-- Brad Friedman

As if Sequoia Voting Systems doesn't have enough trouble already, the company now needs some $2 million dollars in cash...quickly. Without it, it is likely to be subsumed by one of its nearest competitors, Hart InterCivic of Austin, TX, as soon as next Tuesday, The BRAD BLOG has learned.

As if Sequoia Voting Systems doesn't have enough trouble already, the company now needs some $2 million dollars in cash...quickly. Without it, it is likely to be subsumed by one of its nearest competitors, Hart InterCivic of Austin, TX, as soon as next Tuesday, The BRAD BLOG has learned.

In what could well be a major shift on the American election industry landscape --- and certainly on elections themselves in dozens of states across the country --- voting machine company Hart InterCivic informed the current owners of the beleaguered Sequoia of their intention to acquire ownership of the company in a move which could take effect as early as next week.

The attempted hostile takeover --- which, we've learned, has been quietly in the works behind the scenes since mid-February --- has set off a building panic among the senior management and owners at Sequoia, whose money woes had already led them to schedule a shut-down of their Oakland headquarters. That shop is to close within a matter of months, as the operations for the company are to be consolidated at its Denver offices.

The takeover by Hart is made possible in the wake of a deal made by Sequoia's current owners, SVS Holdings, Inc., with its former owners, the off-shore consortium Smartmatic. Smartmatic was forced to give up control of the company after the media and Congress noticed in 2006 that the company had ties to Venezuela's Hugo Chavez. The officers and owners of SVS are comprised largely of previous Sequoia officials who took over the company after Smartmatic's failed attempt to find an outside buyer in 2006. The deal resulted in an agreement between SVS and Smartmatic for the latter to hold a $2 million note from the purchase. Smartmatic now appears ready to sell that note to Hart as part of a $16 million dollar deal which SVS has a contractual right to match within a 60-day period, ending on April 15th.

Sequoia is believed by election experts to be this country's third largest voting machine company, followed by Hart. The combined operation, should the takeover be completed, could well create a new powerhouse in the industry, displacing #2 Diebold/Premier, and coming up just behind the country's currently largest election vendor, ES&S.

Court documents obtained by The BRAD BLOG reveal that Hart notified SVS of its intention to purchase the $2 million note held by Smartmatic on February 15th, giving the group of owners and share holders of SVS --- including CEO and President Jack Blaine, and VPs Michelle Shafer and Edwin Smith (whose names BRAD BLOG readers may recognize) --- just 60 days to match the offer Hart had given to Smartmatic. As the deadline nears, Due Dilligence processes have begun, and are near the final phases of completion at Sequoia...whether company management likes it or not.

Hart's move has sent Sequoia/SVS executives into a legal and financial tizzy and --- perhaps taking a page from Hillary Clinton's campaign book --- the company seems to be throwing the legal kitchen sink at both Hart and Smartmatic in an attempt to nullify Hart's offer. Court documents reveal arguments that Hart's is not a "bona fide" offer that SVS is legally required to match. So far, however, those legal maneuvers, reflected by a dizzying array of motions and cross-motions, suits and counter-suits --- completely unreported by anyone in the media until now --- have all been summarily and soundly rejected by the Delaware magistrate adjudicating the matter.

Every legal effort by Sequoia and SVS to dispatch with the hostile takeover attempt has failed miserably so far, leading Vice Chancellor Stephen P. Lamb of the Court of Chancery in Delaware to even describe one such legal theory of SVS' as...(big irony alert!)...a "conspiracy theory"!

But while Sequoia faces a plethora of legal liabilities concerning their oft-failed voting systems, Hart InterCivic faces its own share of challenges with a pending --- and damning --- federal fraud/qui tam suit against the company, as unsealed late last month. Moreover, Hart's acquisition plan could face scrutiny from members of Congress and Treasury Department officials, as well as states across the country who thought they had turned over control of their elections to Sequoia, only to soon learn there will be a new owner, not of their choosing, of the secret software and devices which determine the results of their public elections.

While litigation over claims of fraud and failure in both company's voting systems await, so does at least one major prize to the victor of this grudge match: New York state's soon-to-be-completed $100 million deal with Sequoia...or maybe now with Hart...or...whoever...

The Stakes...

The BRAD BLOG has learned that several major Sequoia contracts are near completion in which the money has yet to change hands. The Due Dilligence items demanded by Hart, as part of the final stages leading to their potential takeover, refer to, among many other things, copies of the full and final contracts struck with the City of San Francisco and the various New York state entities involved in Sequoia's most lucrative pending deal.

While the contract to sell new voting systems to San Francisco amounted to just over $10 million, it is the major New York state deal --- comprised of agreements for Sequoia to supply some $100 million worth of systems over two years --- that has both SVS and Hart salivating. It will likely be payments from those NY contracts --- which Sequoia will be working on cooperatively with yet another competitor, Dominion Voting Systems Corporation of Ontario, Canada --- that will go towards a large part of the total $16 million purchase price that Hart promises to pay to Smartmatic over the next five years in their proposed deal to take over the note from Smartmatic.

The proposed deal, detailed in Hart's February 15th "Letter of Intent," is referenced in the court documents we reviewed on the case.

"In addition to providing non-cash consideration," the Lamb's recent findings detail, "Hart has agreed to pay Smartmatic $7 million on closing, as well as 40% of the net income of the combined Hart/Sequoia company for the next 5 years, with a promise to pay at least $9 million in those 5 years. Thus, Hart promises to pay at least $16 million, and possibly more," to Smartmatic.

The news will likely be of particular interest to SF, NY and a host of jurisdictions around the country who have recently chosen to do business with Sequoia, rather than Hart --- a company which, among other problems, now has a serious federal whistleblower suit hanging over their head, alleging all manner of false claims and other criminal behavior --- but who now may be forced to deal with a new corporate entity whether they originally agreed to that or not.

The news will likely be of particular interest to SF, NY and a host of jurisdictions around the country who have recently chosen to do business with Sequoia, rather than Hart --- a company which, among other problems, now has a serious federal whistleblower suit hanging over their head, alleging all manner of false claims and other criminal behavior --- but who now may be forced to deal with a new corporate entity whether they originally agreed to that or not.

That risk is one that may not have been foreseen by many states and counties when they chose to outsource and privatize their voting systems, or when they chose, for whatever reason, to go with the Sequoia company, instead of Hart.

In truth, is there anything at all that would keep a corporation such as Halliburton from making a similar move to takeover control of a voting company and, with it, direct control of American elections?

A recent hostile takeover attempt, by defense contractor United Technology, Inc. (UTI), in their effort to gain control of Diebold, Inc., the nation's current #2 voting machine company, kicked off a media flurry of concern, and sent a chill down the spine of many Election Integrity advocates who follow such developments in the industry. So far, Diebold has resisted the takeover attempt, but there seems little in the way of such corporate wheeling and dealing changing the hands of those who have unique access to every aspect of the inner-workings of our public democracy from county to county, state to state and coast to coast.

It's little wonder then that all four of the corporate entities involved in the pending Hart/Smartmatic/Sequoia/SVS deal have gone to extraordinary lengths to keep the matter out of the public limelight during the two months of squabbling, negotiation, and legal maneuvering since Hart's initial "Letter of Intent" was delivered on February 15th.

Hopefully the light now shed by The BRAD BLOG's currently-exclusive coverage of this matter will wake up a few more entities --- state and county jurisdictions, elected officials, and other media outlets --- to what may be going on here, the dangers we've left ourselves open to, and the direct effect it all may have on American democracy.

The Court Case(s)...

The motions and counter-motions filed by SVS and Sequoia, against Hart and Smartmatic seem to illustrate the same legal expertise (or lack thereof) which Sequoia has attempted to leverage recently in places like New Jersey, where their AVC Advantage touch-screens failed to boot up during the state's recent Super Tuesday Primary. To make matters far worse, after the election, it was discovered that the machines had misreported vote totals.

In their effort to quell the damage caused by the failing machines in NY's neighboring NJ, Sequoia has recently embarked on a number of embarrassing legal and public relations efforts to avoid scrutiny of the same failed NJ systems, even as they are currently set for use in several counties in next week's important Pennsylvania primary election.

In their effort to quell the damage caused by the failing machines in NY's neighboring NJ, Sequoia has recently embarked on a number of embarrassing legal and public relations efforts to avoid scrutiny of the same failed NJ systems, even as they are currently set for use in several counties in next week's important Pennsylvania primary election.

Following discovery of the NJ tabulation errors, election officials in the state requested an independent study of the systems be carried out by two Princeton computer scientists. In response, Edwin Smith, Sequoia's VP of Compliance, Quality and Certification --- who is an SVS shareholder, as well as former operations manager for Hart InterCivic --- emailed threats of legal action to two Princeton computer science professors, warning them not to independently examine the Advantage voting machines, despite a request to do so by NJ election officials.

Instead, Sequoia's VP of Communications & External Affairs, Michelle Shafer (herself, an SVS share holder) announced the company had commissioned an "independent review of its voting equipment used in New Jersey." The announcement stated the review would be carried about by a company named "Kwaidan Consulting," who The BRAD BLOG then discovered to be a "blonde nymphomaniac"-seeking technician from Sugarland, TX who had (unsuccessfully) attempted to conceal his questionable babe-hounding past once we began making inquiries.

The BRAD BLOG has since learned that Gibbons had been contracted by Sequoia for several months for other work for the company. Since we broke our story on Gibbons, he has been removed from the project. (We may have additional information on Gibbons in a later article.)

A judge in NJ has recently ordered the failed voting machines from six counties be subpoenaed and submitted for mandatory testing. Following that court order, Sequoia yesterday filed an 82-page legal motion [PDF] attempting to quash the subpoenas.

Rutgers University attorney, Penny Venetis, representing Election Integrity advocates in the NJ court case, has argued in response that Sequoia is not a party to her client's case against the state, and therefore, as a third-party, has no standing to object to the judge's order.

While we await the NJ court's response to Sequoia's latest legal attempts to keep the officials who run the elections in the state from examining the malfunctioning machines they purchased from Sequoia, the company can only hope their legal response brings more success than the SVS/Sequoia attorneys have so far had in the Delaware courtroom where the Hart takeover is being adjudicated.

Vice Chancellor Lamb, of Delaware's Court of Chancery, seemed decidedly unimpressed with each and every legal argument SVS/Sequoia has so far attempted to use in trying to block the impending sale to Hart, according to documents obtained by The BRAD BLOG.

In addition to describing one of SVS/Sequoia's legal arguments --- ironically enough to those who have covered the Election Integrity fight in America over the years --- as a "conspiracy theory", Lamb, in his opinion dated April 4, 2008, variously slammed SVS/Sequoia's arguments, writing that he would "not play referee to the parties' contract negotiations"; that "The court wholly disagrees with SVS"; finding that "SVS fails to raise issues of material fact"; that their "allegations...are insufficient as a matter of law"; that "SVS has utterly failed to allege facts supporting this truly odd claim" which was found to be "baseless"; while other SVS claims were similarly described by the Vice Chancellor as "completely frivolous," and "too outlandish to survive summary judgment."

Lamb's April 4, 2008 opinion letter on behalf of the court, denying every legal challenge by SVS/Sequoia can be downloaded here [PDF].

Sequoia's legal track record in other matters around the country have often shown to be similarly outlandish, frivolous and baseless, and the pickle the company now finds themselves in, while desperately scrambling to find the $2 million needed to save themselves, might well have been averted had many of the legal arguments they're using to try and stop the sale to Hart, actually been included in their initial deal with Smartmatic.

That deal, poorly structured as it apparently was, seems to have left the owners of SVS completely open to this impending takeover.

The CFIUS Review...

Hart's attempt to takeover Sequoia includes a deal with Smartmatic, who remains in the e-voting business, in which Hart has promised to avoid direct competition with Smartmatic in certain international regions, according to court documents review by The BRAD BLOG.

"Hart promises not to compete with Smartmatic in Latin America, the Philippines, and Belgium," Vice Chancellor Lamb writes in describing the Hart/Smartmatic agreement, in his latest letter of opinion for the court. "In return, Smartmatic promises to grant Hart a license to use its intellectual property found in Sequoia's machines."

SVS has challenged that particular aspect of the agreement between Hart and Smartmatic on the basis that it would violate previous agreements Smartmatic had made with the U.S. Treasury Department's Committee on Foreign Investment in the United States (CFIUS), charged with overseeing foreign investment of key national security infrastructure, such as our election systems.

In 2006, Sequoia and their parent company Smartmatic made headlines when it was noticed that the latter was comprised of a series of shadowy foreign companies and owners, which may be been controlled, in part, by interests tied in with Venezuela's Hugo Chavez.

Chavez' government had enlisted Smartmatic to run their elections in 2004 in partnership with a Venezuelan software firm in which the Venezuelan government had a 28% ownership stake.

