obscured by partisan blinders, but, I, and I believe a good number of others, would see that as simply an objective observation of the fatally flawed reasoning you post in comment-after-comment.

COMMENT #12 [Permalink]

...

Brad Friedman

said on 3/12/2013 @ 10:27 pm PT...

Steve -

I'm not gonna waste much more time on this here in comments. You have a proven record of failing to admit when you're wrong.

That said, since you clearly have at least some research skills, I'm happy to invite you to put together an article for submission and potential publication at The BRAD BLOG on this issue that you believe you have found to be at the heart of the Obama Administration going easy on HSBC and the many other banks and large corporations it has refused to hold accountable.

Please understand (as Ernie will most certainly attest), you'll need to have your ducks in order, with a very solid, and independently verifiable case presented before I would consider publication here. But I'm happy to look at your work, if you'd like to put in the effort.

Since I was not making the case that the Obama Admin was going easy on any particular corporation due to a quid pro quo exchange for campaign favors --- as you are arguing here --- it is not something I wrote about in this article or looked at when doing so. I've not personally seen a direct connection of the sort you are alleging, but I've not been personally looking into it either (there is a lot to cover here, with few resources with which to do it). So I'm more than happy to look at a fully compiled case/article written on the subject for potential publication here. No promises, but I'll make my best faith effort to review your work, work with you on edits, and then publish it here if it meets our standards.

It's up to you, of course, if you'd like to do that. I'm always on the hunt for good new writers, researchers and reporters.

COMMENT #13 [Permalink]

...

Ancient

said on 3/13/2013 @ 1:17 am PT...

COMMENT #14 [Permalink]

...

David Lasagna

said on 3/13/2013 @ 6:26 am PT...

The day wingnutsteve actually does THOROUGH research and gets his ducks in order is the day ducks become head coaches in the NFL.

But my guess is that Steve will either ignore Brad's offer cuz he can't hack it or dismiss it out of hand cuz to actually do what is required to create journalism one can trust would make his partisan head explode.

Love to be wrong on this, but I just don't see it.

COMMENT #15 [Permalink]

...

lmk

said on 3/13/2013 @ 6:38 am PT...

Dear Mr. Wingnut:

Correlation does not always equal causation.

Signed,

The Peanut Gallery

PS: Brad, the "Feins" in your squib about this item on the right side of your page hurts my eyeballs. I see nothing about the Irish mentioned so I am assuming the word you meant to use was "Feigns".

COMMENT #16 [Permalink]

...

Ernest A. Canning

said on 3/13/2013 @ 8:42 am PT...

Go easy on the Ducks, David Lasagna. They won a Stanley Cup a few years back.

COMMENT #17 [Permalink]

...

Roberts

said on 3/13/2013 @ 10:48 am PT...

"a negative impact on the national economy, perhaps even the world economy." This statement by Holder is the same as the republican view...To big to keep honest? Hmmm...Boy,have we ever been hoodwinked...

As for wingnuts like this guy steve, I have learned these folks are not open to other views...and would rather argue for bad policy instead of accepting the truth...

COMMENT #18 [Permalink]

...

David Lasagna

said on 3/13/2013 @ 1:39 pm PT...

Sorry, Ernie, certainly meant no disrespect to either the Ducks or ducks in general. I was speaking more to what I had always viewed as a lack of interest in the NFL by ducks generally. But I may have been anthropomorphizing.

COMMENT #19 [Permalink]

...

WingnutSteve

said on 3/13/2013 @ 5:47 pm PT...

Nice offer Brad, appreciate it. I think I'll continue to read what you write. I got a chuckle out of "some research skills" btw, I wouldn't really know where to start.

COMMENT #20 [Permalink]

...

Ernest A. Canning

said on 3/16/2013 @ 2:16 pm PT...

Why am I not surprised that when Brad offers Steve Snyder aka WingnutSteve the opportunity to back up his claim that the Obama administration has bought into too big to jail based upon a campaign contribution from HSBC, Steve admits that he "wouldn't know where to start."

As my friends from Texas say, Steve, you're all hat and no cattle.

A Pretty Weak 'Strongman': 'BradCast' 10/30/25

A Pretty Weak 'Strongman': 'BradCast' 10/30/25 'Green News Report' 10/30/25

'Green News Report' 10/30/25

Proposal for 'First Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29/25

Proposal for 'First Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29/25 Monster Storm, Endless Wars, Gamed Elections:

Monster Storm, Endless Wars, Gamed Elections: 'Green News Report' 10/28/25

'Green News Report' 10/28/25 Let's Play 'Who Wants

Let's Play 'Who Wants Sunday 'Cartoonists Dilemma' Toons

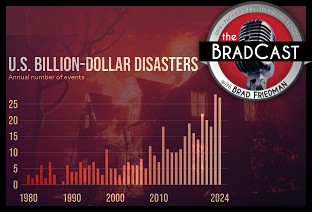

Sunday 'Cartoonists Dilemma' Toons Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25

Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25  'Green News Report' 10/23/25

'Green News Report' 10/23/25 Trump-Allied GOP Partisan Buys Dominion Voting Systems: 'BradCast' 10/22/25

Trump-Allied GOP Partisan Buys Dominion Voting Systems: 'BradCast' 10/22/25 Trump, Republican Law(lessness) & (Dis)Order: 'BradCast' 10/21/25

Trump, Republican Law(lessness) & (Dis)Order: 'BradCast' 10/21/25 'Green News Report' 10/21/25

'Green News Report' 10/21/25 Celebrating 'No Kings': 'BradCast' 10/20/25

Celebrating 'No Kings': 'BradCast' 10/20/25 Sunday 'How It Started' Toons

Sunday 'How It Started' Toons SCOTUS Repubs Appear Ready to Gut Rest of Voting Rights Act: 'BradCast' 10/16/25

SCOTUS Repubs Appear Ready to Gut Rest of Voting Rights Act: 'BradCast' 10/16/25 'Green News Report' 10/16/25

'Green News Report' 10/16/25 The 'Epstein Shutdown' and Other Autocratic Nightmares: 'BradCast' 10/15/25

The 'Epstein Shutdown' and Other Autocratic Nightmares: 'BradCast' 10/15/25 Group Vows to Block MO's GOP U.S. House Gerrymander: 'BradCast' 10/14/25

Group Vows to Block MO's GOP U.S. House Gerrymander: 'BradCast' 10/14/25 Trump Labor Dept. Warns Trump Policies Sparking Food Crisis: 'BradCast' 10/9/25

Trump Labor Dept. Warns Trump Policies Sparking Food Crisis: 'BradCast' 10/9/25 Trump's Losing Battles: 'BradCast' 10/8/25

Trump's Losing Battles: 'BradCast' 10/8/25 Trump, Roberts and His Stacked, Packed and Captured SCOTUS: 'BradCast' 10/7/25

Trump, Roberts and His Stacked, Packed and Captured SCOTUS: 'BradCast' 10/7/25 Trump Attempting His 'Invasion from Within': 'BradCast' 10/6/25

Trump Attempting His 'Invasion from Within': 'BradCast' 10/6/25 Biden Budget Expert: Mass Firings in Shutdown 'Illegal': 'BradCast' 10/2/25

Biden Budget Expert: Mass Firings in Shutdown 'Illegal': 'BradCast' 10/2/25 Why is DOJ Suing 'Blue' States for Their Voter Databases?: 'BradCast' 10/1/25

Why is DOJ Suing 'Blue' States for Their Voter Databases?: 'BradCast' 10/1/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL