'Green News Report' 5/6/25

'Green News Report' 5/6/25|

w/ Brad & Desi

|

|

SCOTUS Allowing Publicly-Funded Religious Schools 'Would be a Ground-Breaking Disaster': 'BradCast' 5/7/25

SCOTUS Allowing Publicly-Funded Religious Schools 'Would be a Ground-Breaking Disaster': 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Attempt to Steal 2024 State Supreme Court Election: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Attempt to Steal 2024 State Supreme Court Election: 'BradCast' 5/6/25 Prosecutors Resign After Trump U.S. Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Resign After Trump U.S. Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Sunday 'Good Buy, Dolly!' Toons

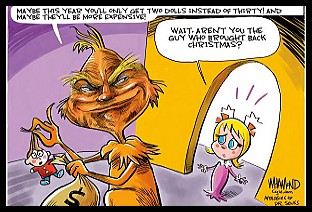

Sunday 'Good Buy, Dolly!' Toons

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 'Green News Report' 5/1/25

'Green News Report' 5/1/25|

w/ Brad & Desi

|

|

100 Daze: 'BradCast' 4/30/25

100 Daze: 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 'Green News Report' 4/29/25

'Green News Report' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Sunday 'Desperation' Toons

Sunday 'Desperation' Toons

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25 'Green News Report' 4/24/25

'Green News Report' 4/24/25 Sunday

Sunday -

Trump Trade Sanctions Tank U.S., World Markets: 'BradCast' 4/3/25

-

WI Election Landslide; Booker Makes Senate History: 'BradCast' 4/2

-

Judge Ends Long Challenge to GA Voting System: 'BradCast' 4/1/25

-

Bad Court, Election News for Trump is Good for U.S.: 'BradCast' 3/31

-

Vets Push Back at Health Care Cuts, V.A. Job Loss: 'BradCast' 3/27

-

Signal Scandal Worsens; Big Dem Wins in PA: 'BradCast' 3/26

-

'Emptywheel': Trump NatSec Team Should 'Resign': 'BradCast' 3/25/25

|

BARCODED BALLOTS AND BALLOT MARKING DEVICES

BMDs pose a new threat to democracy in all 50 states...

| |

|

VIDEO: 'Rise of the Tea Bags'

Brad interviews American patriots...

|

'Democracy's Gold Standard'

Hand-marked, hand-counted ballots...

|

(All times listed as PACIFIC TIME unless noted)

- DAILY!: The BradCast on KPFK/Pacifica Radio Network (90.7FM Los Angeles, 98.7FM Santa Barbara, 93.7FM N. San Diego and nationally on many other affiliate stations!) | ALSO VIA Podcast RSS/XML feed | Pandora | TuneIn | Apple Podcasts/iTunes | iHeart | Amazon Music

|

GOP Voter Registration Fraud Scandal 2012...

|

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK

Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA

DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST

Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL

|

The Secret Koch Brothers Tapes...

|

| MORE BRAD BLOG 'SPECIAL COVERAGE' PAGES... |

On today's BradCast, I share an idea that I've thought long and hard about, struggled with and, frankly, never thought I'd have, much less recommend, as this idea is essentially counter to everything I have long fought for as a democracy advocate. But, as they say, desperate times...and all that. [Audio link to full show follows this summary below.]

On today's BradCast, I share an idea that I've thought long and hard about, struggled with and, frankly, never thought I'd have, much less recommend, as this idea is essentially counter to everything I have long fought for as a democracy advocate. But, as they say, desperate times...and all that. [Audio link to full show follows this summary below.]

Next Wednesday, Senate Majority Chuck Schumer has told Democrats, he plans to bring up the Freedom to Vote Act for a cloture vote, which --- if successful --- would then allow the Senate to proceed to debate on the bill that is critical right now for the survival of American democracy itself. Even if passed, Freedom to Vote won't save everything, of course, but it will help. Big time. The Joe Manchin-approved "compromise" version of the For the People Act (which has already been passed by the House) would, among a boatload of other long-overdue things, institute automatic voter registration and minimum requirements for Absentee and Early Voting in all 50 states; adopt rules that would limit the most disenfranchising Photo ID restriction laws; require hand-marked paper ballots for all voters(!); and prevent extreme partisan gerrymandering among other much needed stuff that would benefit all voters and democracy itself --- if not necessarily the Republican Party, as they see it, while they continue to lie about the bill in order to place party above both country and democracy.

Next week's cloture vote on the measure is likely to be supported by all 50 members of the Democratic caucus in the Senate. But it is unlikely to be allowed up for debate in the minoritarian Senate because, unless Manchin and any other Democratic obstructionists agree to reform the filibuster to allow democracy saving legislation to pass with a simple majority, it won't receive the 60 votes needed to overcome a Republican obstructionist filibuster. That, as GOP-controlled states across the country continue to adopt measures making it harder for (certain) voters to vote and easier for Republicans to cheat by overturning election results they don't like by partisan fiat.

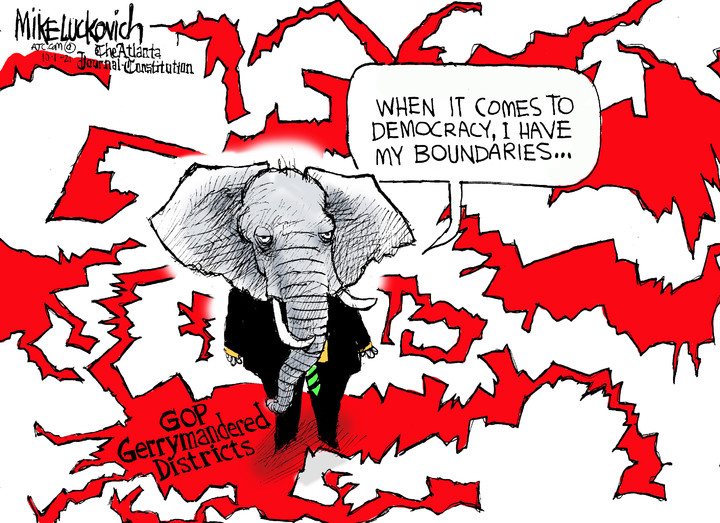

In 2010, the GOP's so-called "REDMAP" program succeeded with Republicans taking over state legislatures in order to draw extreme partisan gerrymanders following that year's decennial census to assure themselves majorities in both statehouses and Congressional delegations for the ensuing decade, even when receiving a minority of the vote. Now that the 2020 census has been completed --- and the GOP's stolen and packed U.S. Supreme Court has determined that federal courts may not intercede to block partisan gerrymanders in any way --- those same Republican state legislatures are in the process of drawing even more extreme gerrymanders for partisan advantage over the next decade. Experts say that "red" states are now in the process of redistricting in such a way that even if the nation voted exactly as it did in 2020, Republicans would end up taking control of the U.S. House --- even with millions of fewer votes than Democrats receive for their elected members of Congress.

That is just part of the near future that all Americans can look forward to if the Republicans and Democrats like Manchin and Kyrsten Sinema in the Senate prevent passage of the Freedom to Vote Act along with its federal restrictions on extreme partisan gerrymanders.

While I hate the idea, all one has to do is take a look at what the Texas legislature (and others like it) are currently up to and planning this year to realize that it's time --- at least if Freedom to Vote is not adopted --- for Democratically-controlled states to answer the GOP assault on democracy by instituting their own extreme partisan gerrymanders in response.

As noted, I hate that idea. It is, at least on the surface, counter to the small "d" democratic ideals that I have always fought for. But, at this point, with the American democratic experiment now teetering toward unstoppable authoritarianism, unilateral disarmament by Democrats seems more like a suicide pact. Yes, for Democrats, but, much more importantly, for democracy itself.

I suspect not everyone will agree with me here, including my guest today. I'm joined by the man who actually wrote the book on partisan gerrymanders, DAVID DALEY of FairVote.org. His book on the GOP's REDMAP assault on democracy is called Ratfucked: The True Story Behind the Secret Plan to Steal America's Democracy. His more recent follow-up, out this year, is Unrigged: How Americans Are Battle Back to Save Democracy.

Daley details the horrors to come from the GOP's extreme gerrymandering plans that we will see in the next few weeks and months, describing them as "really bleak for the Democrats on the redistricting front". For example, he explains, "if you look at the 2020 election, Democratic candidates for the U.S. House won 4.7 million more votes than Republican candidates, but that only turned into a 5 seat majority. Republicans, simply by redistricting in Texas, Georgia, North Carolina and Florida alone --- before you even get to the handful of other states where they can pick up individual seats --- could probably get at least twice the number that they need to flip the House simply by gerrymandering those states."

But, even as he argues in favor of "Constitutional hardball" from Democrats, he does not agree with me that Dems should participate in the same sort of behavior in response when it comes to redistricting this year, describing it as "rearranging deck chairs on the Titanic." He explains why, and we debate the issue on today's program.

I welcome your thoughts on this matter via email or in comments below, as I hope to discuss this more on the show in the days ahead.

Finally today, as if anyone needed more evidence of the dangers that await a fully Trumpified GOP takeover of democracy (even more than has already occurred), at least one Republican candidate running for the House of Delegates in Virginia next month should scare the hell out of you..and, for reasons that Desi Doyen explains, especially Virginians...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

From legal and election wonkery to supply chain wonkery, there is no wonkery that is too wonky for today's BradCast! But I suspect (or, at least, hope) you'll find it a pretty good show nonetheless. And you'll even find out why I actually agree (mostly, sort of) with not one, but two of Donald Trump's dumb, manipulative, self-serving statements he released yesterday! [Audio link to full show is posted below at end of this summary.]

From legal and election wonkery to supply chain wonkery, there is no wonkery that is too wonky for today's BradCast! But I suspect (or, at least, hope) you'll find it a pretty good show nonetheless. And you'll even find out why I actually agree (mostly, sort of) with not one, but two of Donald Trump's dumb, manipulative, self-serving statements he released yesterday! [Audio link to full show is posted below at end of this summary.]

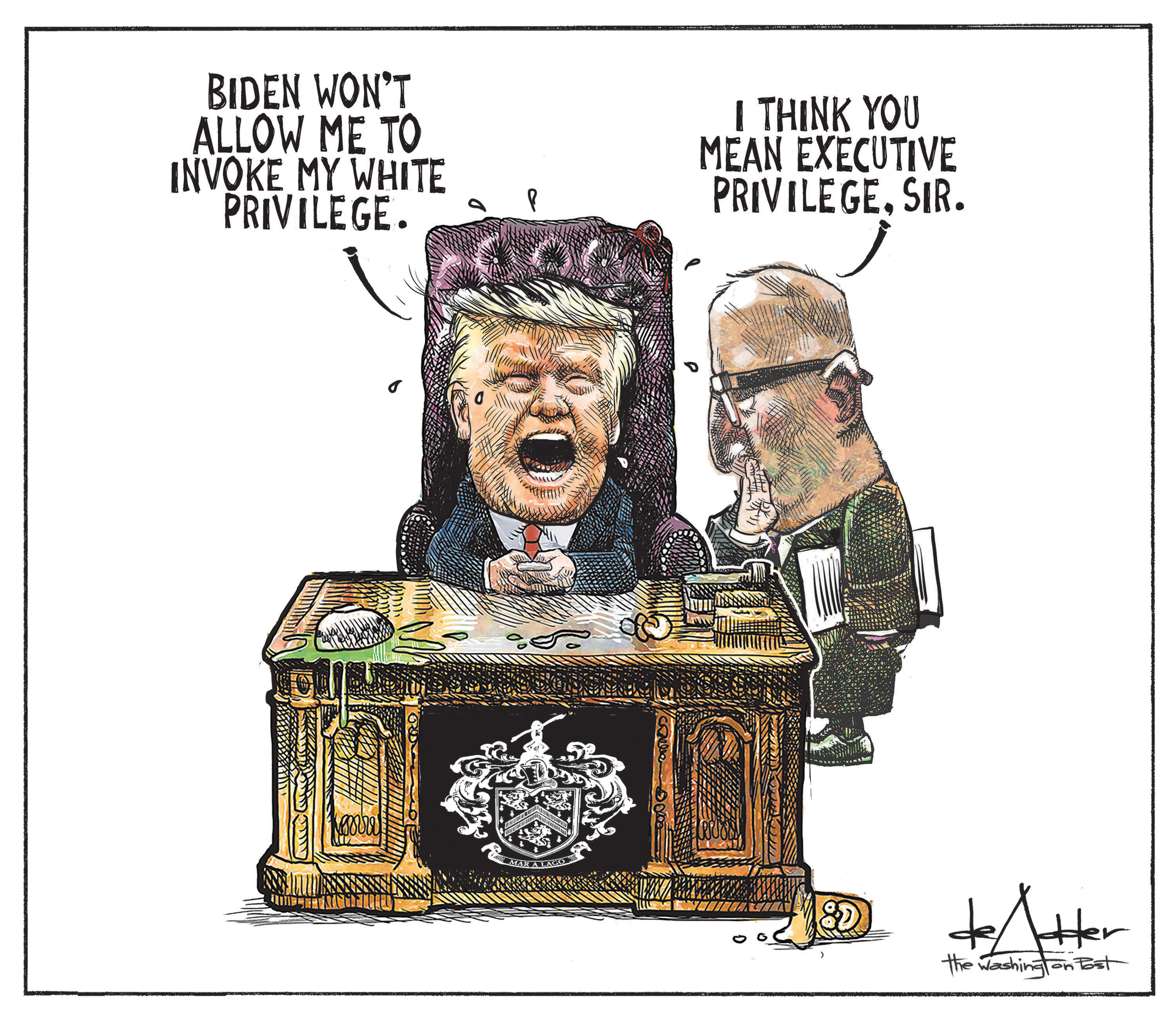

- First up, Steve Bannon is in trouble. He has no legitimate legal claim to not answer the subpoena of the U.S. House Select Committee on the January 6th attack for both testimony and documents. Yet he's taking his (bad) legal advice from the disgraced former President and may wind up in jail because of it. If --- and it's still a big if --- Attorney General Merrick Garland is up to the job he was appointed to. We bring you up to date on all of the Committee's subpoenas to date, and who, other than Bannon, may also soon be facing criminal contempt charges.

- Then, on Wednesday, Trump issued two dumb statements that we, shockingly. can (mostly, sort of) get behind. The first one was simply this: "If we don’t solve the Presidential Election Fraud of 2020 (which we have thoroughly and conclusively documented), Republicans will not be voting in ‘22 or ‘24. It is the single most important thing for Republicans to do." --- Of course, there has been zero evidence of election fraud of any note from 2020 documented thoroughly or otherwise. But we definitely agree his Republican supporters should absolutely stay home during next year's mid-terms and 2024's Presidential election. It's just the right thing for Republicans to do. That said, I also explain why this statement may suggest that Trump, contrary to conventional wisdom of late, may not be planning to run for President again.

- Next, on Wednesday, a state Superior Court judge in Georgia (I misspoke on the show, describing this as a federal case) dismissed [PDF] the last major legal challenge still pending to the 2020 Presidential election in the state. It's a civil complaint filed by lead petitioner Garland Favorito of VoterGA. He has been on this show several times over the years, and who I've known him as an election integrity advocate long before Trump decided to pretend to be one. As explained, while I've got some problems with Favorito's lawsuit and, in fact, a number of claims he's made regarding the 2020 election since being discovered by the MAGA Mob (who, like Trump, also had zero interest in actual election integrity until now --- and still don't, to be frank), his lawsuit should not have been dismissed. At least not on the grounds that the Judge Brian J. Amero did so.

The petition, seeking a physical inspection of absentee ballots in Fulton County (Atlanta), charges, among other things, that "pristine" counterfeit ballots --- never folded and bubbled in perfectly, as if by a computer --- were discovered during one of three statewide post-election "audits" last year. The evidence for the claim is largely based on allegations made by a woman who participated in the state-run hand-count "audit", though the affiant reportedly never brought the matter to the attention of officials during the audit and her story has changed somewhat over time, as she received attention from the MAGA media.

Nonetheless, investigators from Republican Sec. of State Brad Raffensperger's office told the court this week that they examined the ballots in question, and reported to the judge that they could find no such "pristine" counterfeit ballots in the batches specified by the complaint. While the judge says he reviewed that report by the state investigators, he says his dismissal is for a different reason. He held that the petitioners had no legal standing to sue, since they could show no "particularized injury," affecting them "in a personal and individual way". In other words, while their complaint could be true, it affected all Fulton voters, not just Favorito and friends.

It's not Judge Amero's fault. The judicial theory is absurd, but it is based on a ruling by the state's 11th Circuit Court earlier this year. It was used as the basis to dismiss a separate attempt to overturn Georgia's 2020 elections results filed by L. Lin Wood, one of several Trumpy attorneys who, like Rudy Giuliani and Sidney Powell, have had laughable, evidence-free 2020 "fraud" cases tossed out of courts and have been sanctioned for filing them. But the notion that a petitioner can't sue in Georgia, essentially because everyone has been affected by a certain alleged wrong, is a very bad precedent. And it's likely to harm other important and actually legtiimate lawsuits in the Peach State.

More to the direct point here for now, as Favorito correctly noted in response to the ruling, according to the Atlanta Journal Constitution: "All citizens of Georgia have a right to know whether or not counterfeit ballots were injected into the Fulton County election results. It is not adequate for any organization [in this case, the inspectors at the Sec. of State's office] to secretly tell us there are no counterfeit ballots and refuse to let the public inspect them."

He is right. And so was Trump --- accidentally and disingenuously, of course --- in his own dumb, self-serving response to the court's ruling on Wednesday when he correctly asked "Why can't the public see the ballots?" (Most of the rest of his statement was either wrong or ridiculous.) Favorito says he will appeal.

As explained on the show in more detail, public elections belong to the public. And only public oversight of public elections offer any chance of avoiding the situation we are now in where dishonest cretins, like Trump and his supporters, can falsely claim fraud. Secret vote counting by computers and ballots kept beyond the (controlled) reach of the public will guarantee that such claims --- legitimate or otherwise --- will continue to be made in future elections. That is a grave threat to democracy itself --- just in case you haven't noticed. It is the one we are now facing. And it can only have a chance of being cured by public oversight. Favorito and the public should be allowed to visually inspect the actual physical ballots --- so long as he pays for the effort and the ballots stay in the custody of public officials (unlike what happened in the Cyber Ninjas' clown show "audit" in Maricopa County, AZ). If it reveals counterfeit ballots, good. We should know that. If it doesn't, even better. The claim can be, hopefully, put to bed.

Anyway, more detail and explanation on all of this on today's program.

- Finally, Desi Doyen joins us for our latest Green News Report, on the disrupted global supply chain amid the pandemic resulting in a huge spike in energy prices and some very good climate news for both California under Gov. Gavin Newsom and the United States under President Joe Biden...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

IN TODAY'S RADIO REPORT: Supply chain disruptions spike global energy prices; Putin says Russia would never artificially limit natural gas deliveries to Europe; California bans gas-powered lawn and leaf blowers; PLUS: Biden Administration goes big on offshore wind... All that and more in today's Green News Report!

PLEASE CLICK HERE TO HELP US CELEBRATE WITH A DONATION!

Got comments, tips, love letters, hate mail? Drop us a line at GreenNews@BradBlog.com or right here at the comments link below. All GNRs are always archived at GreenNews.BradBlog.com.

IN 'GREEN NEWS EXTRA' (see links below): Michigan tells majority-Black city not to drink tap water amid new lead crisis; Over 100 Nations To Adopt 'Kunming Declaration' To Boost Biodiversity; CA Alisal Fire forces new evacuations, closure of 101 freeway and Amtrak route; Pollution from N.C.'s poultry farms unduly harms communities of color; Will China beat Tesla at its own game?; Trumpist solution to sea level rise: get rid of boats; Coastal fog around the world is declining due to warming climate... PLUS: Solving Bali's rivers of trash... and much, MUCH more! ...

On today's BradCast: We're nearly two years into this seemingly endless pandemic. If you happen to teach at a college or university in a "blue" state and have been vaccinated, you can probably go to work each day feeling relatively safe. If you work at a "red" state university, however, the story is very different. That, of course, is thanks to the twisted politics of our former President and those who either fear his wrath or have been brain-poisoned enough to put their own families and communities at risk because of it. [Audio link to full show follows this summary.]

On today's BradCast: We're nearly two years into this seemingly endless pandemic. If you happen to teach at a college or university in a "blue" state and have been vaccinated, you can probably go to work each day feeling relatively safe. If you work at a "red" state university, however, the story is very different. That, of course, is thanks to the twisted politics of our former President and those who either fear his wrath or have been brain-poisoned enough to put their own families and communities at risk because of it. [Audio link to full show follows this summary.]

But, first up --- mostly for Desi and other Trekkers like her --- we spend a few minutes on William "Captain Kirk" Shatner after he oldly went were a few have gone before. But while Shatner got a free ride to the edge of space for three minutes on Wednesday, courtesy of Jeff Bezos, it only serves as a reminder of the many essential, working class grunts who actually paid for his trip. On the other hand, some of Shatner's remarks upon return to Earth also remind us of our fragile climate and thin blue atmosphere that keeps us alive, even as we treat it like a garbage dump.

Speaking of essential workers, new data from the Labor Department this week reveals many are quitting their jobs in droves, particularly those forced to come face-to-face with an angry, frequently privileged, sometimes violent, often mask-free public right now in low-wage service jobs at bars, restaurants, hotels and retail outlets. The record number of workers quitting to look for better working conditions in August comes as businesses are struggling to find workers, with some employers --- gasp! --- forced to offer higher wages and benefits to stay in business.

But while it may be easy enough to leave one bartender job for a better one at an establishment that takes better care of its workers, it's not quite as easy for those who teach at colleges and universities. We've all seen endless videos of furious parents at local school board meetings, threatening school officials if they dare institute mask mandates to help keep teachers and children --- and their furious parents --- safe. But we've heard less about higher education faculty whose institutions, often in Republican-leaning states, find themselves at the mercy of GOP Governors mandating anti-masking rules or state-run boards (often controlled by the same rightwing politicos) who refuse to hear the pleas of college and university students and faculty alike.

Late last month, for example, more than 50 faculty members at the University of Georgia, many with expertise in the study of infectious diseases, signed a faculty statement declaring: "In order to protect our students, staff and faculty colleagues, we will wear masks and will require all of our students and staff to wear masks in our classes and laboratories until local community transmission rates improve, despite the ban on mask mandates and the USG [University System of Georgia] policy to punish, and potentially fire, any faculty taking this action."

We're joined today by DR. MATTHEW BOEDY, Associate Professor of Rhetoric and Composition at the University of North Georgia in Gainesville. He also serves as the Georgia chapter President of the American Association of University Professors (AAUP), where eight national chapters recently urged the federal government to step in to help keep faculty and students safe at public universities were Governors and school boards will not.

The USG is governed in the Peach State by the Board of Regents, many of whom are appointed by the sitting Republican Governor. "They generally follow the Governor's wishes in terms of policies," Boedy explains. But last year, "they pushed him aside and gave us a mask mandate when Gov. Brian Kemp said he didn't want any mask mandates." The rule was repealed in June, however, as the pandemic momentarily ebbed. "Then Delta came, and we desperately needed [another mask mandate], and they refused to have one because they weren't going to push aside the Governor a second time, especially in terms of how heated it has gotten. The Governor, of course, has banned mask mandates around the state."

As an expert in rhetoric, I asked about the irony of Republicans opposing mandates by instituting mandates against mandates. "The groups on the right and politicians on the right will use words in opposite of their intended meaning or their usual meaning to get what they want. They don't like mandates, but they'll push mandates in another way. It is truly cognitive dissonance," Boedy asserts. "And it just shows that this is not driven by science, it's not driven by common sense. It's not even driven by any type of logic that I can follow, because if you speak to these people, they just change in any direction that is against what you're saying. "

"As a rhetoric teacher," he continues, "I'm teaching a class on misinformation, and I'm doing it for this reason. It's just really difficult to get beyond the cognitive dissonance, and I'm trying to teach people not just to recognize it but to find rhetorical ways to persuade people who seem to not want to be persuaded." We wish him luck.

In the meantime, Boedy also details the actions that the AAUP has taken to try and get help for "red" state universities from government officials and the responses they've received from elected officials both at the state and federal level. He notes that in a state where "collective bargaining is barred by state law," they don't have unionized power behind them, but they had considered walkouts anyway, before deciding against it. At least for now. "We didn't want to punish our students for the deplorable actions of our university administration. We didn't want to walk out. We didn't want to stop class. We didn't want to add to the punishment their getting with the lack of masks," he says. "What we're trying to do is keep up public pressure --- I call it a public shaming of our university leaders --- and hopefully, they respond. So far, sadly, they have not."

Boedy says, however, that they may get some help from the Biden Administration's Department of Education. In the meantime, we happened to catch him on "a dark day" for higher education in Georgia. On Wednesday, the Board of Regents made conditions arguably worse for professors in the University of Georgia System, as they voted on Wednesday to approve a new tenure policy allowing tenured professors to be fired without faculty input. "What we have now is tenure in name only," Boedy explains. "They erased the due process protections for a particular group of professors, ending tenure protections for them. So, the dominoes can certainly fall after that to the rest of us. But it is, yes, the death of tenure and due process in Georgia."

Finally, after a week or two of reporting on the recent oil spill off the coast of Southern California in Orange County on this show, some much brighter, somewhat related news. "The Biden administration announced on Wednesday a plan to develop large-scale wind farms along nearly the entire coastline of the United States, the first long-term strategy from the government to produce electricity from offshore turbines," according to the New York Times late today. We happily discuss...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

Well, we've got another news-packed, rant-packed, and (hopefully) democracy-saving BradCast for you today. [Audio link to full show is posted below this summary.]

Well, we've got another news-packed, rant-packed, and (hopefully) democracy-saving BradCast for you today. [Audio link to full show is posted below this summary.]

Tune in for the most bang for your buck (by far), but among the stories and issues touch-stoned on today's program...

- NASA is launching a rocket to strike an asteroid in hopes of knocking it off its orbit as a test for future "planetary defense". What could possibly go wrong?

- Democratic U.S. Senators held a press conference outside the U.S. Capitol last week to insist that critical provisions to finally take on our climate crisis may not be removed from the Dems' proposed Build Back Better Act to win the support of obstructionist Senators Joe Manchin and Kyrsten Sinema. Rev. Lennox Yearwood of the hop-hop caucus, spoke at the presser, and laid out the "no climate, no deal" existential stakes. We share his important remarks.

- Speaking of the Dems' proposed, expansive, ten-year, $3.5 trillion bill, never mind the price tag. Unlike the accompanying smaller bipartisan infrastructure bill championed by Manchin and Sinema with Republicans, which is not fully paid for, the Build Back Better bill is, via small tax increases for wealthy people and corporations. But, lost in Manchin and Sinema's silly quibbles over the price tag for Build Back Better is the extraordinary number of wildly popular provisions in it, on everything from the expansion of Medicare to include hearing, vision and dental coverage for seniors, to free pre-K and community college, to 12 weeks of paid family leave, and, of course, the critical climate measures to move the nation's utility companies from dirty fossil fuels to clean, renewable energy. But that's a tiny sampling of what's in this long-overdue bill. MSNBC's Mehdi Hasan offers much more on what's actually in the most transformative piece of legislation since the LBJ- and FDR-eras --- and he does so in less than 60 seconds!

- Both the larger bill and the smaller bill compromising Biden's agenda must be passed (and soon!) if Democrats are to have any chance at holding off the Authoritarian Front (otherwise known as the Republican Party) in 2022. To that end, we've been discussing of late how the media (including us!) do not seem to be sounding the alarm bells as loudly as warranted, given the Trump/GOP assault on democracy itself in advance of next year's mid-terms and the 2024 Presidential race. A recent conversation on that point with media critic Eric Boehlert last Friday on this show, included a "major error", brought to our attention via email by a listener. After sharing the error with Boehlert, he issued a correction. Tune in for all the details today, but we are grateful to listener Linda C. for checking the facts and holding our feet to the same fire as we hold to everyone else's!

- In more American-democracy-on-the-brink news, top Republicans are still, shamefully, unwilling to say out loud that Joe Biden won the 2020 election fair and square, that it was not stolen from Donald Trump, and that there is absolutely zero credible evidence suggesting otherwise, nearly a full year since the election. Rep. Steve Scalise (R-LA), the second-highest ranking Republican in the House after minority leader Kevin McCarthy (R-CA), is the latest to prove his cowardice and refusal to say as much during a weekend interview on Fox "News".

- Speaking about his new book, Midnight in Washington: How We Almost Lost Our Democracy and Still Could, detailing Trump's two impeachments and the disgraced former President's attempt to steal the 2020 election by sending his supporters to attack the U.S. Capitol on January 6th, Rep. Adam Schiff (D-CA) discussed what happened that day on CNN this morning. Of note, as we share, he discusses the abject fear among GOP leadership to cross Donald Trump in any way, and the threat that poses to democracy itself. Schiff describes "the insurrectionists in suits and tie", like Scalise and McCarthy, who, "unlike those people climbing outside the building" on January 6th, "they knew it was a lie". But, in their "relentless attack on the truth," he explains, they are now willing to pretend that they don't know that Trump tried to steal the 2020 election.

- Longtime Republican columnist Max Boot, however, does know that the Big Lie was, in fact, a lie. He also seems to appreciate the threat it now poses to democracy itself. In his Washington Post column this week, he explains why, despite formerly being a lifelong Republican, he is now "a single-issue voter. My issue is the fate of democracy in the United States. Simply put, I have no faith that we will remain a democracy if Republicans win power. Thus, although I’m not a Democrat, I will continue to vote exclusively for Democrats ... until the GOP ceases to pose an existential threat to our freedom." Thank you, Max. I hope anyone who still supports democracy takes Boot's warning to heart because, as he notes, "What matters now is preserving our democracy."

- And what are Republicans doing where they do hold the power to govern instead of destroy? They're destroying. In Texas yesterday, Republican Governor and cowardly tyrant Greg Abbott issued an executive order certain to results in many more dead Texans. It prohibits any entity in the state, including private business, from imposing any COVID vaccine requirements for employees or customers. Because, freedom? At the same time, the Texas Republican Party chair who thinks Abbott isn't Trumpy enough, stepped down from the Chairmanship several months ago to oppose the incredibly-Trumpy Governor in next year's primary. That former chair is former Florida Congressman and loon Allen West, who, as of this weekend, is now hospitalized with COVID. He's now posting on Facebook from his hospital bed about taking hydroxychloroquine and the horse de-worming drug Ivermectin, while proudly swearing he's more anti-vaccine than ever and simultaneously proving he knows absolutely nothing about how either health care or even "Big Pharma" works.

(For the record, even though he's a far-right wingnut loon, we went to bat for West and his supporters in 2012 after he got screwed by a major voting system tabulation failure during his failed reelection bid against Democrat Patrick Murphy in Florida that year. Scroll down his BRAD BLOG category page for some of the highlights. Just a helpful reminder for all of the brain-poisoned dupes stopping by the blog of late to say, "Hey, Brad what happened to you?! I can't believe you'd put party over country by failing to call out all the fraud in the 2020 election!" Yes, brain-poisoning is exceedingly toxic. Try some horse de-wormer, kiddies.)

- Finally, Desi Doyen joins us for our latest Green News Report, with her usual roller-coaster mix of horrific and hopeful (but mostly horrific) environmental news...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

IN TODAY'S RADIO REPORT: 'No climate, no deal!' --- Democratic Senators demand climate policies stay in Biden's Build Back Better Act; A quarter of all critical U.S. infrastructure is at risk of failure due to flooding; Mounting costs of extreme weather disasters in 2021 already surpass all of 2020; PLUS: President Biden restores Bears Ears and two other national monuments... All that and more in today's Green News Report!

PLEASE CLICK HERE TO HELP US CELEBRATE WITH A DONATION!

Got comments, tips, love letters, hate mail? Drop us a line at GreenNews@BradBlog.com or right here at the comments link below. All GNRs are always archived at GreenNews.BradBlog.com.

IN 'GREEN NEWS EXTRA' (see links below): Congress Might Blow Its Biggest Opportunity To Tackle The Climate Crisis; More Than 30 Countries Join U.S. Pledge to Slash Methane Emissions; Madagascar Prays For Rain As U.N. Warns Of 'Climate Change Famine'; New California Law Bans Gasoline-Powered Lawn Mowers, Leaf Blowers; Mass Floods Hit China’s Coal Hub, Threatening Power Supplies; Climate Action At COP26 Could Save Millions Of Lives, WHO Says... PLUS: Can the World’s Most Polluting Heavy Industries Decarbonize?... and much, MUCH more! ...

The good news is that one of the Southern California beaches hit hardest by last week's toxic oil spill reopened today. The bad news comprises the rest of today's BradCast.

The good news is that one of the Southern California beaches hit hardest by last week's toxic oil spill reopened today. The bad news comprises the rest of today's BradCast.

The beach at the SoCal town known as Huntington Beach --- in the heart of "Surf City USA" --- was reopened on Monday, after last week's oil spill of anywhere from 25,000 to 144,000 gallons of crude. It leaked from a fractured, 17.5 mile pipeline terminating in Long Beach from a complex of platforms about 5 miles offshore in federal waters. It took anywhere from 10 hours to several days --- we still don't know --- to shut the pipeline down after it cracked, perhaps due to being dragged by a ship anchor along the ocean floor.

But, by the weekend, earlier than expected, there were no longer toxins associated with petroleum at detectable levels in the water off of Huntington Beach, according to officials, even as crews continued to remove tarballs from the sand onshore. That beach, at least for now, has been reopened. Neighboring beaches remain closed to the south, including those at Newport Beach and Laguna Beach. The Orange County Oil Spill was just the latest in a long series of disastrous oil spills that have fowled the CA coastline going back decades, and it has renewed calls to ban offshore drilling in the state.

We're joined today by REP. ALAN LOWENTHAL (D-CA), a member of the House Progressive Caucus whose 47th Congressional District includes Long Beach in Orange County and parts of western L.A. County. Last week, appearing at a news conference with Gov. Gavin Newsom in Huntington Beach just after the spill, Lowenthal called for "a plan to not only stop new drilling, but to figure out how do we stop all drilling that's going on in California." The Congressman joins us today to discuss just that. Long story short, but none of it is easy and for many reasons.

"In California, there have not been any new offshore pipelines in forty years, so there is no new technology. It's all old technology, it's all corroding, it's all waiting for the next disaster to occur," he tells me, before we dive into the murky waters of what would be required to end both leasing and drilling permits at the federal level --- in federal waters, 3 or more miles offshore --- as well as in California waters. Here, the Governor argued last week, it's easy to block new leases (the state hasn't issued any in decades), but shutting down existing platforms and pipelines, and replacing those jobs, is far more difficult.

Lowenthal, who has served in the House since 2013, after many years as a CA Assemblyman and then Senator, is calling for a Congressional probe into the OC Spill and fighting to keep language banning new offshore federal drilling leases in the Democrats' Build Back Better Act. But those provisions could be targeted by West Virginia's fossil fuel friendly Senator Joe Manchin, as Democrats battle with Manchin and Arizona's Kyrsten Sinema to pass Biden's agenda into law. In a best case scenario, the BBB Act would only ban new drilling leases off shore, while permitting existing leases to be developed. Back in the state, on the other hand, a bit more can and should be done, he argues. As we discuss, even the progressive Newsom Administration's oil and gas regulators have approved thousands of new drilling permits on existing leases since the Governor took office in 2019.

"There are two things that California can do," says Lowenthal. "One is to stop the pipelines that come from the federal waters. And the second is not to provide permitting. It's one thing when you say 'no new leases,' but once you already have an existing lease that's developing, there are permits to change the flow, to change the direction and California doesn't have to issue those permits. They can stop it."

There was much more from the Congressman, both enlightening and frustrating at various times. I'll urge you to tune in for the full discussion.

Then, we've been discussing on several recent shows how the media are failing to adequately sound the alarm bells about the terrifying and dangerous rise of rightwing authoritarianism in the U.S., as Trump threatens to run again in 2024 after blatantly trying, but failing, to steal the 2020 election. This time, according to a lengthy and very disturbing monologue from Bill Maher this weekend, he is laying the groundwork to avoid the mistakes he made last time. "He's like a shark that's not gone. Just gone out to sea," Maher warns of the "slow moving coup", before explaining why "we're gonna need a bigger boat," as the GOP is now playing along with his long con. That, as the media begin to repeat many of the very same mistakes they made before his 2016 election.

How can we, in the media, avoid those mistakes and do a better job of informing the nation about the unprecedented assault on democracy itself that we all now face? I really don't know. But we discuss that and open up the phone lines to listeners at the end of today's show to at least begin that critical, much-needed conversation...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

After five years of underestimating Donald Trump, and nearly a full year since he tried to steal the 2020 election, you'd think the media would "get it" by now. But, according to our guest on today's BradCast, the national press is still under-appreciating and under-reporting the very real threat that Trump and his far-right radicalized Republican Party now represent to democracy itself. And maybe that's on purpose. [Audio link to full show follows below this summary.]

After five years of underestimating Donald Trump, and nearly a full year since he tried to steal the 2020 election, you'd think the media would "get it" by now. But, according to our guest on today's BradCast, the national press is still under-appreciating and under-reporting the very real threat that Trump and his far-right radicalized Republican Party now represent to democracy itself. And maybe that's on purpose. [Audio link to full show follows below this summary.]

But first up, some brighter news. President Biden has now reversed Trump's unprecedented (and likely unlawful) rollback of protected public lands established by his predecessors in three different national monuments. On Friday, Biden restored environmental protections for millions of acres of pristine expanses and sacred tribal lands at Bears Ears and Grand Staircase-Escalante national monuments in Utah, and the Northeast Canyons and Seamounts marine monument off the coast of New England. Deb Haaland, the nation's first native American Interior Secretary, was justifiably emotional about today's return of protection from mining, drilling and other development for millions of acres of sacred lands and architectural treasures. Biden's rollback of Trump's order, however, left in place a small parcel of acreage newly established as protected public lands by the former President at Bears Ears. So that national monument is now even larger than it was before Trump attempted to sell it off to his investors. Add it to the long list of losses for our loser former President.

And here's another. New documents released by the U.S. House Committee on Oversight on Friday reveal that Trump's company concealed losses of more than $70 million on his D.C. hotel during his four years in office, even while a major part of the business at the Trump International Hotel at the old D.C. post office building came from foreign governments, as well as lobbyists and businesses hoping to curry favor with the disgraced President. All of that, as Trump attempted to portray the project publicly as a stunning success while the Trump Organization had to quietly pump in more than $24 million dollars to it to cover losses, and as Deutsche Bank, according to the Democratic Committee co-chairs, offered "undisclosed preferential treatment" on a $170 million loan for the project that had been personally guaranteed by Trump. The Trump Organization is now desperate to find a buy to unload the loser project, but there are reportedly few takers as the current, inflated asking price.

While the media failed to adequately sound the alarm about a Trump property just blocks from the White House used as a deposit box for unconstitutional payments to the President from foreign governments, businesses, lobbyists and party faithful during his tenure in the White House, are they doing any better in raising what should be an even louder alarm following the past year of Trump attempting to steal a second term while directing supporters to attack the U.S. Capitol itself to block the Constitutional transfer of power on January 6th?

Our guest today, longtime media analyst ERIC BOEHLERT argues the mainstream corporate media appear to have learned next to nothing. More insidiously, he suggests, they are even "purposely" ignoring what he describes in a PressRun newsletter this week as "the clarion calls of democratic doom." That, despite alarm bells and clear signs that American democracy is facing an unprecedented internal threat from the rise of rightwing authoritarianism. "America isn’t guaranteed a happy ending," he writes, "although most of us grew up with the shared assumption that it was."

"There's a failure of imagination, but I feel like it's a purposeful failure of imagination," among the press, he tells us today, citing what he sees as the media's vested interest in the return of Trump as a candidate and even as President in a second term. "After the election, long before the insurrection, Trump was doing everything in his power, as we now know more and more" to try and overturn --- yes, to steal --- Joe Biden's election victory. "But in November and December of 2020, Politico called it 'bad sportsmanship.' There was lots of media coverage on he was 'sulking' in the White House. Basically the media's narrative was 'Just give him some time. He's mad. He's upset he lost. No big deal. He's not going to try to steal the election. The Republican Party would never do that,' etc. And we know how that unfolded."

But, nearly one year and an attempted U.S. Capitol insurrection later, the "purposeful failure of imagination" by the press still persists, he charges. Given all of the many signs of increasing political violence and radicalism from the Right and the Republican Party itself, how should the press be appropriately covering and warning about what appears to be going on in and our nation? How could they --- and we --- be doing a better job of adequately sounding the "fire alarm"?

Boehlert explains, and cites by way of one critical example, the media's fear of "taking sides", even when the two sides are no longer Democratic v. Republican parties, but democracy v. authoritarianism. "'We can't take sides! If the Republican Party is anti-democracy, we can't be PRO-democracy, because that looks like we're opposing them! So we're just going to recede into the sidelines, and we'll give you updates every time they try to demolish our democracy.'"

"It's just this passive frog in the boiling water, the lack of clarity about authoritarianism in this country. This idea that it can't happen here, we are immune to this, we are immune to fascism, we are immune to authoritarianism. Oh sure, in the last ten years, it's happened in Hungary, it's happened in Poland, it's happened in Turkey. Those aren't us," he snarks. "We've been doing this for 270 years. No matter what Trump and the Republican Party hatch, this country is indestructible, this democracy is indestructible --- which is a complete fantasy."

Tune in for much more.

Finally, after starting off today with some good news for native Americans, we end with a bit more, as the Biden White House becomes the first to officially commemorate Indigenous Peoples' Day this coming Monday, on what is still officially known, barring an act of Congress, as Columbus Day...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

Way back in January, we reported on "How Trump Attempted to Use DoJ to Steal the Election". Why do our nation's corporate media outlets, all these months later, still have so much difficulty reporting it as such, despite the growing mountain of evidence on the unprecedented attempted theft of a Presidential election by a sitting U.S. President? That's just one of a number of stories and questions asked on today's BradCast. [Audio link to full show is posted below this summary.]

Way back in January, we reported on "How Trump Attempted to Use DoJ to Steal the Election". Why do our nation's corporate media outlets, all these months later, still have so much difficulty reporting it as such, despite the growing mountain of evidence on the unprecedented attempted theft of a Presidential election by a sitting U.S. President? That's just one of a number of stories and questions asked on today's BradCast. [Audio link to full show is posted below this summary.]

Among those many stories...

- What took the Coast Guard and Amplify Energy Corp --- owner of the pipeline that spewed more than 3,000 barrels of crude oil into the waters and protected wetlands nearly Huntington Beach in Southern California last week --- so long to respond to the spill? Residents smelled it, witnesses saw oil on the water and on boats, and even the National Oceanographic and Atmospheric Administration (NOAA) called in their report to the Coast Guard of a possible spill spotted from a satellite. Still, it was almost 10 hours before the Coast Guard investigated, and almost 12 hours before Amplify shut it down. That, despite technology pipeline companies always (falsely) claim will immediately detect spills and shut down the system as soon as they occur. Someone needs to face criminal charges, and this nation needs to get off oil, ASAP.

- Some brighter news out of Texas, where a federal judge has temporarily enjoined the state's S.B. 8 statute that deprives women of their Constitutionally-protected right to an abortion. The new GOP law in the Lone Star State inserts Big Government between a woman and her doctor to mandate that the medical procedure may not be carried out after 6 weeks of pregnancy, before most women know they're pregnant. Even in the case of rape or incest, Texas Republicans are demanding that women carry their rapists babies to term under the new law. On Wednesday, a U.S. District Court judge shut that whole thing down. For now. He also refused to put his stay on hold pending the state's appeal, because, as he wrote in his 113-page decision [PDF]: "The State has forfeited the right to any such accommodation by pursuing an unprecedented and aggressive scheme to deprive its citizens of a significant and well established constitutional right."

- Yesterday, we reported that Senate Minority Leader Mitch McConnell and fellow Republicans blinked in their ongoing effort to block Democrats from lifting the nation's borrowing limit to avoid the economic calamity that would ensue when the U.S. defaults on its debts, for the first time in history, on October 18th. Today, after McConnell blinked, he and Majority Leader Chuck Schumer agreed on terms for the legislative process that Republicans will allow to let Democrats avoid disaster, at least until early December, when the GOP threatens the same economic terrorism all over again. AP (and other national outlets) continued to mislead the public by reporting: "the Republican and Democratic leaders edged back from a perilous standoff." But that's not what happened at all. The "leaders" (plural) did not "edge back", and it was not a "standoff". As longtime journalist, author and media critic James Fallows has been expertly reporting for some time now, this was nothing more than a nihilistic Republican threat to tank the nation's, and the world's, economy. "To call it an 'impasse' or 'standoff' is misleading," writes Fallows this week. "This is the same kind of 'impasse' as one between a kidnapper demanding ransom for a captured executive, and a company that believes it should not pay. It is not a level-playing-field difference of view."

- The debt ceiling is hardly the only area where mainstream corporate media have been failing by ill-serving the public and our democracy. Today, they were joined in that disservice by the Senate Judiciary Committee Democrats, who released an otherwise very important report on how Donald Trump attempted to use the U.S. Dept. of Justice to STEAL the 2020 Presidential election. The 394-page report [PDF] was eight months in the making and is titled: "Subverting Justice: How the Former President and his Allies Pressured DOJ to Overturn the 2020 Election." Media reporting on the new report has taken to echoing that language (as they have since last November) in explaining how Trump tried to "subvert" the election, or "question" its results, or tried to "undermine" its legitimacy. He used a "big lie" to try and pull off a "self coup". Of course, Trump did all of those things, but it was all in service to one single criminal objective: An attempt to STEAL the election! Why do corporate media --- and Democrats, for that matter --- have such a difficult time calling it out as such? There is a mountain of hard, independently verifiable evidence to support that admittedly very serious charge, that I would never issue lightly. Today, Senate Democrats just added 394 more pages of said evidence to that mountain. Media need to start accurately calling out what happened here. A then sitting President of the United States abused the levers of his power to try and STEAL a Presidential election from the American people. It's as simple as that. Media should begin reporting it as such.

- Trump's attempted theft of the 2020 election continues, at least in hopes of stealing the next one. Despite the abject failure of the Cyber Ninjas in Maricopa County, Arizona (Sen. Dick Durbin called them "Ninja Turtles" today) to find any legitimate evidence of election fraud (or to even hand-count the results of the election accurately), the MAGA Mob is still continuing to waste tax payer dollars with phony "audits" and "investigations" of last year's election in other states. In Wisconsin, as in Arizona, Republican legislators have hired someone completely inexperienced in elections to investigate their loss in last year's election. In this case, the man placed in charge of the review is a former state Supreme Court Justice named Michael Gableman. This week Gableman admitted to the Milwaukee Journal Sentinel that he does not have "any understanding of how elections work." Great choice, Republicans! I'm sure he'll very wisely spend the $676,000 in taxpayer money that you "conservatives" gave him. The effort may even be as successful as the Turtles'!

- Finally, Desi Doyen joins us for our latest Green News Report, with more on last weekend's massive SoCal oil spill; a new study finding that, globally, the fossil fuel industry receives $11 million in government subsidies every minute (no doubt Joe Manchin will be furious about their "entitlement society"!); and another notorious pipeline company with high-tech spill prevention technology is charged with dozens of criminal counts for pipelines that leaked into Pennsylvania's drinking water...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

IN TODAY'S RADIO REPORT: Ship's anchor appears to have caused devastating Southern California oil spill; Fossil fuel industry receives $11 million in government subsidies every minute, new report finds; PLUS: Pennsylvania Attorney General files criminal charges against notorious pipeline developer... All that and more in today's Green News Report!

PLEASE CLICK HERE TO HELP US CELEBRATE WITH A DONATION!

Got comments, tips, love letters, hate mail? Drop us a line at GreenNews@BradBlog.com or right here at the comments link below. All GNRs are always archived at GreenNews.BradBlog.com.

IN 'GREEN NEWS EXTRA' (see links below): WHO slashes guideline limits on air pollution from fossil fuels; White House outlines plan to overhaul Trump NEPA rules; DOJ investigating Trump’s probe of car companies; City In Michigan Urged To Use Bottled Water Due To Lead Risk; Canada Invokes 1977 Treaty With US As Dispute Over Pipeline Intensifies... PLUS: Burning Wood (Biomass) Is Promoted As A Carbon Neutral Fuel. But Is It?... and much, MUCH more! ...

Something not terrible actually happened in D.C. today! We celebrate at the top of today's BradCast! [Audio link to full show is posted below summary.]

Something not terrible actually happened in D.C. today! We celebrate at the top of today's BradCast! [Audio link to full show is posted below summary.]

Faced with the likelihood of the U.S. defaulting on its debts in a matter of days for the first time in American history (and being blamed for the economic devastation that would go with it), or otherwise facing the possibility that Democrats would be forced to reform the filibuster to allow a carve out for raising the debt ceiling, Mitch McConnell and Senate Republicans blinked today. They have now agreed to call off their filibuster to allow Democrats to raise the debt ceiling by themselves, if only for about two months. That's okay. It's a clear win for the Dems, whose unwillingness to back down to the GOP's economic terrorism and weaponization of the need to borrow money to pay for stuff that Congress (including Republicans!) have already bought, has paid off. It has also revealed McConnell's bluff. Something to keep in mind the next time this comes up again in December. We explain.

It also means that Congressional Dems can now focus on passage of their Build Back Better agenda, specifically, their transformative and long-overdue expansion of healthcare, education, child care and the first real attempt to take on climate change in their proposed $3.5 trillion bill that would spend $350 billion a year over the next ten years. That's not a lot of money, in truth, for the U.S. Government. The Treasury Department may take in $300 billion in tax revenue on any given single day. Not to mention, the entire bill, as proposed, is paid for with a small tax increase on corporations and the wealthy. But that hasn't prevented Sen. Joe Manchin (D-WV) and his sidekick Kyrsten Sinema (D-AZ) from pretending that the implementation of wildly popular progressive programs --- which the Democratic President actually ran and won on --- will lead to an "entitlement society".

Amid the negotiations over the final price tag of the Build Back Better Act, Manchin has been demanding "means testing guardrails" on all new family and health related programs. What does that mean, exactly? If only Americans below a certain income are allowed, for example, to enjoy the two free years of pre-K and community college included in the Democratic proposal, why not impose such conditions on the rest of our public education system? "Once we’re means-testing pre-K," The Prospect's Harold Meyerson recently observed in response to Manchin's demands, "it’s hard to see why governments at all levels don’t means-test K itself, not to mention K-12."

The Philadelphia Inquirer's longtime national columnist WILL BUNCH describes "means testing" in his newsletter this week as "two dirty words for America's middle class" and "the two most insidious and abused words in American politics." He joins us today to explain why that is and what other, alternate, betters ways their may be to meet the seemingly intractable (and dumb) demands from Manchin and Sinema that the Democrats' fully-paid-for bill be scaled back from it's current price tag.

"When means testing is applied," Bunch explains, "the reality is, what you're really doing is reducing the size of the program, so you're reducing the amount of money that needs to be raised to pay for the programs, which means you're reducing the amount that taxes would be increased on these wealthy people and on these corporations, who happen to be Joe Manchin's patrons."

"What really happens is that people who are entitled to these programs don't get the benefits because of means testing," he argues, "because it creates all kinds of bureaucratic hoops. The more you make them jump through hoops, the more you heighten the feeling of stigma that some people feel about getting government aid, they just say 'forget it' and give up. So the utilization rate of these programs --- they find that usually a quarter of the people eligible for these programs don't take advantage of them for reasons like that."

But, he says, it's also simply about money. "Let's focus on what's really going on here. They're really trying to squeeze every dollar to not go to middle class and working class families. And all those dollars that they squeeze, they go into bigger tax cuts for billionaires and corporations," who, unlike middle-class tax-payers, do not face such means testing for benefits they enjoy. "It's like reverse means-testing! The more means you have, the more we're going to bend over backwards to cut your taxes!"

We discuss all of that and more --- including the Rolling Stones concert that Bunch went to this week in Pittsburgh. Yes, I'm jealous!

Finally, as crazy and dangerous as the Republican Party has become in recent years, a number of its elected officials are apparently set on pushing the envelope to new standards of insane behavior...even if it means taking on fellow elected Republican officials, as the Lt. Governor of Idaho has done this week --- once again --- while the state's Republican Governor was out of town on state business. Yes, the madness continues on today's BradCast. We do our best to keep up with it...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

Wait. Even the so-called "audit" results from the Cyber Ninjas that appear to confirm Joe Biden's 2020 victory in Arizona over Donald Trump were phony?! Yup. "The Ninjas made up the numbers out of whole cloth," says our guest on today's BradCast, after examining and sharing the actual evidence in support of that claim. [Audio link to full show is posted below this summary.]

Wait. Even the so-called "audit" results from the Cyber Ninjas that appear to confirm Joe Biden's 2020 victory in Arizona over Donald Trump were phony?! Yup. "The Ninjas made up the numbers out of whole cloth," says our guest on today's BradCast, after examining and sharing the actual evidence in support of that claim. [Audio link to full show is posted below this summary.]

But first, the partisan, wingnut audit by the Ninjas in Maricopa County, AZ, is hardly the only epic fail by Trump MAGA Mob dead-enders who have been unable, in almost a year, to show any evidence of any substantive fraud or manipulation of the 2020 election results. The latest epic fail comes out of the deep red state of Idaho, where Trump was certified to have defeated Biden by more than 30 points. Nonetheless, loony tunes deep-pocketed pillow impresario and deep state Trump stooge, Mike Lindell, claims that those numbers were also wrong! He charges, in a new document titled "The Big Lie", that votes were flipped electronically in all 44 counties in the state, for some reason, to help Joe Biden (who, again, lost in Idaho by more than 30 points!)

Idaho's Republican Secretary of State, however, suspected that Lindell's claims may have been wrong, especially given that 7 counties in the state use no computers at all to tally their ballots. They hand count them! Nonetheless, his office went about doing full, transparent, video-taped hand-counts (and posted them on YouTube) in front of Democratic and Republican Party officials in two small Idaho counties, just to be safe. What did those recounts show? You guessed it, Biden's margin increased. He received the same number of votes in each counties' recount, but Trump lost about 9 votes in one county and picked up one single vote the another. Lindell, however, refuses to accept those publicly hand-recounted results by the Republican Sec. of State in Idaho, in his continuing drive to make himself the nation's number one laughing stock.

But Lindell has competition on that score from the Cyber Ninjas and its CEO Doug Logan in Arizona!

A week and a half ago, The BradCast was the first in the nation to detail to the findings in the long-awaited final report from the Ninjas' 5-month long secret "audit" of the 2020 Presidential election results in Maricopa County (Phoenix). Rather hilariously, the Ninjas reported that their hand-count of 2.1 million ballots cast in the County matched up almost perfectly with the original, certified, computer-tallied results from the county's Dominion Voting Systems tabulators. In fact, the Ninjas claimed to have found that Trump actually lost 261 votes in their hand-count, while Biden picked up 99 votes.

But never mind even those numbers! Because a group of actually experienced, bipartisan election auditors, who call themselves The Audit Guys, say the Ninjas' numbers are completely bunk. "An epic hoax" according to their own review of the Ninjas' "audit". Those results were "fiction," they told New York Times. "The reality is they just made up the numbers," they explained to Arizona Republic. In fact, The Audit Guys' own report charges that "the entire exercise in hand counting ballots on lazy Susans for two months, was a hoax." Moreover, they say, the GOP President of the AZ Senate who arranged the entire audit and selected the inexperienced, conspiracy theorist company, Cyber Ninjas, to carry it out, is now part of a "coverup" to try and hide the scam.

We're joined today by Audit Guy, LARRY MOORE, founder of the Clear Ballot Group, which audits elections around the country. Since retiring from the company, Moore has teamed up with prominent Pima County (Tucson), AZ Republican data analyst Benny White and Clear Ballot's retired Chief Technology Officers Tim Halvorsen to independently check the Ninjas efforts.

Moore explains today how they determined that the Ninjas numbers were "made up out of whole cloth". Specifically, when the state Senate released the Ninjas' three-volume report, they appear to have accidentally left a number of pages in it that detailed discrepancies in the hand-count of ballots carried out by the Ninjas versus a separate, independent machine count of ballots done by the Senate at the end of the process, to try and reconcile numbers that were reportedly way off. In fact, as Moore details, the data released by the Senate revealed that their machine count of ballots (not results, just the number of ballots) matched almost perfectly with the County's originally certified totals. But the Ninjas' hand-count of the number of ballots was off by a mile.

The Senate report revealed (apparently accidentally) that one pallet of ballot boxes actually contained 48,371 ballots in 40 boxes, according to the Senate's machine count. That number matches the County's originally tallied numbers. But the Ninjas hand-count of that same pallet of ballot boxes was off by 15,692 ballots! And, as Moore explains today, that was no more than 2.5% of the 2.1 million ballots cast in the County last year and theoretically hand-counted by the Ninjas on those colorful lazy Susan tables.

"In short," The Audit Guys' report notes, before they lay out their full findings and evidence, "with this enormous discrepancy, any discussion of vote counts --- including Biden's 99 vote gain and Trump's 261 vote loss --- is meaningless."

On today's show, Moore explains how his team was able to confirm the numbers they compared with the Senate's machine-count. Randy Pullen, one of the Senate's liaisons to the count, oversaw that late, independent machine count of the numbers of ballots. He now has "some 'splaining to do", Moore tells me. Extrapolating out the numbers from the single pallet of ballots that Pullen's report accidentally revealed, results in "about a 300,000 ballot discrepancy" if averaged with the rest of the 2.1 million ballots the Ninjas supposedly counted.

If that's true, why did the Ninjas' claim that not only their count matched the County's, in general, but that Biden's margin of victory actually increased a bit? Moore offers his explanation on today's program.

We also discuss the response, so far, from both Pullen and Sen. Fann to the Audit Guys' findings ("Crickets," says Moore) and how Fann herself now appears to be participating in a coverup to hide the real numbers and much more. A state court judge has ordered the Senate to release all records from the "audit" and communications with the Ninjas and other contractors as part of public records requests. Fann, however, has refused to release thousands of pages of documents, including the rest of Pullen's and the Ninjas' box-by-box, batch-by-batch reconciliation data. (Longtime progressive AZ election transparency advocate John Brakey, who was allowed inside much, if not all, of the "audit", also recently confirmed on this show that documents were being withheld, when he explained how many of his own communications with Fann were not included in an earlier tranche of documents released as part of the original court order.) There is a hearing scheduled before the judge this week to force the rest of the documents out of Fann.

We also take a few minutes to discuss the concerns that some, including Moore, have about all of these demands for post-election audits in the wake of Trump's evidence-free Big Lie that the election was stolen from him. I don't personally mind such audits, as long as they are done publicly, with the cooperation of election officials (unlike the offensive clown show carried out by the Ninjas in Maricopa). Moore has a different view, however. We discuss.

Finally, we're joined by Desi Doyen for our latest Green News Report, much of which focuses on the weekend's massive oil pipeline rupture off the coast of Southern California, and on the big bucks that Big Oil is now spending to try and block Joe Biden's Build Back Better agenda in Congress...

UPDATE, 6/6/2023: Confirming our reporting from a year and a half ago, text messages finally obtained by the Arizona Republic, via court order, from Cyber Ninjas CEO Doug Logan confirm that, as Moore explains in the show detailed above, Logan simply made up the numbers for this "audit" after being unable to add up or reconcile tabulation sheets created during the Ninjas' months-long "counting" spectacle at the Arizona Veterans Memorial Coliseum. Full details now here...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

IN TODAY'S RADIO REPORT: Massive oil spill off Southern California coast despoils fish and fowl; SoCal beaches closed, with calls renewed for total offshore drilling ban; PLUS: Big Oil spending big bucks to block climate provisions in Biden's Build Back Better agenda... All that and more in today's Green News Report!

PLEASE CLICK HERE TO HELP US CELEBRATE WITH A DONATION!

Got comments, tips, love letters, hate mail? Drop us a line at GreenNews@BradBlog.com or right here at the comments link below. All GNRs are always archived at GreenNews.BradBlog.com.

IN 'GREEN NEWS EXTRA' (see links below): An "attack on American cities" by the natural gas industry is freezing climate action in its tracks; National Audubon Society calls for 'Lights Out' after 'mass mortality' event of migratory birds; Babies are full of microplastics, new research shows; What climate change requires of economics; 14 percent of world's coral lost in a decade; Oil spills plague Venazuelan coast; Urban heat is getting more dangerous... PLUS: The Dimming of Planet Earth... and much, MUCH more! ...

Advertiser Privacy Policy | The BradCast logo courtesy of Rock Island Media.

Web Hosting, Email Hosting, & Spam Filtering for The BRAD BLOG courtesy of Junk Email Filter.

Largest U.S. Broad-caster Hoaxes Viewers to Help Gut FCC Rules: 'BradCast' 4/23/25

Largest U.S. Broad-caster Hoaxes Viewers to Help Gut FCC Rules: 'BradCast' 4/23/25 FCC on Precipice of Ending All Limits on Corp. Control of Local TV Stations

FCC on Precipice of Ending All Limits on Corp. Control of Local TV Stations GOP Earth Day 2025 Hypocrisies and Dilemmas: 'BradCast' 4/22/25

GOP Earth Day 2025 Hypocrisies and Dilemmas: 'BradCast' 4/22/25 Pope Francis Dies, Trump Still Alive and Criming: 'BradCast' 4/21/25

Pope Francis Dies, Trump Still Alive and Criming: 'BradCast' 4/21/25 Soc. Sec. Expert Warns DOGE of Collapse, Privatization: 'BradCast' 4/10/2025

Soc. Sec. Expert Warns DOGE of Collapse, Privatization: 'BradCast' 4/10/2025 Trump Blinks, Chaos Reigns, Markets Spike Amid Tariff 'Pause': 'BradCast' 4/9/25

Trump Blinks, Chaos Reigns, Markets Spike Amid Tariff 'Pause': 'BradCast' 4/9/25 SCOTUS Deportation Ruling Grimmer Than First Appears: 'BradCast' 4/8/25

SCOTUS Deportation Ruling Grimmer Than First Appears: 'BradCast' 4/8/25 Cliff Diving with Donald: 'BradCast' 4/7/25

Cliff Diving with Donald: 'BradCast' 4/7/25