CFIUS failed to review the takeover of Sequoia by Smartmatic initially, raising the eyebrows and ire of some on both the political right and left in this country. The matter caught the notice of CNN's Lou Dobbs Tonight, which, after learning of the Sequoia/Smartmatic controversy, launched into a series of regular reports --- easily the most coverage of anyone within the broadcast media --- concerning problems, worries and failures in electronic voting machines, and about all of the American voting machine companies who make them.

Congresswoman Carolyn Maloney (D-NY) called for a CFIUS review of Smartmatic's takeover of Sequoia, citing "serious national security concerns about the integrity of elections."

The media attention succeeded in gaining notice of CFIUS. But rather than face a review by the federal commission, Smartmatic sold Sequoia to the group of Sequoia executives who incorporated as "SVS Holdings, Inc." on September 13, 2007. The contractual agreement between the team of top management includes a provision to "maintain and perpetuate control of the Corporation among themselves."

Smartmatic held the $2 million note for the purchase by SVS Holdings, and it is that note which is now at stake as Smartmatic verges on selling it to Hart and, with it, the full control of Sequoia to a direct competitor.

SVS contends, according to the legal documents, that the foreign non-compete agreement between Hart and Smartmatic demonstrates "'indirect control' by Smartmatic over Sequoia, in violation of agreements with the government." SVS argues that the deal would be in violation of the Smartmatic agreement with CFIUS, struck after the company claimed to have sold off controlling interest to SVS in November of 2007.

The real control of Sequoia, however, could come into question again if CFIUS were to review the newly pending deal, and the way in which it seems Smartmatic has interpreted their right to offer away Sequoia's "intellectual property", even while striking a deal with an American company (Austin-based Hart) to avoid overseas competition.

Though the claim is included in legal documents, as one of SVS' efforts to put a stop to the attempted takeover, Lamb struck down the motion SVS attempted to cite as an example of "tortious interference" in their business by Hart and/or Smartmatic. Lamb found that Smartmatic and Hart were welcome to structure their deal anyway they wished, and that any agreements that Smartmatic held with CFIUS were by and large outside the scope of the claims that SVS was making against either of the two parties.

Indeed, if the terms of the Hart/Smartmatic deal are found to raise new CFIUS questions, those matters would (theoretically) be handled through the federal government oversight process. Maloney, who was instrumental in passing new CFIUS reforms after the Smartmatic/Sequoia issue came to light, tells The BRAD BLOG, after we requested comment on these new revelations, that she is "confident the strengthened [CFIUS] review process will bring to light any potential national security concerns with this case and any others."

Hart spokesperson Peter Lichtenheld responded to our request for comment on several items related to this story by emailing that he "cannot comment on any of this at this time."

Sequoia spokesperson and stock holder, Michelle Shafer, who, like Ed Smith, also worked at Hart herself for nearly a decade before joining Sequoia, also currently serves as Chairperson of the Election Technology Council (ETC), an election industry trade group formed by a consortium of major e-voting vendors under the under the umbrella of the Information Technology Association of America (ITAA). Shafer, so far, has not respond to our request for comment on a number of issues raised in this report.

Additional research for this article by John Gideon.

CORRECTION: The originally published version of the article above had identified former Asst. Defense Sec. Lawrence J. Korb as one of the shareholders of SVS. In fact, the former Reagan Administration official is not the same Lawrence W. Korb who holds stock in SVS. We've removed the short paragraph mentioning Korb, which had also referenced SVS shareholder Waldeep Singh, who was correctly identified as an official in the administration of former CA Sec. of State Bill Jones. The BRAD BLOG regrets the error.

UPDATE 4/20/08: Sequoia confirms buyout attempt in light of this story, warns employees to not speak to media. Full details now here...

UPDATE 4/25/08: CEO Blaine admits in "confidential" company-wide phone call that Smartmatic, not Sequoia, controls the Intellectual Property (IP) rights for Sequoia's voting machines. Details now here...

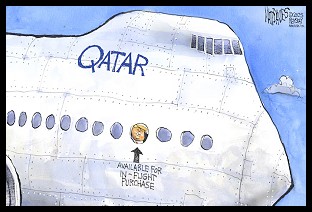

Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World:

Mad World: 'Green News Report' 5/15/25

'Green News Report' 5/15/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25

'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25 'Green News Report' 5/13/25

'Green News Report' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Sunday 'New Guy, Old Guy' Toons

Sunday 'New Guy, Old Guy' Toons Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 'Green News Report' 5/8/25

'Green News Report' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25

100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL