On today's BradCast: Who could have predicted it? Another Election Day meltdown in Georgia? Even with the brand new, $104 million, unverifiable, disease-vector touchscreen voting system the state's Republican Secretary of State forced every voter in the state to use at the polls for the first time during Tuesday's twice-postponed Presidential primary in the critical battleground state? Yup. And what has been happening on Wall Street of late underscores how perilous this moment is, and the need to save the voting system in the battleground Peach State before the critical November 3rd elections. [Audio link to full show is posted below this summary.]

On today's BradCast: Who could have predicted it? Another Election Day meltdown in Georgia? Even with the brand new, $104 million, unverifiable, disease-vector touchscreen voting system the state's Republican Secretary of State forced every voter in the state to use at the polls for the first time during Tuesday's twice-postponed Presidential primary in the critical battleground state? Yup. And what has been happening on Wall Street of late underscores how perilous this moment is, and the need to save the voting system in the battleground Peach State before the critical November 3rd elections. [Audio link to full show is posted below this summary.]

Yes, as we've been warning for years now, the roll out of Secretary Brad Raffensperger's new computerized voting system would be a disaster for Georgia voters --- at least for those in or near Atlanta in some of the most heavily Democratic, heavily minority counties in the state. Voters reported wait times as long as 2, 3 and 4 hours in precinct after precinct, to cast their votes today --- even those who showed up before 6am in hopes of being first in line!

New computerized electronic poll-books failed. New computerized touchscreen Ballot Marking Devices (BMDs) failed. New optical-scan computers used to scan the unverifiable ballots printed out by the $4,000 electronic pens (BMDs) failed. What didn't fail was Raffensperger's propensity to blame county officials and poll workers who risked their lives to help voters vote during a deadly pandemic for his own failures to implement a simple, verifiable and much less expensive hand-marked paper ballot system.

More disturbing, the outrageous (if predictable) catastrophic failures of his new systems --- featuring touchscreens made by Canada's Dominion Voting Systems --- come even after Raffensperger ordered absentee ballot applications sent to each of the state's 6.9 million active registered voters (whatever "active" means in his assessment) to help mitigate the dangers of COVID-19 on state voters. Many of those in the same counties which saw huge lines at a reduced number of polling places on Tuesday reported never receiving their requested absentee ballots in the mail.

Today, we detail just some of the hundreds of reported nightmares voters faced trying to vote on Tuesday in Fulton, Cobb, Gwinnett, Muscogee and other counties in the Peach State, as voting equipment was missing altogether at some polling places when they opened; as hand-marked paper ballots quickly ran out at precincts where electronic voting systems couldn't be booted up or failed to work properly once they were turned on; as County officials called for official investigations; and as Raffensperger tried to blame it all on everyone but himself. Yes, we have spent many months (in fact, years now) detailing the lawsuits filed against him, as voters (and some counties) begged him to to move to a hand-marked paper ballot system instead.

Then: No, you are not crazy. You are not imagining it. Yes, up is down and down is up right now. Coronavirus infection rates are, indeed, spiking in a whole bunch of states that have opened up for business around the U.S., despite many collectively pretending the nightmare is over. It isn't. But much of the nation, encouraged by Donald Trump and his supporters, is now pretending otherwise. Similarly, on Wall Street, investors are pretending that the economy is great and the worst of the coronavirus pandemic's shock to the U.S. financial system is over. Of course, we now know the economy had already gone into recession as of February, even before the worst of the COVID-19 shutdowns had begun, ending an 11-year economic expansion that started during Barack Obama's administration and ended under Trump's.

But Wall Street is decidedly not the economy, where, back here in the real world, tens of millions of Americans are newly jobless amid the worst economic downturn since the Great Depression. Nonetheless, on Wall Street, the Nasdaq closed at a record high on Tuesday and both the Dow and S&P 500 indexes have rallied back in recent days to near the record highs they were at before the economy crashed. Billionaires on Wall Street are so drunk with irrational exuberance and flush with decades of sweet sweet tax cut cash that they are even beginning to buy up shares in companies that have filed for bankruptcy amid the crash.

According to the Institute of Policy Study's updated "Billionaire Bonanza 2020" report, between March 18 (roughly the start of the pandemic shutdown), through the fist week of June, "U.S. billionaire's total wealth surged by over $565 billion," even as 42.6 million U.S. workers filed for unemployment. What explains the obscene inequality between the billionaire oligarch class and all of the rest of us?

We're joined today by CHUCK COLLINS, co-author of the IPS study as Director of their Program on Inequality and the Common Good, where he co-edits Inequality.org, to explain what happened and how we can --- and must --- begin to correct the absurd, decades-long and still-growing imbalances in our economy.

"Only 14% of Americans have direct investments in stock," Collins explains. "So this tells us the story of how the top ten percent --- and in this case, how the billionaires --- are seeing their wealth surge during an unfortunate time for everyone else."

"We're now at the culmination of four decades of growing income and wealth inequality. As we went into the pandemic, we were at maybe our greatest unequal level since the Gilded Age. And the reality is, since 2009, only about 20 percent of households have recovered where they were in terms of savings and net worth prior to the Great Recession of 2008. So, think about that --- 80 percent of households went into the pandemic with an economic hangover, still not really fully back on their feet in the last eleven years. This recession and pandemic are going to supercharge the existing income and wealth inequalities that we are already living through."

Collins charges that "we're just absorbing now the pre-existing condition of extreme inequality in America," while reminding us that America did manage to "reverse the first Gilded Age" about 100 years ago. But, he cautions, "It required the fight of our lives. And that's what we're heading into."

As you might suspect, the solutions begin (though do not end) at the ballot box. But, he says, as he details a number of programs that could reverse our current Gilded Age, "the pressure is building" and "people understand the rich have been gaming the system." But, the reversal will not come easily, as "we're living in an oligarchy where the rich use their wealth and power to get more wealth and power."

Finally, Desi Doyen joins us for our latest Green News Report, as the 2020 hurricane season is already breaking records; as the Trump Administration is using coronavirus Shock Doctrine politics to roll back tons of public health and endangered species protections while few are noticing; and as record warmth in May has resulted in a catastrophic oil spill on the melting permafrost in Siberia...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

Judge Dismisses Long-Running Challenge to GA's Unverifiable, Insecure E-Vote System: 'BradCast' 4/1/25

Judge Dismisses Long-Running Challenge to GA's Unverifiable, Insecure E-Vote System: 'BradCast' 4/1/25 'Green News Report' 4/1/25

'Green News Report' 4/1/25

Bad Court and Election News for Trump is Good News for America: 'BradCast' 3/31/25

Bad Court and Election News for Trump is Good News for America: 'BradCast' 3/31/25 Sunday 'Great Start!' Toons

Sunday 'Great Start!' Toons Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25

Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25 'Green News Report' 3/27/25

'Green News Report' 3/27/25 Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26 'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25

'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25 'Green News Report' 3/25/25

'Green News Report' 3/25/25 USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25

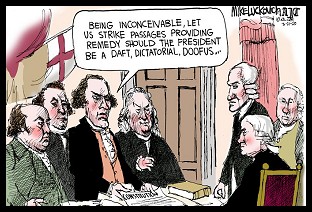

USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25 Sunday 'Suddenly Conceivable' Toons

Sunday 'Suddenly Conceivable' Toons 'Green News Report' 3/20/25

'Green News Report' 3/20/25 We're ALL Voice of America Now: 'BradCast' 3/20/25

We're ALL Voice of America Now: 'BradCast' 3/20/25 What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25

What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25 Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25

Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25 Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25

Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25 Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25

Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25 Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25

Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25 Bad Day for 'Strongmen': 'BradCast' 3/11

Bad Day for 'Strongmen': 'BradCast' 3/11 WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL