The conventional wisdom is that Mitt Romney has been attempting to withhold his tax returns from public scrutiny so that we'll not learn just how small the percentage is that he pays on his enormous income (which is said to be largely reported as capital gains, and thus taxed at just 15%.)

The conventional wisdom is that Mitt Romney has been attempting to withhold his tax returns from public scrutiny so that we'll not learn just how small the percentage is that he pays on his enormous income (which is said to be largely reported as capital gains, and thus taxed at just 15%.)

But there's another interesting issue that could be revealed when he releases his 2010 tax returns on Tuesday, as promised.

Remember last June when little-known Republican candidate Fred Karger filed a complaint with the state of Massachusetts charging that Romney committed voter fraud by using the unfinished basement of his son's house in Belmont, MA as his address for voting purposes after he'd sold his own him there in 2008, rather than registering to vote at his $12.5 million ocean front home in La Jolla, California or at his $10 million compound in New Hampshire?

Voter registration fraud in MA is punishable by a $10,000 fine and up to five years in jail. Residency requirements in MA are defined as "where a person dwells and which is the center of his domestic, social, and civil life." Yet, when Karger filed his complaint last Summer he noted that local residents in Belmont had told him at the time that the Romney's had "moved to California".

"I haven’t seen Mrs. Romney in over two years, and she used to come in here all the time," Karger says a local merchant told him. A member of the nearby Mormon Temple and Meetinghouse in Belmont, where Mitt and his wife Ann had attended weekly church services when they lived there, said she "hadn’t seen the Romneys since 2008."

If you don't recall all the specifics, here's our detailed coverage at the time, where the case didn't look good for Mittens, even while the state of Massachusetts seemed to be more interested in ignoring the allegations all together for some reason. The piece also includes details on some other recent apparent GOP voter fraud felons too.

And here's our in-studio interview with Karger [MP3] on the Mike Malloy Show from June 16, 2011, discussing the issue just after he'd filed his complaint...

Could be an interesting day tomorrow...

By the way...We should also note, no matter what we learn from Romney's tax returns tomorrow, his main GOP competitor Newt Gingrich also has a little "voter fraud" trouble of his own...

UPDATE 1/24/12, 11:27am PT: Well, here's what we seem to have concerning filing address from Romney's now-posted 2010 federal tax form...

The redaction of the street address is from the version of the form the Romney team has posted.

So what does this tell us at the moment?...

Here's a helpful brief summary of what we know about the Romneys' residency, as compiled by BoBo2020 at dKos today after picking up on our story. The chronology is based on Karger's complaint filed in MA last year...

2) A year later, in April 2009, the Romneys sold their home in Belmont, Massachusetts, for $3.5 million, and allegedly registered to vote from an address in the basement of an 8,000 square-foot Belmont manse owned by their son Tagg.

3) the National Journal reported in May 2009 that the Romneys had actually made their primary residence a $10 million estate in New Hampshire.

4) January 2010 Romney votes in the Massachusetts special election

5) July, 2010 - Romney finally buys a [$895,000] townhouse in Belmont, MA.

Since the Romneys redacted the street address on their federal return, we can't know for sure if the address used is their son's mansion or their recently-purchased townhouse in Belmont. But by the end of 2010, when the Romneys filed their federal taxes, it might make sense that they'd want to appear to be living in Belmont, MA using the address of the newly purchased townhouse there. After all, they were running for President by then, for Pete's sake!

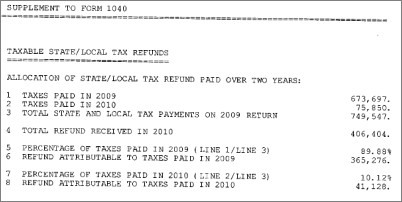

But can it legitimately be said that they lived in MA when Mitt voted there in January, 2010 in the special election for the U.S. Senate (won by Republican Scott Brown)? It seems we still don't know based on what he's published to date. It doesn't look like they have posted his state tax returns yet, but page 137 of his federal return [PDF] includes a "Statement 3" on state and local taxes which begins this way...

We're anything but tax experts here, so we'll have to do some checking to find out if there are any hints in the above statement. But keep in mind that New Hampshire doesn't have an income tax, whereas both Massachusetts and California do. Mitt's federal return for 2010 is over 200 pages long, including all form of supposedly-legal tax havens and loopholes he used to keep his rate as low as possible (to an effective rate of just 13.9% for the year).

Would Mitt have been paying MA income tax from January through July when he finally purchased his own MA residence? Or was he enjoying the income tax-free NH rates during that period? Not sure if the form above offers us any hints or not, but we'd welcome input from those who may be better versed in this stuff as we see what, if anything, we can learn directly from the Romney campaign's press folks or from tax experts who may be able to ring in...

Trump Labor Dept. Warns Trump Policies Sparking Food Shortage, Farmworker Crisis: 'BradCast' 10/9/25

Trump Labor Dept. Warns Trump Policies Sparking Food Shortage, Farmworker Crisis: 'BradCast' 10/9/25 'Green News Report' 10/9/25

'Green News Report' 10/9/25

Trump's Losing Battles: 'BradCast' 10/8/25

Trump's Losing Battles: 'BradCast' 10/8/25 'Supreme Arrogance': Trump, John Roberts and His Stacked, Packed and Captured SCOTUS: 'BradCast' 10/7/25

'Supreme Arrogance': Trump, John Roberts and His Stacked, Packed and Captured SCOTUS: 'BradCast' 10/7/25 'Green News Report' 10/7/25

'Green News Report' 10/7/25 Trump Attempting His

Trump Attempting His Sunday 'Shutshow' Toons

Sunday 'Shutshow' Toons Biden Budget Expert: Mass Firings in Shutdown 'Extremely Illegal': 'BradCast' 10/2/25

Biden Budget Expert: Mass Firings in Shutdown 'Extremely Illegal': 'BradCast' 10/2/25 'Green News Report' 10/2/25

'Green News Report' 10/2/25 Why is DOJ Suing 'Blue' States for Their Voter Databases?: 'BradCast' 10/1/25

Why is DOJ Suing 'Blue' States for Their Voter Databases?: 'BradCast' 10/1/25 'A War from Within' Trump's Twisted Mind: 'BradCast' 9/30/25

'A War from Within' Trump's Twisted Mind: 'BradCast' 9/30/25 'Green News Report' 9/30/25

'Green News Report' 9/30/25 'Fear is the Tool of a Tyrant':

'Fear is the Tool of a Tyrant': Sunday 'Long Arm/Small Man' Toons

Sunday 'Long Arm/Small Man' Toons 'Green News Report' 9/25/25

'Green News Report' 9/25/25 I Don't Know What This Means, But I Thought You Should Know: 'BradCast' 9/25/25

I Don't Know What This Means, But I Thought You Should Know: 'BradCast' 9/25/25 Gov't Shutdown Looms as Dems Fight to Save Healthcare Subsidies: 'BradCast' 9/24/25

Gov't Shutdown Looms as Dems Fight to Save Healthcare Subsidies: 'BradCast' 9/24/25 Updates: Homan Bribery; Kimmel Censorship; Our Insane Prez at U.N.: 'BradCast' 9/23/25

Updates: Homan Bribery; Kimmel Censorship; Our Insane Prez at U.N.: 'BradCast' 9/23/25 Trump 'Border Czar' Took $50k in Sting, DOJ Dropped the Case: 'BradCast' 9/22/25

Trump 'Border Czar' Took $50k in Sting, DOJ Dropped the Case: 'BradCast' 9/22/25 MAGA Exploiting Kirk's Death as Their 9/11: 'BradCast' 9/17/25

MAGA Exploiting Kirk's Death as Their 9/11: 'BradCast' 9/17/25 Our Crumbling Courts and Withering Rule of Law: 'BradCast' 9/16/25

Our Crumbling Courts and Withering Rule of Law: 'BradCast' 9/16/25 After Kirk Murder, 1st Amendment, Not 2nd, Under Attack: 'BradCast' 9/15/25

After Kirk Murder, 1st Amendment, Not 2nd, Under Attack: 'BradCast' 9/15/25 SCOTUS Suspension of 4th Amendment an Ominous Threat to Constitutional Republic

SCOTUS Suspension of 4th Amendment an Ominous Threat to Constitutional Republic

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL