Diebold may dump e-voting headaches

Monday, March 5, 2007

By M.R. KROPKO

AP Business Writer

DAYS NUMBERED? Randy Fox (right) explains how to work the printer housing on a Diebold Electronic Voting Systems unit during a training session in Cleveland in October. Just five years after Diebold boldly plunged into the changing United States e-voting market, some close observers think the company soon may try to find a way out.

Main Story Headlines

• Police turning to YouTube to catch suspects

• Diebold may dump e-voting headaches

Yesterday's Headlines

• Engineer seeks allies for hike in license tax

• New schools can be ‘godsend,’ headache

Advertisement

CLEVELAND (AP) — Diebold Inc. saw great potential in the modernization of elections equipment. Now, analysts say, executives may be angling for ways to dump its e-voting subsidiary that’s widely seen as tarnishing the company’s reputation.

Though Diebold Election Systems — the company’s smallest business segment — has shown growth and profit, it’s faced persistent criticism over the reliability and security of its touch-screen voting machines. About 150,000 of its touch-screen or optical scan systems were used in 34 states in last November’s election.

The criticism is particularly jarring for a nearly 150-year-old company whose primary focus has long been safes and automated teller machines.

“This is a company that has built relationships with banks every day of every year. It pains them greatly to see their brand tarnished by a marginal operating unit,” said Gil Luria, an investment analyst who monitors Diebold for Wedbush Morgan Securities Inc.

In the calm after the November midterm elections, Tom Swidarski, Diebold’s chief executive officer, told analysts in a conference call that the company plans to announce its long-term strategy for the elections unit early this year.

Swidarski declined an interview request to shed more light on the voting segment’s future.

But in an annual report filed last week with the Securities and Exchange Commission, Diebold’s discussion of its election systems business pointed out various ongoing concerns. Diebold acknowledged that complaints about its voting products and services have hurt relations with government election officials.

Diebold indicated it still is “vulnerable to these types of challenges because the electronic elections systems industry is emerging.” The report also mentioned inconsistency in the way state and local governments are adapting to federal requirements for upgrades in voting technology.

More changes in the voting laws could further hurt business, the filing said.

Diebold spokesman Mike Jacobsen said that whenever Diebold evaluates one of its businesses, it looks for growth, profitability and characteristics that make it a long-term strategic fit.

Jacobsen would not say when the announcement about the subsidiary’s future may come.

“I imagine at this point it’s a question of whether have they found a private equity buyer yet or are they about to announce they are going to look for one,” Luria said. He did not speculate on who that may be.

Diebold headaches have abounded.

Some of its voting machines have been criticized for lacking a voter-verified paper trail for post-election audits. Last summer, the Open Voting Foundation issued a report alleging that Diebold touch-screen functions can be changed with the flip of an internal switch. Activists have found source code online. And there have also been numerous lawsuits and leaked internal memos.

FTN Midwest Securities analyst Kartik Mehta wonders if a business that has been a lightning rod for criticism is worth it. He said Diebold leaders need to decide “if that negative publicity is hurting them in selling products to financial institutions, security products to government or any of their other customers.”

North Canton, Ohio-based Diebold jumped into e-voting in 2002, when it acquired Global Election Systems. It had some prior experiences with electronic voting through its Procomp business in Brazil.

The elections business was good for 8 percent of Diebold revenue and about 12 percent of profit last year, but some of that is from Diebold’s voting and lottery contracts in Brazil.

By comparison, the ATM segment produced about 65 percent of the company’s revenue and 63 percent of profit in 2006. Safes have evolved into Diebold’s second biggest segment, now called “security solutions.” It makes various devices and systems for business and government security. Last year it gave Diebold about 27 percent of its revenue and 25 percent of its profit.

If profit is the key measure for Diebold, the voting business would seem to be a good fit. But for this segment, a 2006 gross profit (before taxes, costs and expenses) on products and service of about $83.5 million isn’t the whole story.

“I’ve been surprised that Diebold has stayed in the voting business for this long, considering the size of the company and the other sources of revenue,” said Avi Rubin, a computer scientist at Johns Hopkins University and a frequent foe of Diebold voting systems’ programming. Rubin is director of ACCURATE, an e-voting research organization funded by the National Science Foundation.

Diebold has always defended its voting machines and its own intentions, even after its former chairman and chief executive, Wally O’Dell, sought with little success to convince critics his strong ties with Republican politics as a fundraiser for George W. Bush were not the motive for the company’s involvement in elections.

O’Dell resigned in 2005 and was replaced by Swidarski, who had been the company’s president and chief operating officer. His main focus has been on expanding international business for ATMs, a less public business.

Critics remained. About the time of the November elections, HBO aired a scathing documentary entitled “Hacking Democracy” that again raised questions about the security of Diebold machines.

Might Diebold choose to keep the voting business and grow it?

“It’s a possibility, but I’d assign it a very low probability,” Luria said.

Voting machine makers such as Diebold; Election Systems & Software, of Omaha, Neb.; Sequoia Voting Systems, of Oakland, Calif., and Hart InterCivic, of Austin, Texas have had the federal Help America Vote Act of 2002 as a sales catalyst. HAVA, with $3.9 billion of funding, urged the nation to move past punch card voting and hanging chads that delayed the conclusion of the 2000 presidential election.

ES&S, Sequoia and Hart InterCivic declined to comment on a possible Diebold Election Systems sale.

Douglas Rodgers, managing partner and chief executive officer of Washington-based investment banking firm FOCUS Enterprises Inc., said he has worked with Diebold executives on recent acquisitions. He could not comment on Diebold’s intentions for voting systems.

Kimball Brace, who closely tracks voting system vendors as president of Washington-based Election Data Services Inc., said there is uncertainty now in the elections market, a result of possible legislation setting new requirements with no promise there will be additional funding.

He couldn’t say what Diebold will do.

“If I were in these guy’s shoes, I’d be looking close and hard at what I’m doing in this marketplace,” Brace said. “But given the uncertainty, who would buy it?”

———

Miller Co. Arkansas Election Administrator Robby Selph resigned from his job saying this about Election Systems and Software, “The reason I am leaving is the provider of the Ivotronics and related software lacks competency to make their equipment work timely and effectively. They ... make a difficult job impossible to do. They can’t spell, meet deadlines, send documents to the right address or code elections correctly. They leave races off the ballot for us to correct, they can’t program their software to work and you have to hand add the results. And they don’t return phone calls. The ES&S people in Arkansas are capable but the people I have dealt with in the home office in Omaha prevent them from being effective. They are also mean-spirited when you try to get them to correct the numerous and recurring errors.”...

Miller Co. Arkansas Election Administrator Robby Selph resigned from his job saying this about Election Systems and Software, “The reason I am leaving is the provider of the Ivotronics and related software lacks competency to make their equipment work timely and effectively. They ... make a difficult job impossible to do. They can’t spell, meet deadlines, send documents to the right address or code elections correctly. They leave races off the ballot for us to correct, they can’t program their software to work and you have to hand add the results. And they don’t return phone calls. The ES&S people in Arkansas are capable but the people I have dealt with in the home office in Omaha prevent them from being effective. They are also mean-spirited when you try to get them to correct the numerous and recurring errors.”...

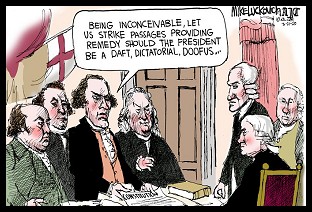

Sunday 'Great Start!' Toons

Sunday 'Great Start!' Toons Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25

Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25 'Green News Report' 3/27/25

'Green News Report' 3/27/25

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26 'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25

'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25 'Green News Report' 3/25/25

'Green News Report' 3/25/25 USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25

USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25 Sunday 'Suddenly Conceivable' Toons

Sunday 'Suddenly Conceivable' Toons 'Green News Report' 3/20/25

'Green News Report' 3/20/25 We're ALL Voice of America Now: 'BradCast' 3/20/25

We're ALL Voice of America Now: 'BradCast' 3/20/25 What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25

What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25 Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25

Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25 Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25

Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25 Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25

Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25 Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25

Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25 Bad Day for 'Strongmen': 'BradCast' 3/11

Bad Day for 'Strongmen': 'BradCast' 3/11 WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL