Marveling at the remarkably positive vibe emerging from the recent Democratic National Convention in Chicago, Philadelphia Inquirer columnist Will Bunch observed:

Marveling at the remarkably positive vibe emerging from the recent Democratic National Convention in Chicago, Philadelphia Inquirer columnist Will Bunch observed:

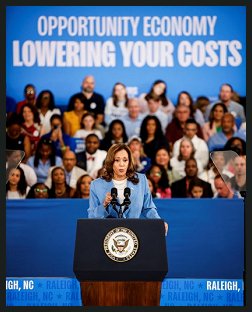

That "new power dynamic" Bunch references is embodied in Vice President Kamala Harris' open alignment with the economic needs of the vast majority of Americans who make up the working and middle classes.

Whether or not the recommendation from Sen. Bernie Sanders, this nation's most progressive Senator, was a factor, it is clear that Harris' decision to pick one of the nation's most progressive Governors, Tim Walz of Minnesota --- a governor who gleefully signed a bill for free breakfast and lunch for all school children into law --- as her Vice-Presidential pick, reflects her commitment to progressive values.

As Georgia's Republican former Lt. Gov. Geoff Duncan made clear during his DNC speech, there's no need for Harris to move to the right to attract voters from outside of the progressive realm. The threat to democracy posed by Donald Trump, Project 2025 and the MAGA cult, along with the Democrats' commitment to "freedom", "patriotism" and respect for the rule of law, will be enough to attract honest conservative voters irrespective of whether they still call themselves Republicans or now describe themselves as either former Republicans or independents.

By adhering to her progressive economic values --- whether it comes to support for organized labor, an increase in the federal minimum wage, the expansion of social safety net programs, tax increases on the wealthy, the expansion of accessible health care and a crackdown on corporate price gouging --- Harris can not only maintain authenticity but also take advantage of the fact that an overwhelming majority of the American electorate both want and need such progressive economic policy initiatives...

LABOR UNIONS

"President Biden", CNBC reported, "made history as the first sitting president to ever appear on a picket line when he visited the United Auto Workers strike in Michigan." Yet, he wasn't the first member of his administration to appear with striking workers on a picket line. Then Senator Kamala Harris joined striking UAW workers on a picket line in 2019.

The willingness of both Biden and Harris to directly support striking workers offers a stark contrast to Donald Trump's appearance at a non-union shop where rally attendees, who were neither auto workers nor union members, held up fake "union members for Trump" and "auto workers for Trump" signs. Trump, himself, erased any doubt about his desire to destroy unions when he gleefully suggested to mega-billionaire Elon Musk that striking workers should be fired.

Harris is on the side of the electorate on this issue. A 2023 AFL-CIO study [PDF] found that 71% of all Americans support unions, as opposed to only 19% who oppose them. Remarkably, the same poll reflects that 75% of Americans support "workers going on strike to negotiate better wages, benefits and working conditions."

MINIMUM WAGE

The federal minimum wage ($7.25/hour) has not been raised since 2009. In 2009, the average rent was $879. Today, the average rent is $1,448. Rent, of course, is illustrative, yet only a single inflationary factor, reflecting the gaping inadequacy of today's federal minimum wage.

Yet, Republicans have steadfastly blocked increases in the minimum wage.

In terms of popularity, a proposal to raise the federal minimum wage is a no-brainer. Two-thirds of Americans support an increase. Thus, it comes as no surprise that, at a recent rally in Las Vegas, Harris voiced her support for raising the minimum wage. She also proposed eliminating taxes on tips earned by hospitality and food service workers. Her campaign later clarified that, unlike her opponent's proposal, high income individuals, like hedge fund managers, could not exploit this by classifying their income as tips. The Harris/Walz tax exemption for tips would include limits on the level of earnings to which the exemption could be applied.

EXPANDING SOCIAL SECURITY

Like backing an increase to the minimum wage, Harris' support for an expansion of Social Security is similarly a no-brainer. A poll taken in 2022 found that 83% of all Americans want Social Security to not only be retained but also expanded.

ACCESS TO HEALTH CARE

In 2019, then-Senator Kamala Harris co-sponsored a single-payer, Medicare for All bill that had been introduced by Senator Sanders. While that position was abandoned by Harris when she became President Biden's running-mate, her more recent remarks suggest a possible renewal of support for Medicare for All and certainly for universal health care.

Last April, Harris told Biden administration supporters in North Carolina that "access to healthcare should be a right and not a privilege for those who can afford it".

Harris hasn't explicitly said she will renew her prior support for a Medicare for All program. If she openly embraced it during the campaign, Harris would be tapping into an immensely popular policy. As of 2020, single-payer, Medicare for All was supported by 69% of all voters, including 87% of all Democrats.

A more recent Gallop survey released in January 2023 described a more modest majority (57%) who "believe that the federal government should ensure all Americans should have healthcare coverage." That poll, however, may have been skewed by poorly worded questions. The Gallop poll reflected that "53% prefer that the U.S. healthcare system be based on private insurance rather than run by the government."

In the U.S., government-run healthcare is provided for eligible veterans by the Department of Veterans Affairs (VA). Medicare, as it now exists, or as envisioned by single-payer advocates, does not entail a "government-run" system. To the contrary, Medicare for All advocates envision a system, like Canada's, where citizens and residents select their own providers. In Canada, the providers are directly funded by the government. "All citizens and permanent residents...receive medically necessary hospital and physician services free at the point of use." There are some excluded services, for example, dental and prescription meds, for which many Canadians obtain insurance.

Thanks to the Inflation Reduction Act, the Centers for Medicare and Medicaid Services (CMS) can use its collective purchasing power to negotiate lower prescription drug prices for those, mostly seniors, who qualify for Medicare. A single-payer, Medicare For All system would allow CMS to negotiate lower prescription drug prices for all citizens and lawful residents. Lower prescription drug prices are immensely popular among the public.

TAXING WEALTHY INDIVIDUALS AND CORPORATIONS

Both President Biden and Vice President Harris support a tax plan that would raise $5 trillion in revenue over the next decade --- a plan that would not increase taxes on anyone earning less than $400,000/year. This would include raising the corporate tax rate from 21% to 28%, an increase on the top marginal tax rate on wealthy individuals from 37% to 39.6%, and changes in how investment income is taxed.

(In this writer's view, the proposed increase in the top marginal rate is woefully inadequate. During the Eisenhower era, the top marginal rate was 91%. Among other things, the monies produced by those taxes funded President Eisenhower's creation of the interstate highway system across the entire nation. And much of the corrupting political mischief engaged in by the billionaire class could be reduced if the 91% rate were restored and applied to all incomes over $10 million per year. Harris, however, has not shown support for such an expansive increase in taxes, even for the wealthy.)

Harris also supports a Biden proposal, blocked by the current Congress, that would impose a tax on unrealized capital gains. The proposal would only apply to individuals who have more than $100 million in personal wealth if at least 80% of that wealth is in assets that can be traded.

Regardless of the precise top marginal rate, proposals to raise taxes on the wealthy and on corporations are immensely popular. "Four in five Americans," Maryann Cousins of Navigator reported earlier this year, "support raising taxes on the rich."

HOUSING COSTS AND PRICE-GOUGING

In recent speeches, Harris has laid out plans for the federal government to crack down on corporate price-gouging that has led to high grocery costs and to take on rent hikes --- plans that, according to former Labor Secretary Robert Reich, were promptly mischaracterized by Donald Trump as "price controls". That dishonest critique was echoed on the right by economists and media personalities.

"Harris is not advocating price controls," Reich argued. She's "attacking the source of high-prices: monopoly power" by "offering anti-trust competition."

To a large degree, Harris is simply expanding upon both the Biden administration's policies and anti-trust enforcement by the U.S. Department of Justice (DOJ).

Indeed, the DOJ just announced that it, along with the Attorneys General from eight States (NC, CA, CO, CT, MN, OR, TN and WA), have filed a civil anti-trust lawsuit against RealPage, Inc. According to the DOJ, the company is allegedly utilizing algorithmic software powered by artificial intelligence to allow corporate and wealthy landlords to unlawfully coordinate on rents and housing prices.

High rents and inflated prices for homes are also the product of a decision by Wall Street institutional investors to buy-up single-family residences, which are then placed on the market as high-priced rentals. Institutional ownership reduces the number of homes available for individual families to purchase, thereby increasing the cost to purchase a home. Harris plans to curb institutional ownership and invest in the construction of three million new homes in order to increase supply and reduce pressure on pricing. She also proposes federal government grants of up to $25,000 for down-payment assistance to first-time home buyers.

Similarly nefarious price-gouging issues have arisen with respect to groceries, where "corporate profits rose five-times faster than the rate of inflation from 2020 to 2022."

Last year, the DOJ "filed a civil antitrust lawsuit against Agri Stats Inc...for organizing and managing anticompetitive information exchanges among broiler chicken, pork and turkey processors." And, just this week, in sworn testimony during an antitrust trial, Kroeger's Senior Director for Pricing admitted that the retail giant had engaged in price-gouging by raising prices beyond the level of inflation.

In March, the Biden administration announced an immensely popular plan to create a "strike force" to curb corporate price-gouging. A poll conducted by New Data For Progress that same month discovered that 77% of voters agreed the federal government "should do more to take on corporations that unfairly and illegally raise prices on consumers."

Building upon that, Harris proposed a new federal ban on price-gouging by instituting rules to "make clear that big corporations can't unfairly exploit consumers to run up excessive profits." The programs she has favored, to date, can hardly be characterized as the "Marxist" "price controls" that Trump and his disingenuous supporters characterize them to be.

Thus, by advancing progressive economic issues --- from support for organized labor, to higher wages for workers, a fairer tax code, more accessible health care, more affordable housing and enforcement of anti-trust laws against corporate interests --- Harris/Walz campaign is offering voters precisely what they need and want. She should ignore the predictable calls from Republicans, echoed by the nation's corporate media outlets, to move toward the right in her general election campaign. She is already exactly where the majority of the electorate wants her to be.

Ernest A. Canning is a retired attorney, author, and Vietnam Veteran (4th Infantry, Central Highlands 1968). He previously served as a Senior Advisor to Veterans For Bernie. Canning has been a member of the California state bar since 1977. In addition to a juris doctor, he has received both undergraduate and graduate degrees in political science. Follow him on Twitter: @cann4ing

Ernest A. Canning is a retired attorney, author, and Vietnam Veteran (4th Infantry, Central Highlands 1968). He previously served as a Senior Advisor to Veterans For Bernie. Canning has been a member of the California state bar since 1977. In addition to a juris doctor, he has received both undergraduate and graduate degrees in political science. Follow him on Twitter: @cann4ing

Former Federal Prosecutor: Trump Must Be Sentenced in NY Before Taking Office Again: 'BradCast' 11/20/24

Former Federal Prosecutor: Trump Must Be Sentenced in NY Before Taking Office Again: 'BradCast' 11/20/24 'Bullet Ballot' Claims, Other Arguments for Hand-Counting 2024 Battleground Votes: 'BradCast' 11/19/24

'Bullet Ballot' Claims, Other Arguments for Hand-Counting 2024 Battleground Votes: 'BradCast' 11/19/24 'Green News Report' 11/19/24

'Green News Report' 11/19/24

Trump Already Violating Law (He Signed!) During Transition: 'BradCast' 11/18/24

Trump Already Violating Law (He Signed!) During Transition: 'BradCast' 11/18/24 Sunday 'Into the Gaetz of Hell' Toons

Sunday 'Into the Gaetz of Hell' Toons Computer Security Experts Ask Harris to Seek Hand-Counts Due to Voting System Breaches: 'BradCast' 11/14/24

Computer Security Experts Ask Harris to Seek Hand-Counts Due to Voting System Breaches: 'BradCast' 11/14/24  'Green News Report' 11/14/24

'Green News Report' 11/14/24 Trump Criminal Cases Fade After Election as GOP 'Does Not Believe in Rule of Law': 'BradCast' 11/13/24

Trump Criminal Cases Fade After Election as GOP 'Does Not Believe in Rule of Law': 'BradCast' 11/13/24 Climate Advocates Brace for Fight With Trump 2.0: 'BradCast' 11/12/24

Climate Advocates Brace for Fight With Trump 2.0: 'BradCast' 11/12/24 'Green News Report' 11/12/24

'Green News Report' 11/12/24 Let It All Out: 'BradCast' 11/11/24

Let It All Out: 'BradCast' 11/11/24 Sunday 'Like it or Not' Toons

Sunday 'Like it or Not' Toons Not All Bad: Abortion Rights Won Big (Almost) Everywhere: 'BradCast' 11/7/24

Not All Bad: Abortion Rights Won Big (Almost) Everywhere: 'BradCast' 11/7/24 'Green News Report' 11/7/24

'Green News Report' 11/7/24 U.S. CHOOSES CONVICTED CRIMINAL, ADJUDICATED RAPIST: 'BradCast' 11/6/24

U.S. CHOOSES CONVICTED CRIMINAL, ADJUDICATED RAPIST: 'BradCast' 11/6/24 ELECTION DAY 2024: Tea Leaves, Probs for Voters, What's Next: 'BradCast' 11/5/24

ELECTION DAY 2024: Tea Leaves, Probs for Voters, What's Next: 'BradCast' 11/5/24 'Closing Arguments' for Undecideds, Third-Party Voters: 'BradCast' 11/4/24

'Closing Arguments' for Undecideds, Third-Party Voters: 'BradCast' 11/4/24 The GOP 'Voter Fraud' Before the Storm: 'BradCast' 10/31/24

The GOP 'Voter Fraud' Before the Storm: 'BradCast' 10/31/24 'Closing Arguments'with Digby and Driftglass: 'BradCast' 10/30/24

'Closing Arguments'with Digby and Driftglass: 'BradCast' 10/30/24 Trump Promises to be a Lawless, Authoritarian President. Believe Him: 'BradCast' 10/29/24

Trump Promises to be a Lawless, Authoritarian President. Believe Him: 'BradCast' 10/29/24 Ballots Burn, Billion-aires 'Obey in Advance', Callers Ring In: 'BradCast' 10/28/24

Ballots Burn, Billion-aires 'Obey in Advance', Callers Ring In: 'BradCast' 10/28/24 Musk's Privatized Internet Satellite System Threatens U.S. National Security

Musk's Privatized Internet Satellite System Threatens U.S. National Security

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL