In a white paper issued in March, the California Federation of Labor (CFL) called for reforms to "undo the damage" wrought by SB 899, a California GOP-sponsored workers' compensation "reform" bill that was touted by AP in April 2004 as “one of the biggest victories of [then Gov. Arnold Schwarzenegger's] new political career".

In a white paper issued in March, the California Federation of Labor (CFL) called for reforms to "undo the damage" wrought by SB 899, a California GOP-sponsored workers' compensation "reform" bill that was touted by AP in April 2004 as “one of the biggest victories of [then Gov. Arnold Schwarzenegger's] new political career".

The celluloid action hero insisted the "reform" was necessary to curtail the spiraling costs of workers' compensation insurance for California employers.

As the CFL white paper correctly notes, the rationale behind Schwarzenegger's workers' compensation "reform" legislation was largely a scam. Like so many other investment schemes, the source of spiraling workers' compensation costs can be found in the 1993 deregulation of the insurance industry and a subsequent burst of a workers' compensation insurance investment bubble. Yet, Schwarzenegger refused to include limits on the rates insurance companies could charge employers as part of his "reform" package.

Despite an initial drop in the cost of workers' compensation insurance in California, costs have again climbed --- so much so that, according to a May 15 article that appeared in the Ventura County Star, "the Port of Hueneme is preparing to pay 120 percent more for workers' compensation insurance" in the coming year.

Contrary to the philandering actor-turned-Governor's claims that the savings would not be extracted from the backs of injured workers, SB 899 contained drastic reductions in benefits --- so drastic that, in a 2004 letter published by Los Angeles Times, after pointing out that I had represented litigants in workers' compensation proceedings since 1979 and was regarded by my peers as an exceptionally effective litigator, I warned California employees that if they were injured on the job, God help them because I was not sure I could.

Whatever efforts are now made to "undo the damage" wrought by SB 899, they will come too late for my client, Charles Romano. Thanks to the law's massive reduction in prohibitive penalties that could have been assessed for bad faith refusals to furnish vital, life-sustaining medical treatment --- the new penalties are a drop-in-the-bucket compared to what it had cost to keep him alive --- Charles is no longer with us...

There are no 'minor' surgeries

At the time I first agreed to represent Charles there was no way either he or I could have anticipated the tragic events that would ensue. He had sustained what appeared to be a rather modest injury to his left shoulder and neck while employed by Ralph's Grocery Co. on Dec. 20, 2003. (Unlike smaller employers, Ralph's, which is a division of the nation's largest supermarket chain, Kroger Co., was not directly affected by the increase in workers' compensation premiums that the Schwarzenegger "reform" claimed to address. Ralph's was, and is, permissibly self-insured against workers' compensation liability.)

On Aug. 20, 2005 Charles underwent what appeared to be routine surgery in the form of a left shoulder arthroscopy. Post-surgery, his doctor, not noticing any irregularities upon visual inspection, prescribed physical therapy, a course of which began in October 2005.

After a brief period of modest improvement, Charles experienced increasing pain and stiffness --- to the point that he couldn't raise his arm above shoulder level and had to sleep in a chair. When he saw his therapist, she noted pustules at the surgery site that were exquisitely painful to the touch. The therapist failed to inform Charles of a need to immediately see his physician.

During the next few days, Charles began running a fever. He was driven to Ventura County Medical Center (VCMC) by a friend, losing consciousness on the way there. When he again awoke, inside the hospital's intensive care unit, to his horror, Charles learned that he had acquired methicillin-resistant staphylococcus aureas (the extraordinarily aggressive antibiotic-resistant staph infection known as MRSA). Worse, Charles learned that he had come dangerously close to dying. The blood-borne MRSA caused both renal and pulmonary failures as well as heart problems and retinal hemorrhages. The MRSA also produced a lesion on Charles' 8th cervical vertebrae that resulted in a permanent and complete paralysis from the level of his chest to his toes. He was left with some residual function in his hands, severe pain in his neck, but no sensation whatsoever in his torso and lower extremities.

When I asked one of Charles' physicians, Joel Rosen, M.D., a specialist in physical medicine and rehabilitation at Northridge Hospital, what was meant by "complete," he responded by noting that a surgeon could amputate one of Charles' legs without an anesthetic, and Charles would not feel a thing.

From Nov. 30, 2005 to the date of his death, May 2, 2008, Charles was essentially bedridden, incapable of being transported without the assistance of at least two individuals, the use of a special, motorized wheelchair with a tilt and a wheelchair accessible van. His condition was such that he required access to a broad array of physicians, including specialists in physical medicine and rehabilitation, infectious disease, cardiologists, orthopedists, neurologists, pulmonary specialists, a podiatrist and psychiatrists. His paralysis was so extensive that he lacked complete muscle control over his breathing. He required the use of a BiPAP to insure that he did not stop breathing altogether in his sleep.

Legal struggle to survive

Although its position was at odds with the opinions of multiple treating and evaluation physicians, the employer, relying upon its own evaluating physician, disputed the causal relationship between the surgery and the MRSA infection. Since the conditions Charles suffered included MRSA-related pneumonia, the employer's internist postulated that Charles could have acquired an airborne MRSA.

A hospital study appended to my evaluating internist's report revealed that MRSA infections occur in the community at large, but they are far more frequent in a hospital setting. Of all areas within the hospital, the report noted, the highest rate of MRSA infections occurred in orthopedic surgery. And, of course, there were those pustules at the surgery site, which, as found by the VCMC physicians, contained high concentrations of MRSA.

During the time that this issue was litigated, Medi-Cal stepped up to the plate, covering Charles' lengthy hospitalization at VCMC (Nov. 30, 2005 to July 1, 2006) during which medical bills in excess of $1.1 million were generated.

Upon his release from VCMC, Charles self-procured treatment at an attendant care facility, Country Villa Oxnard Manor. The inadequacy of treatment offered by that facility was underscored by the testimony of Charles' friend, who, when responding to an emergency call from Charles, discovered that his Foley catheter bag was filled with blood and that Country Villa personnel had refused to call 911.

Transported by ambulance, Charles was twice taken to St John's Regional Medical Center in Oxnard, once in September 2006 and a second time in November 2006, shortly after a Workers' Compensation Judge issued an Oct. 26, 2006 amended findings and award, expressly finding that the MRSA infection and its horrific, life-threatening sequelae were industrially related. The court ruled that the employer was legally obligated to furnish medical care to cure or relieve the above conditions and to pay or adjust the bills for all of the outstanding treatment.

Extraordinary bad faith

Despite the award and despite (or perhaps because of) expert testimony that a delay in authorizing treatment of even seemingly minor infections could produce end organ failure and death, the employer, operating through its claims administrator, flat out refused to meet its affirmative obligation to ascertain and provide vital, life-sustaining care. Amongst the most disturbing actions was its refusal to authorize a BiPAP without which the administrator knew that Charles could stop breathing and die.

The claims administrator relented only after Dr. Rosen refused to discharge Charles to an outpatient nursing facility, Care Meridian, until the BiPAP and other vital, life-sustaining equipment was furnished. Where the cost of Charles' in-patient care at Northridge Hospital was approximately $24,000/day, the outpatient facility cost was $25,000/month.

Dr. Rosen made it clear that Charles would require immediate access to multiple physicians. At Care Meridian, Charles had access to a single in-house physician, Dr. Feiss, who visited one time per week. The claims administrator failed to take steps to insure transportation and access to vital, life-sustaining, multi-modality care while at Care Meridian. Instead, on multiple occasions, the claims administrator refused to honor Dr. Feiss' prescriptions for referrals to other physicians, for diagnostic testing and for the appointment of a nurse case manager. When Charles was forced to resort to his own devices via the purchase of a wheelchair accessible van, the claims administrator refused to pay for it.

"We have rarely encountered a case in which a defendant has exhibited such blithe disregard for its legal and ethical obligation to provide medical care to a critically injured worker," a unanimous three-commissioner panel of the California Workers' Compensation Appeals Board wrote in their April 16, 2013 decision [PDF] in The Romano Trust vs. The Kroger Co.. "Sedgwick CMS, acting as claims administrator for The Kroger Company/Ralph's Grocery Company, demonstrated a callous indifference to the consequences of its delays, inaction, and outright neglect."

That callous indifference entailed not only unreasonable refusals and delays in authorizing treatment but refusals to pay for authorized treatment --- something which, according to one witness, was so stressful for Charles that he protested in the only way open to him --- by refusing medications and food. "They want me to die," Charles told the witness. "So I'll die."

Dr. Rosen's warnings about the catastrophic consequences of lack of access to appropriate care came to fruition. While at Care Meridian, Charles' health deteriorated to the point that he became gravely ill and had to be transferred to Community Memorial Hospital in Ventura. As revealed by the April 16, 2013 decision, the claims administrator then sought to "escape liability through a see-no-evil, hear-no-evil passive approach to claims administration in a catastrophic, life-and-death case." In essence, the claims administrator pretended not to know that Charles had been hospitalized for the very conditions that the Worker's Compensation Appeals Board had determined to be industrially-related.

SB 899 and the economics of bad faith

Even before passage of the 2004 "reform," injured employees were prevented from suing their employers or their carriers for a bad faith refusal to provide medical care. The Workers’ Compensation Act provides the "exclusive remedy" injured employees have against their employers and their insurance carriers. The "exclusive remedy" provisions were a product of a century-old bargain in which the Golden State's legislature created a no fault system in which employees would be compensated for work related injuries in exchange for a loss of the right to sue their employer in civil courts.

Under pre-SB 899 law, the remedy when an employer or carrier unreasonably delayed or refused to provide a benefit was a penalty equal to 10% of the value of the entire class of benefits. Thus, under the old system, a bad faith refusal to authorize the BiPAP would entail a penalty equal to 10% of the value of all expenditures for medical treatment necessary to cure or relieve the injury over the life of the file.

Under the old system, the size of the unreasonable delay penalty was proportional to the severity of the injury. A 10% penalty for an unreasonable refusal to furnish medical treatment in a finger injury case would be negligible. In a catastrophic case, where the value of medical care might exceed $10 million, a 10% penalty against medical care could be quite substantial. Moreover, under the old law, each separate and distinct act of unreasonable delay carried with it an additional 10% penalty. Here, the court found that there were eleven (11) separate and distinct instances in which the claims administrator unreasonably delayed or refused to provide vital medical care.

Add up eleven 10% penalties against a $10 million life time medical exposure, and you're suddenly talking real money. Thus, the old system provided a direct financial incentive for the employer to insure that a catastrophically injured employee promptly receives vital, life-sustaining care.

All that changed with the adoption of SB 899. Now the penalty entails a maximum of 25% of the amount of the unreasonably delayed item, not to exceed $10,000 --- a penalty that is negligible when measured against the perverse economic incentive that exists where death would put an end to the employer laying out some $24,000 for every day Charles Romano survived inside a hospital.

Take the BiPAP, which was vital to Charles' survival. That item costs between $1,600 and $2,000. Under SB 899, the maximum penalty that can be imposed upon the employer for a bad faith refusal to authorize this vital, life-sustaining device would be $500.

While, as revealed by the three-member panel decision, the level of claims administrator bad faith and callous disregard for the life of a gravely ill, injured employee was extraordinary, perhaps even criminal, one has to question whether it would have occurred if the employer had been faced with the prospect of prohibitively expensive penalties that existed under the old system.

By eliminating penalties as a meaningful deterrent, the Schwarzenegger "reform" of the California Workers' Compensation Act altered the economics and facilitated a bad faith course of conduct that, in all probability, hastened the death of Charles Romano.

Democrats share blame

What occurred in the California state legislature in April of 2004 has all too often become a hallmark of gutless Democratic Party "leaders" in the face of an effective, right wing propaganda blitz. In this case, a slick, well-funded propaganda blitz, coupled with the popularity of an actor-turned-politician led to the recall of former Gov. Gray Davis (D).

Amongst those who funded that well-orchestrated campaign was one Darrell Issa (R-CA) --- a Congressman with a past criminal record who now spends his time spearheading an attempt to manufacture a "scandal" through his endless investigation of what took place in the aftermath of the tragic assault on the consulate in Benghazi. Issa, who is the richest member of Congress, donated $1.7 million of his own money towards the successful recall campaign, while Schwarzenegger took dead aim at the California workers' compensation system during the campaign.

The level of propaganda was so pervasive that, by late 2004, the party of the one percent (aka the GOP) floated the idea of amending the U.S. Constitution so that the foreign born movie star and steroid enhanced, body builder could run for President.

Cowering in the face of Schwarzenegger's manufactured popularity, CA Democratic "leaders" simply abandoned their posts and the injured workers who depended upon them. Instead of displaying courageous leadership by challenging the efficacy of the so-called workers' compensation "reform," the bill was passed (77-3 in the Assembly; 33-3 in the Senate) sans anything resembling due diligence.

It would take another year before California voters would come to realize that Emperor Schwarzenegger had no clothes. On Nov. 9, 2005 California voters delivered a "stinging rebuke" to the Republican governor by defeating all four ballot measures he supported at the polls. That was good news for the nurses, firefighters and teachers who had opposed those measures, but it came too late for injured workers, like Charles Romano, who was left to needlessly suffer and die.

Bad Court and Election News for Trump is Good News for America: 'BradCast' 3/31/25

Bad Court and Election News for Trump is Good News for America: 'BradCast' 3/31/25 Sunday 'Great Start!' Toons

Sunday 'Great Start!' Toons Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25

Vets Push Back at Trump, Musk Plan to Slash Health Care, 80K V.A. Jobs: 'BradCast' 3/27/25 'Green News Report' 3/27/25

'Green News Report' 3/27/25

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26

Signal Scandal Worsens for Trump, GOP; Big Dem Election Wins in PA: 'BradCast' 3/26 'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25

'Emptywheel' on Why Trump NatSec Team Should 'Resign in Disgrace' After Signal Chat Debacle: 'BradCast' 3/25/25 'Green News Report' 3/25/25

'Green News Report' 3/25/25 USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25

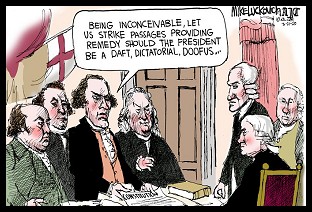

USPS 'Belongs to the People, Not the Billionaires': 'BradCast' 3/24/25 Sunday 'Suddenly Conceivable' Toons

Sunday 'Suddenly Conceivable' Toons 'Green News Report' 3/20/25

'Green News Report' 3/20/25 We're ALL Voice of America Now: 'BradCast' 3/20/25

We're ALL Voice of America Now: 'BradCast' 3/20/25 What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25

What Trump's 'Timber Production Expansion' Means (and Costs): 'BradCast' 3/19/25 Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25

Courts Largely Holding Against Trump, Musk Lawlessness: 'BradCast' 3/18/25 Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25

Chief VOA Reporter on Outlet Falling Silent First Time Since 1942: 'BradCast' 3/17/25 Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25

Trump EPA Unveils Plans to Endanger, Sicken Americans: 'BradCast' 3/13/25 Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25

Trump Nixed Enforce-ment Against 100 Corp. Lawbreakers: 'BradCast' 3/12/25 Bad Day for 'Strongmen': 'BradCast' 3/11

Bad Day for 'Strongmen': 'BradCast' 3/11 WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

WI Election Could Flip Supreme Court Control, Musk Jumps In: 'BradCast' 3/10

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL