Since the entrance of Sen. Bernie Sanders into the race for the 2016 Democratic Presidential nomination (and even well before), we've been discussing the concept of the "democracy deficit", defined by Noam Chomsky as the significant gap between the policy positions of the electorate and their "representatives", occasioned by the manner in which, as he argues, "elections are skillfully managed to avoid issues and marginalize the underlying population…freeing the elected leadership to serve the substantial people."

Since the entrance of Sen. Bernie Sanders into the race for the 2016 Democratic Presidential nomination (and even well before), we've been discussing the concept of the "democracy deficit", defined by Noam Chomsky as the significant gap between the policy positions of the electorate and their "representatives", occasioned by the manner in which, as he argues, "elections are skillfully managed to avoid issues and marginalize the underlying population…freeing the elected leadership to serve the substantial people."

An article by Kevin Cirilli in The Hill last week, "Banks brace for Bernie Sanders" provides yet another opportunity to examine that troubling paradigm and the well-organized role the nation's corporate elite play in it.

While an effective, issue-based campaign from a self-declared "democratic socialist" like Sanders could otherwise serve to galvanize a bottom-up, small "d" democratic revolution at the polls, The Hill fails to so much as suggest that Wall Street is in any way concerned about what might transpire if Sanders were actually to secure the Democratic Party Presidential nomination. "He poses no real threat to the former secretary of State’s eventual nomination," Cirilli writes, citing the self-fulfilling prophecy of the elusive "conventional wisdom".

Instead, quoting one banking lobbyist after another, each who marginalize Sanders, the DC-based publication reports only that "Wall Street is worried that Sen. Bernie Sanders’s vigorous calls for banking industry reform will pull Hillary Clinton to the left, as the two presidential candidates battle for the 2016 Democratic nomination"...

Hedging bets in the Wall Street casino

Wall Street's slick operators have traditionally hedged their bets by pouring millions of dollars into the campaigns of Democrats like Barack Obama and both Bill and Hillary Clinton, as well as Republicans, like Mitt Romney. The strategy ensures that, irrespective of whether one of these so-called "centrist" Democrats or a Republican prevails in the next general election, Wall Street's interests will not be significantly threatened.

But would candidate Hillary Clinton being "pulled to the left" during the course of the campaign amount to anything more than empty populist rhetoric? Does The Hill's focus on that notion reveal a more subtle strategy to shift the focus away from the possibility of a Sanders nomination and/or Presidency in order to focus only on what effect the independent Vermont gadfly might have on one of Wall Street's favored candidates?

Given the history of Wall Street deregulation under Bill Clinton and the acceleration of wealth disparity during the Obama administration, to the point that at least 91% of all new wealth since the 2008 economic meltdown has been captured by the already-richest one percent, the fear that Sanders' candidacy would somehow translate to genuinely progressive Wall Street reform during a subsequent Hillary Clinton administration is a dubious proposition, at best.

What we really see in The Hill's article is an effort by Wall Street, aided in no small part by its allies in the corporate-owned mainstream media, to take a page out of 19th Century, African-American folklore, in which a sly Br'er Rabbit outsmarted Mr. Fox by begging and pleading not to be thrown into the briar patch.

The Br-er Rabbit tale

For those who do not recall from their childhood the important, if unfortunately somewhat racist Disney depiction of the Br-er Rabbit briar patch tale from Song of the South, here's a reminder...

Knowing that he was despised by Mr. Fox, who'd have no compunction but to eat him alive, Br'er rabbit convinces his nemesis that his greatest fear is to be thrown into the briar patch, when, in reality, the briar patch was precisely where he wanted to be all along.

Wall Street is Br'er Rabbit. Hillary Clinton is their 'briar patch'.

The banking elite and their allies in our capitalist media understand that they cannot compete with Sanders, a self-described "democratic socialist," on a policy-laden playing field --- not at a time when, according to PBS News Hour, "Americans consider inequality [to be the] world's greatest danger." That conclusion was bolstered by a recent YouGov poll, which found that 94% of all Americans agreed with arguments advanced by both Sanders and Sen. Elizabeth Warren (D-MA) that the U.S. political and economic system is rigged to benefit the rich and powerful.

Instead, the elites turn to an array of deceptive tactics. At all costs, the 2016 electoral decision must not become a clear-cut choice between candidates who authentically represent the interests of the middle and working classes versus those who represent the oligarchic interests of what the Occupy Wall Street movement dubbed the "one percent" --- Chomsky's "substantial people."

We are finding a predictably familiar theme throughout the corporate-owned MSM resulting in the "marginalization" of Sanders and his campaign in a manner that treats the prospect of a Sanders victory as a possible outcome they dare not mention, let alone concede. Thus, in The Hill's article, instead of discussing the impact a successful Sanders campaign might have upon those who profit handsomely from Wall Street's mostly unregulated and oft-fraudulent schemes, reporter Cirilli tells us only that "Wall Street is worried" how a Hillary presidency might be effective by those pesky "leftists" like Sanders and his ilk.

The analysis ignores the enormous difference between Wall Street-funded candidates, like Obama and the Clintons, uttering populist, anti-Wall Street rhetoric in order to get elected, versus actual policies that ultimately reflect the "democracy deficit" precisely because they are at odds with the will of the vast majority of the electorate. That electorate, we should add, has traditionally been discouraged at the polling place by the "lesser evil paradigm" into voting for a Wall Street-funded Democrat, as opposed to a "third party" candidate who truly represents their interest. A large segment of the electorate fears that, by casting their "third party" vote, they would actually increase the prospects for an oligarchic Republican to prevail.

As observed last year by FAIR's Peter Hart, while Wall Street raised the alarm last November about President Barack Obama's harsh, anti-Wall Street rhetoric, the "bigger question [was] not Obama’s rhetoric, but his actions." Those actions, Hart added, "most notably [entailed] his administration's failure to hold Wall Street executives responsible for the widespread fraud that helped bring down the economy, and his appointment of financial industry alums like Lawrence Summers and Jack Lew to key economic posts." And, according to Hart, the "story here...is that Wall Street sees Hillary Clinton more favorably than Obama."

The Nation recently reported that Sanders' major piece of new legislation, the "Too Big to Fail, Too Big to Exist Act", would end "too big to fail" banking policies and reinstate Glass-Steagall by prohibiting "banks...from using insured deposits for any kind of speculative activities or hedging." While Sanders, in describing the bill --- which has also been introduced in the House by Reps. Brad Sherman (D-CA) and Alan Grayson (D-FL) --- reportedly avoided questions about Hillary Clinton, "he did sideswipe Bill Clinton’s record on Wall Street at one point." Specifically, Sanders said: "I was one of the leading opponents of Alan Greenspan, Robert Rubin, and Larry Summers, who all told us how wonderful it would be if we deregulated Wall Street back in the 1990s."

At this point, it all seems a bit transparent. Wall Street would like you to believe it fears a "pulled-to-the-left" Hillary Clinton presidency for the same reasons that Br'er Rabbit wanted Mr. Fox to believe he feared being thrown into the briar patch. The only question is whether the American electorate will be duped into playing the role of Mr. Fox. Again.

Sunday 'Leave 'em in Stitches' Toons

Sunday 'Leave 'em in Stitches' Toons President of United States Calls for Killing Democratic Officials: 'BradCast' 11/20/25

President of United States Calls for Killing Democratic Officials: 'BradCast' 11/20/25 'Green News Report' 11/20/25

'Green News Report' 11/20/25

Is MAGA Finally Beginning to Fall Apart?: 'BradCast' 11/19/25

Is MAGA Finally Beginning to Fall Apart?: 'BradCast' 11/19/25 Trump's Terrible, Horrible,

Trump's Terrible, Horrible, 'Green News Report' 11/18/25

'Green News Report' 11/18/25 A Kaleidoscope of Trump Corruption: 'BradCast' 11/17/25

A Kaleidoscope of Trump Corruption: 'BradCast' 11/17/25  Sunday 'Back to Business' Toons

Sunday 'Back to Business' Toons Trump DOJ Takes Stand

Trump DOJ Takes Stand 'Green News Report' 11/13/25

'Green News Report' 11/13/25 Mamdani's 'Surprisingly Affordable' Afford-ability Agenda for NYC: 'BradCast' 11/12

Mamdani's 'Surprisingly Affordable' Afford-ability Agenda for NYC: 'BradCast' 11/12 After the Shutdown and Before the Next One: 'BradCast' 11/11/25

After the Shutdown and Before the Next One: 'BradCast' 11/11/25 'Green News Report' 11/11/25

'Green News Report' 11/11/25 Victories for Democracy in Election 2025; Also: 7 Dems, 1 Indie Vote to End Shutdown in Senate: 'BradCast' 11/10/25

Victories for Democracy in Election 2025; Also: 7 Dems, 1 Indie Vote to End Shutdown in Senate: 'BradCast' 11/10/25 Sunday 'Ass Kicking' Toons

Sunday 'Ass Kicking' Toons 'We Can See Light at the End of the Tunnel' After Election 2025: 'BradCast' 11/6/25

'We Can See Light at the End of the Tunnel' After Election 2025: 'BradCast' 11/6/25 'Green News Report' 11/6/25

'Green News Report' 11/6/25 BLUE WAVE! Dems Win Everything Everywhere All at Once: 'BradCast' 11/5/25

BLUE WAVE! Dems Win Everything Everywhere All at Once: 'BradCast' 11/5/25 Repub Thuggery As Americans Vote: 'BradCast' 11/4/25

Repub Thuggery As Americans Vote: 'BradCast' 11/4/25 Last Call(s) Before Election Day 2025: 'BradCast' 11/3/25

Last Call(s) Before Election Day 2025: 'BradCast' 11/3/25 A Pretty Weak 'Strongman': 'BradCast' 10/30/25

A Pretty Weak 'Strongman': 'BradCast' 10/30/25 Proposal for 'Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29

Proposal for 'Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29 Monster Storm, Endless Wars, Gamed Elections: 'BradCast' 10/28/25

Monster Storm, Endless Wars, Gamed Elections: 'BradCast' 10/28/25 Let's Play 'Who Wants to Be a U.S. Citizen?'!: 'BradCast' 10/27/25

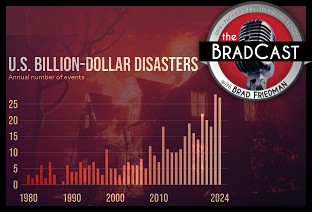

Let's Play 'Who Wants to Be a U.S. Citizen?'!: 'BradCast' 10/27/25 Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25

Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL