Special to The BRAD BLOG by Jim Cirile

Special to The BRAD BLOG by Jim Cirile

Clint Curtis doesn’t know when to quit.

The Florida computer programmer turned infamous whistleblower was allegedly asked by Jeb Bush crony (and future FL-24-R Congressman) Tom Feeney to write vote-flipping software for him in 2000 (here's the quick summary version of BRAD BLOG's coverage of the scandal). At the time, Curtis, then a loyal Republican, delivered the vote-rigging prototype to Feeney under the assumption that his software would be used to prevent e-voting manipulation by Democrats. When Curtis learned that the true purpose was to game the election results in South Florida, he blew the whistle.

A stacked-deck investigation by the Florida Ethics Commission --- where 6 of the 8 members of the panel are either Bush or Feeney appointees, or closely tied to one or both --- dismissed Curtis’ allegations without allowing him to testify, and without examining email and other evidence in the case, in violation of FL law. But Curtis would not go quietly.

He became a crusader, speaking at election integrity events around the country and eventually delivering jaw-dropping testimony (video here) to a stunned Congressional committee (who did nothing in response). Curtis even passed a lie detector test administered by the retired chief polygrapher for the Florida Department of Law Enforcement. Meanwhile, Feeney has been branded among the “Top 25 Most Corrupt in Congress,” for three years straight, by CREW, the non-partisan DC ethics watchdog group, most notably for his involvement --- and golf junket to Scotland --- with disgraced lobbyist Jack Abramoff.

In 2006, Curtis launched his first congressional bid --- now as a Democrat --- taking on Feeney himself for his FL-24 seat. A pre-election Zogby poll showed Curtis in a statistical dead heat with Feeney --- despite Feeney’s big-money smear campaign against Curtis (‘CrazyClintCurtis.com’ featured doctored photos of Curtis wearing a tin foil hat). But on election night, Feeney was announced the winner 57%/43%. Problem is, those election results didn’t make much sense based on the Zogby poll or Curtis’ own internal polling. So Curtis did something remarkable. He filed a Congressional election challenge.

His team went door to door collecting signed affidavits from FL-24 voters testifying as to how they voted. They found the results to be wildly off, by double digits in some places. Despite this evidence, the Democratically controlled House committee summarily dismissed his election challenge, along with several others, without bothering to even review Curtis' evidence.

And yet, Curtis is once again going after the FL-24 Congressional seat. Only this time, he’s not just running against Feeney. First he must defeat an attempt to challenge him by the Democratic party's hand-picked candidate.

We caught up with Curtis on the campaign trail where he made it clear, in our exclusive interview, that he had no intention of lying down or rolling over for naysayers, Democratic insiders, the woman chosen by the DCCC to challenge him, and certainly not the corrupt Tom Feeney...

'A World of Tyrants,

'A World of Tyrants, 'Green News Report' 5/22/25

'Green News Report' 5/22/25

'Dangerous Times': Climate Scientist Warns Trump 'Censorship' Endangering Nat'l Security: 'BradCast' 5/21/25

'Dangerous Times': Climate Scientist Warns Trump 'Censorship' Endangering Nat'l Security: 'BradCast' 5/21/25 And Then They Came for Members of Congress...: 'BradCast' 5/20/25

And Then They Came for Members of Congress...: 'BradCast' 5/20/25 'Green News Report' 5/20/25

'Green News Report' 5/20/25 Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25

Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25 Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World:

Mad World: 'Green News Report' 5/15/25

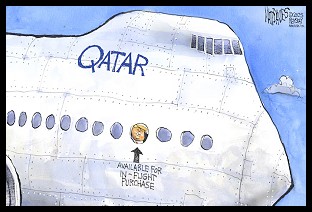

'Green News Report' 5/15/25 Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25

'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25 'Green News Report' 5/13/25

'Green News Report' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Sunday 'New Guy, Old Guy' Toons

Sunday 'New Guy, Old Guy' Toons Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 'Green News Report' 5/8/25

'Green News Report' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25

100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL

Just for the record, it's absolutely insane that Air America has

Just for the record, it's absolutely insane that Air America has  Princeton computer science professor and

Princeton computer science professor and

Is this your America?

Is this your America?

We admit to being perplexed enough by

We admit to being perplexed enough by