Apple CEO Tim Cook is said to have been uncharacteristically angered recently by an organized movement of Rightwing shareholders demanding that the company stop its investments in green initiatives. Apple has announced its intention of obtaining 100% of its power for administrative operations from clean, renewable energy sources in the not-too-distant future.

Apple CEO Tim Cook is said to have been uncharacteristically angered recently by an organized movement of Rightwing shareholders demanding that the company stop its investments in green initiatives. Apple has announced its intention of obtaining 100% of its power for administrative operations from clean, renewable energy sources in the not-too-distant future.

"Since taking the helm at Apple in 2011," the UK Independent reports, "Cook has made notable improvements to the company’s use of renewable energy, increasing the use of solar, wind and geothermal resources used to power Apple’s offices from around a quarter of its total energy use to more than 75 per cent."

The company's sustainability initiative reportedly led the National Center for Public Policy Research (NCPPR), a self-proclaimed "conservative think tank" to demand that Apple "refrain from putting money in green energy projects that were not profitable," the paper reports.

Apple does "a lot of things for reasons besides profit motive," Cook reportedly told the shareholders. "We want to leave the world better than we found it."

"Not everything that Apple does is motivated by money," he said. "If you want me to do things only for ROI [Return on Investment] reasons, you should get out of this stock."

He is said to have added: "When we work on making our devices accessible to the blind, I don't consider bloody ROI."

Good for him. But the episode underscores an important issue and one that is not generally appreciated by well-meaning progressives who would like to see similar actions by more corporate heads. In fact, our particular system of capitalism in this country --- and even the law --- might very well favor the rightwingers from the NCPPR in this argument, rather than Cook and Apple...

With very few exceptions, large, publicly held corporations are not going to simply "do the right thing" just for the purpose of doing the right thing... whether it's better wages and working conditions for employees, less pollution in company operations, or a more responsible and cleaner use of energy.

That's where government must come in.

Publicly held corporations have a fiduciary responsibility to maximize profits for shareholders. However, as University of Chicago's M. Todd Henderson observes, "Shareholder wealth maximization is a standard of conduct for officers and directors, not a legal mandate."

Still, the core foundation of corporate responsibility to maximize profit for shareholders generally seems to go all the way back to 1916's Dodge v. Ford Motor Co., a shareholder lawsuit resulting in the Michigan Supreme Court finding, as Wikipedia describes it, that "Henry Ford owed a duty to the shareholders of the Ford Motor Company to operate his business to profit his shareholders, rather than the community as a whole or employees."

Ford had decided to stop paying special dividends to shareholders, choosing instead to lower prices on cars, hire more workers and expand production. "My ambition is to employ still more men, to spread the benefits of this industrial system to the greatest possible number, to help them build up their lives and their homes," Ford said at the time. "To do this we are putting the greatest share of our profits back in the business."

Setting aside whatever might have been Ford's real motives (and his other questionable politics, which, as coincidence would have it, we managed to opportunistically and brutally satirize at some length last Christmas), that's the altruism that Ford testified to in court when he was sued by the Dodge brothers, who were minority shareholders in the company, for cutting off the special dividends.

Ford lost the case --- at least on the main point. The court found:

The court, while ordering Ford to pay the special dividends to the Dodges and other shareholders, also held that Ford had the right to exercise his "business judgment" in expanding his operations and lower prices for customers as he saw fit. Had he more forcefully argued that the changes to his company were made in the cause of improving long-term profits, rather than for altruistic purposes, he might have been more successful in the case over all.

While "Dodge is often misread or mistaught as setting a legal rule of shareholder wealth maximization," according to Henderson, "This was not and is not the law." Still, the basic idea that corporate directors have a fiduciary duty to maximize profits for the corporation's shareholders, if not a mandate, is still at the core of our capitalistic system. It also helps explain (if not excuse) both why efforts to do the right thing when it comes to clean energy and climate change are so rare among the corporate elite, and why government mandates are otherwise needed in order to force companies to take actions that might not otherwise immediately benefit shareholders.

Yes, in many cases, green initiatives --- such as less waste --- may lead to short-term profits (less waste, more profit), but, in general, even the best-intentioned CEOs may not be willing to foot the cost and face down shareholders and potential lawsuits over sustainability initiatives.

In other words, CEOs are not necessarily going to do the right thing just because they are swell. If we'd like to live in a country where those who work for a living receive a salary they can live on, or on a planet that human beings can actually survive upon, it requires that government set certain minimum standards for corporations licensed to do business here --- whether it's for a minimum wage, healthcare for all, or limits on the amount of carbon pollution that companies are allowed to dump for "free" into the atmosphere.

The fact is, even well-meaning corporate directors can have a very difficult time, and face huge legal obstacles, towards doing the right thing for society and for their corporate shareholders without a government that sets clear and strong standards requiring them to do so.

'Green News Report' 4/1/25

'Green News Report' 4/1/25

Dems Step Up: Crawford Landslide in WI; Booker Makes History in U.S. Senate: 'BradCast' 4/2/25

Dems Step Up: Crawford Landslide in WI; Booker Makes History in U.S. Senate: 'BradCast' 4/2/25 Judge Dismisses Long-Running Challenge to GA's Unverifiable, Insecure E-Vote System: 'BradCast' 4/1/25

Judge Dismisses Long-Running Challenge to GA's Unverifiable, Insecure E-Vote System: 'BradCast' 4/1/25 'Green News Report' 4/1/25

'Green News Report' 4/1/25 Bad Court and Election News for Trump is Good News for America: 'BradCast' 3/31/25

Bad Court and Election News for Trump is Good News for America: 'BradCast' 3/31/25 Sunday 'Great Start!' Toons

Sunday 'Great Start!' Toons Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25

Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25 'Green News Report' 3/27/25

'Green News Report' 3/27/25 Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26 'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25

'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25 'Green News Report' 3/25/25

'Green News Report' 3/25/25 USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25

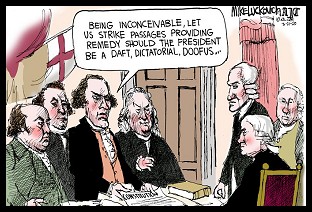

USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25 Sunday 'Suddenly Conceivable' Toons

Sunday 'Suddenly Conceivable' Toons 'Green News Report' 3/20/25

'Green News Report' 3/20/25 We're ALL Voice of America Now: 'BradCast' 3/20/25

We're ALL Voice of America Now: 'BradCast' 3/20/25 What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25

What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25 Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25

Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25 Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25

Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25 Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25

Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25 Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25

Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25 Bad Day for 'Strongmen': 'BradCast' 3/11

Bad Day for 'Strongmen': 'BradCast' 3/11 WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL