On today's BradCast, Congress is in recess and the President may be on a 17-day "working vacation", but that doesn't seem to have kept Donald Trump from his usual barrage of lies to the American people. And, speaking of lies, just like the oil and coal companies, a new report finds the nation's utilities companies learned decades ago about the threat of global warming...before deciding to launch a PR campaign to cover it up. [Audio link to show is posted below.]

On today's BradCast, Congress is in recess and the President may be on a 17-day "working vacation", but that doesn't seem to have kept Donald Trump from his usual barrage of lies to the American people. And, speaking of lies, just like the oil and coal companies, a new report finds the nation's utilities companies learned decades ago about the threat of global warming...before deciding to launch a PR campaign to cover it up. [Audio link to show is posted below.]

First up today: Trump's misleading claim that a new immigration proposal he is supporting will bar legal immigrants from obtaining various public welfare benefits for five years after entering the U.S. Which, by the way, is already federal law, even if Trump either doesn't appear know it, or is simply choosing to lie about it. Trump's new proposal, however, is even crueler, as we discuss today.

Also, not discussed by Trump (and barely noticed by much of the corporate media): the weekend bombing of an Islamic mosque in Minnesota. And, also today: Emails obtained from the USDA reveal that employees at the federal agency were instructed to avoid the use of phases such as "climate change" after Trump took office, even when dealing with farming issues that are directly affected by climate change. That on the heels of Trump's nominee for the top science position at USDA, a non-scientist and denialist rightwing talk radio host, having described progressives as "race traitors".

Then, speaking of denialism, we're joined by DAVE ANDERSON of the Energy and Policy Institute on his new report documenting how the nation's utilities companies learned of the threat of global warming decades ago --- at least as long ago as 1968 --- before purposely choosing to mislead customers and the public about it so they could continue to profit from the burning of cheap, dirty coal.

"What they wanted to do was put the science on ice, you could say," Anderson tells me. In fact, they even created an astroturf outfit calling itself the "Information Council on the Environment" (ICE) in order to mislead the public with a series of magazine and radio ads meant to dispute the science of global warming. (See the "Chicken Little" ad in the graphic above.)

The newly reported revelations echo those recently discovered about Exxon and other fossil fuel companies which confirmed the science of climate change and dangers of burning carbon decades ago, before spending millions on climate change denialism in hopes of confusing and misleading both the public and their own investors.

"Earlier reports had been commissioned by President Lyndon Johnson, and before him, John F. Kennedy, that also touched upon the possible threat posed by CO2 emissions," Anderson says. "Even way back then, government was starting to get involved in climate research, and it seems like utilities were involved in the creation of those reports, and probably knew even earlier than 1968 that this could be a problem."

"In 1971," he documents, "they saw this as a really long term potential issue for power generation. ... Once it exploded onto the front pages of the New York Times, after some pretty interesting Congressional testimony in 1988, it seems like the utilities kind of freaked out. They started looking for people who could spread the message that climate science wasn't legit, and even a hoax."

"One of the interesting documents that we found was Congressional testimony by an expert from the Electric Power Research Institute, which is the utility industry's own R&D shop," Anderson says. "He actually warned Congress that if climate change proved to be a major concern, it could actually make the burning of fossil fuels essentially unacceptable. That was a pretty bold statement in 1977."

A number of large oil and coal companies have recently been sued for their denialism, in cases which mirror those against Big Tobacco in the 90s. (Which makes sense, since Big Fossil Fuel employed many of the same "experts" and attorneys who spent decades misleading the public about the harms of smoking.) Will the utilities companies, some of which are still lying to the public about this, face similar accountability soon? We discuss that and much more today.

Finally today, another Fox 'News' star is suspended amidst new allegations that he sent unwanted genital photos to colleagues. Are we starting to see a pattern here yet?...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

Sunday 'Zero Day' Toons

Sunday 'Zero Day' Toons Soc. Sec. Expert Warns DOGE Hastening Collapse, Privati-zation: 'BradCast' 4/10/2025

Soc. Sec. Expert Warns DOGE Hastening Collapse, Privati-zation: 'BradCast' 4/10/2025 'Green News Report' 4/10/25

'Green News Report' 4/10/25

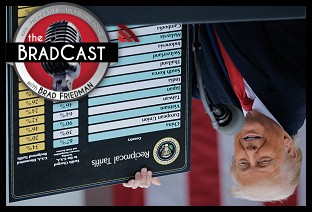

Trump Blinks, Chaos Reigns, Markets Spike as Many Tariffs Remain Despite 90-Day 'Pause': 'BradCast' 4/9/25

Trump Blinks, Chaos Reigns, Markets Spike as Many Tariffs Remain Despite 90-Day 'Pause': 'BradCast' 4/9/25 SCOTUS Deportation Ruling Grimmer Than First Appears: 'BradCast' 4/8/25

SCOTUS Deportation Ruling Grimmer Than First Appears: 'BradCast' 4/8/25 'Green News Report' 4/8/25

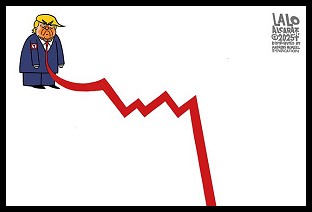

'Green News Report' 4/8/25 Cliff Diving with Donald: 'BradCast' 4/7/25

Cliff Diving with Donald: 'BradCast' 4/7/25 Sunday 'Don't Look Down' Toons

Sunday 'Don't Look Down' Toons 'Green News Report' 4/3/25

'Green News Report' 4/3/25 'Mob Boss' Trump's Trade Sanctions Tank U.S., World Markets: 'BradCast' 4/3/25

'Mob Boss' Trump's Trade Sanctions Tank U.S., World Markets: 'BradCast' 4/3/25 Crawford Landslide in WI; Booker Makes History in U.S. Senate: 'BradCast' 4/2/25

Crawford Landslide in WI; Booker Makes History in U.S. Senate: 'BradCast' 4/2/25 Judge Ends Challenge to GA's Unverifiable, Insecure Vote System: 'BradCast' 4/1/25

Judge Ends Challenge to GA's Unverifiable, Insecure Vote System: 'BradCast' 4/1/25 Bad Court, Election News for Trump is Good News for U.S.: 'BradCast' 3/31

Bad Court, Election News for Trump is Good News for U.S.: 'BradCast' 3/31 Vets Push Back at Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25

Vets Push Back at Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25 Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26 'Emptywheel': Trump NatSec Team Should 'Resign in Disgrace': 'BradCast' 3/25/25

'Emptywheel': Trump NatSec Team Should 'Resign in Disgrace': 'BradCast' 3/25/25 USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25

USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL

On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  On today's

On today's  "I worry that what we have here in Georgia is the Titanic Effect," Georgia Tech Computer Scientist Richard DeMillo

"I worry that what we have here in Georgia is the Titanic Effect," Georgia Tech Computer Scientist Richard DeMillo  On today's

On today's