Following a short "dead cat bounce" at the end of last month, after a precipitous six-month stock price plunge devaluing the company's net worth by more than 50% since an insider sell-off last August, Diebold's fortunes began turning south again late last week as the company was forced to begin restating previously-inflated revenue figures from 2006 and 2007.

Following a short "dead cat bounce" at the end of last month, after a precipitous six-month stock price plunge devaluing the company's net worth by more than 50% since an insider sell-off last August, Diebold's fortunes began turning south again late last week as the company was forced to begin restating previously-inflated revenue figures from 2006 and 2007.

The company's stock price is continuing to plunge today towards a seven-year low, after it admitted last week that it had over-estimated revenues of its election systems division by more than 300%.

As well, the company announced it will soon be laying off 5% of its full-time global workforce. The restatement of revenues comes as part of a deal worked out with the SEC, which continues its ongoing investigation into the financial practices of the once-great, now-disgraced company. Diebold also acknowledges that it is still being investigated by the DOJ, although the reasons and details of that particular investigation remain undisclosed at this time.

The 50% decrease in the company's share price began just after a number of company executives sold off several thousand shares of stock, all on the same day in August of last year, at $53.05/share, very near the company's 52-week high of $54.50, as The BRAD BLOG reported exclusively at the time. In the following week, the company's share price fell 15% just before the management attempted to misdirect investors by renaming their election division in order to offer "a fresh identity for our company."

Following the insider trading and fresh identity, now dubbed "Premier Elections Solutions," the company's share price has continued to fall ever since. The stock is down more than 3% so far today, selling currently at $24.64/share.

A statement released by the company late last week reveals once again that, despite the attempted name change bait-and-switch, the company still bears the liabilities of the old Diebold elections division; the company admits that the SEC and DOJ investigations continue and sales are sharply off for its voting systems, which have been decertified by several states after being found easily hackable and error-prone in study after study over the past year.

As well, there is a Securities Fraud class action lawsuit still pending against the company, as investors cast the only vote that counts --- the one that hits the 150-year old company in the pocket book. The company that made its bones in the security business has tumbled quite a ways since untouchable crime-fighter Eliot Ness served as chair back in the 1940's.

As well, there is a Securities Fraud class action lawsuit still pending against the company, as investors cast the only vote that counts --- the one that hits the 150-year old company in the pocket book. The company that made its bones in the security business has tumbled quite a ways since untouchable crime-fighter Eliot Ness served as chair back in the 1940's.

In the wake of its latest round of misfortunes/karmic return, Diebold announced plans for layoffs of some 800 workers last week. We're not happy to hear that. Though if any of those who find themselves out of a job due to the arrogance, corruption, and general failure of this company to perform as a responsible corporate citizen would like to share any inside information, we'd be delighted to hear from you. Your confidentiality, as needed, will always be respected by The BRAD BLOG.

A partial restatement of 2007 revenue estimates, released by Diebold last week in the wake of the SEC investigation which has forced it to discontinue its previously misleading practice of declaring revenues before products were actually delivered, reveals that the company continues to be rocked by its failing election division, newly renamed or otherwise...

DIEBOLD PLAYS FAST AND LOOSE WITH NUMBERS

According to the statement, the earlier 2007 estimate for revenue from the election division was $185 to $215 million. The newly revised estimate for 2007 election business is just $61 million, revealing the original numbers were inflated by 300-350%.

The admission also reveals that estimated election system revenue for the company is down some 69% from 2006. Other than a similar previous overstatement of expected revenue from a small-ish investment in the Brazilian lottery, the company estimated small but positive growth in all of its other business sectors.

For all the pro-Diebold bluster from supporters out there, downplaying the trouble the company faces with its election division by claiming it's such a small part of its overall business (appx. 5%), the company's real numbers suggest a very different story.

Company CEO Thomas Swidarski, who replaced controversial George W. Bush "pioneer" Walden O'Dell after his infamous 2003 Republican fund raising letter announcing he was "committed to helping Ohio deliver its electoral votes to" Bush in 2004, cites "significant deterioration in the election systems market in 2007" as one of the reasons for the company's current woes.

He goes on to say that the company "will continue to invest in areas that are essential to our growth moving forward, such as deposit automation solutions, integrated services/outsourcing capabilities, software offerings, new security markets and IT infrastructure."

Notice anything missing? We did. Touch the screen HERE if you do as well.

Moreover, the statement later admits ominously: "the previously disclosed investigations by the SEC and U.S. Department of Justice remain ongoing and there can be no assurance that the results of these investigations will not impact previously reported financial statements," before going on to list a number of "forward looking statements" which might be impacted by any of the following notable points...

- the finalization of the impact on the company's financial statements of its change in its revenue recognition practices for its North America business segment and any other business segment;

- the results of the SEC and Department of Justice investigations and the company's review;

- acceptance of the company's product and technology introductions in the marketplace;

- unanticipated litigation, claims or assessments;

- challenges raised about reliability and security of the company's election systems products, including the risk that such products will not be certified for use or will be decertified;

- changes in laws regarding the company's election systems products and services;

- potential security violations to the company's information technology systems;

- the company's ability to successfully execute its strategy related to the election systems business

...

...

Once again, if any company insiders would like to touch base, we'd be happy to hear from you right here.

We should also add the not-wholly-unrelated thought that VelvetRevolution.us (an organization co-founded by The BRAD BLOG) has an ongoing Election Fraud tip-line at: 1-800-VOTE-TIP. Rewards are offered for information that leads to the reversal of an election and/or arrest of culprits. Just thought you should know.

Sunday 'Great Start!' Toons

Sunday 'Great Start!' Toons Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25

Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25 'Green News Report' 3/27/25

'Green News Report' 3/27/25

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26 'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25

'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25 'Green News Report' 3/25/25

'Green News Report' 3/25/25 USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25

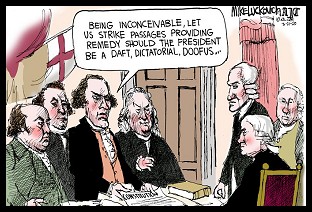

USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25 Sunday 'Suddenly Conceivable' Toons

Sunday 'Suddenly Conceivable' Toons 'Green News Report' 3/20/25

'Green News Report' 3/20/25 We're ALL Voice of America Now: 'BradCast' 3/20/25

We're ALL Voice of America Now: 'BradCast' 3/20/25 What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25

What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25 Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25

Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25 Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25

Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25 Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25

Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25 Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25

Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25 Bad Day for 'Strongmen': 'BradCast' 3/11

Bad Day for 'Strongmen': 'BradCast' 3/11 WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL