READER COMMENTS ON

"Can Ordinary Citizens Fight Wall Street?"

(16 Responses so far...)

COMMENT #1 [Permalink]

...

Jon in Iowa

said on 1/7/2010 @ 11:44 am PT...

I'd encourage everyone to get your money out of Wells Fargo before Wells Fargo gets your money outright. They're twisted pricks with a fee fetish.

COMMENT #2 [Permalink]

...

Shortbus

said on 1/7/2010 @ 12:29 pm PT...

I moved out of banking years ago when the mergers began and joined a credit union.

3 car loans and a home mortgage later, I couldn't be happier

COMMENT #3 [Permalink]

...

NYCartist

said on 1/7/2010 @ 2:27 pm PT...

The trascript is online at DemocracyNow for people who have hearing disabilities or are deaf:

www.democracynow.org

Ques.:would community bank include the labor bank,

Amalgamated Bank in NYC? Dem.Now has also had

coverage of the dispute over ownership of the bank, between the original union and the break away group. The customer service is wonderful.

COMMENT #4 [Permalink]

...

Move My Money

said on 1/7/2010 @ 3:12 pm PT...

COMMENT #5 [Permalink]

...

Agent 99

said on 1/7/2010 @ 3:15 pm PT...

I have moved my [no] money to a decent community bank to get away from these evil capitalist banks more times in my life than I care to contemplate. Each and every time the great bank I moved my money to was eaten up by the evil capitalists and I ended up fuming and having to find another place for my money.

Move yer money to yer mattress, right next to yer shotgun.

COMMENT #6 [Permalink]

...

Ernest A. Canning

said on 1/7/2010 @ 3:31 pm PT...

Agent 99 said

Move yer money to yer mattress, right next to yer shotgun.

____________

Hey 99, maybe we should change your handle to Ma Barker

COMMENT #7 [Permalink]

...

Agent 99

said on 1/7/2010 @ 3:44 pm PT...

COMMENT #8 [Permalink]

...

Dave Werth

said on 1/7/2010 @ 10:41 pm PT...

99, I recommend you find yourself a credit union. I've been with mine for over a decade.

COMMENT #9 [Permalink]

...

BlueHawk

said on 1/8/2010 @ 1:42 pm PT...

COMMENT #10 [Permalink]

...

jack

said on 1/9/2010 @ 3:00 pm PT...

This is a fine idea, as long as it is kept in perspective. This is not the way the world or the system changes. "Be the change you desire" is neither effective or a quote from Gandhi (http://www.gandhitopia.org/forum/topics/a-gandhi-quote).

Change is made through mass uprisings, mass organizing and political pressure. Power has to be marshaled.

We must never be sidestepped into a being-impotent-but-feeling-good-about-it state.

COMMENT #11 [Permalink]

...

BlueHawk

said on 1/9/2010 @ 5:12 pm PT...

Jack @10

Mass uprisings don't happen until the masses are enlightened. Teabaggers are uprising, but they're not enlightened theirs is just an anger uprising manufactered and exploited by the right wing.

"Be the change" whether Gandhi originated it or not; is how TRUE, Revolutionary changes occur. It's not a marshalled force as much as it's demonstrated almost person to person and then it inundates society like a tsunami.

Being the change we want to see...entails we becoming just as a people first...we adopt peace as our only goal...we practice and demand economic justice for all...

Civil disobedience requires some "Be the change" mojo....civil disobedience entails some personal investment of our own security...and us being able to uphold each other until our voices are heard and heeded.

Civil disbedience like...refusing to pay income taxes until we're out of Iraq and Afghanistan, Wall Street and the banks be held accountible....That's where the bulk of our tax dollars are going...to the Military Industrial Complex and Wall Street Bankers. Let's see how long they can operate when people en masse refuse to pay income taxes.

To be that change people have to be enightened ...not marshalled or herded...we have a marshalled and herded public now. They've been marshalled and herded with lies....being the change means having the guts to speak and ACT truth to power.

Gandhi led a mass of Indians to the sea to make salt in order to circumvent the British salt tax...in that simple action he threw off the British empire from India...

Gandhi didn't marshall anything...he simply walked out his enlightenment...a nation followed and Britain lost control.

Does this nation have the guts ?

The guts to lead...or follow someone doing a simple act of civil disobedience simply because it's the right thing to do.

For the record Gandhi wasn't trying to "defeat" Britain...he was disobeying a stupid law that taxed something that was abundantly available for free...In that disobedience India was freed from British colonization.

Do we have the guts...?

COMMENT #12 [Permalink]

...

Ernest A. Canning

said on 1/9/2010 @ 5:35 pm PT...

Jack, this is the first time I read anything that questioned the attribution of the Ghandi quote. You may be right on that, but you are not right when you say "this is not the way the world or the system changes."

As Howard Zinn observed in A Power Governments Cannot Suppress:

There is a basic weakness in governments, however massive their armies, however vast their wealth, however they control images and information, because their power depends on the obedience of citizens, of soldiers, of civil servants, of journalists and writers and teachers and artists. When the citizens begin to suspect they have been deceived and withdraw their support, government loses its legitimacy and its power."

Recall the effect of a minority of homes going into foreclosure on the big banks.

Johnson's appeal is to the 97% of Americans who do not benefit from the Wall Street schemes. If that 97% were to transfer their money from the big four to local Community Banks, the result would bring the big six to their knees.

True power is in the hands of the people. What is lacking is knowledge on their part of the scope of that power.

COMMENT #13 [Permalink]

...

BlueHawk

said on 1/9/2010 @ 5:45 pm PT...

A Tax revolt...

If we as a nation stopped paying our income taxes, we could affect massive changes.

Those that are employed change your withholding to 0, those that are self employed stop paying period.

We as a people would have to able to support those who the system comes down on...their families and legal expenses etc. But the system can't process or prosecute 50 million people for income tax evasion.

Up to 75% of our income tax dollars go directly to military industrialists and to the federal reserve who are raping the nation. We could bring those systems into compliance with the people's wishes by NOT SUPPORTING THEM with our money anymore...

They're leeches enriching themselves on our labor.

This kind of action won't be easy or pretty...We as a people would have to take responsibility for our fellow citizens, we would have to find commonground and keep our minds fixated on the justice we're meeting out to the system that has used and abused us for decades.

We need some steel in our resolve...

As I said earlier...do we have the friggin' guts?!?

COMMENT #14 [Permalink]

...

Sophia

said on 1/11/2010 @ 4:30 pm PT...

I propose we create a little social movement: create a flyer w/a catchy title like: why you should break up with your bankster and give people actions steps w/local credit unions to take their money to. It's a start! We gotta start SOMEWHERE!

COMMENT #15 [Permalink]

...

BlueHawk

said on 1/12/2010 @ 6:40 am PT...

"Just slip out the back Jack, make new plan Stan, no need to be coy Roy....just listen to me...Hop on the bus Gus you don't need to discuss much, just drop off the key Lee and get yourself free"

I agree Sophia...it's a start...I like the idea...

COMMENT #16 [Permalink]

...

renzoku bb.com

said on 1/13/2010 @ 9:36 pm PT...

when we say we, we might do better to be realistic in terms of how limited that word is defined. Serious change requires the we to be much bigger than the we that we can muster here. We (here) do not control the media that we(the entire populous)are educated or rather miseducated and thusly manipulated controlled by.

This moveyourmoney thang is a case in point. Thom Hartmann clicked on it. The screen came back that there were no local banks for him but for a mere $1000, they'd gladly send him a list of banks he could switch to. I clicked on it for my zip code and it sent me to TCF National, Woodforest National and Marquette Natnl. These are not small banks. TCF is a rightwingnut run bank gobbler out of Minnesota with a nasty history and branches in a huge midwest grocery store chain. Woodforest is the same out of Texas with a branch in every Walmart. At some point, we gotta acknowledge where and when we're being beaten with a stick.

So now we're searching out a local credit union and working to find out which are honest and trustworthy. Good luck to all.

'A World of Tyrants,

'A World of Tyrants, 'Green News Report' 5/22/25

'Green News Report' 5/22/25

'Dangerous Times': Climate Scientist Warns Trump 'Censorship' Endangering Nat'l Security: 'BradCast' 5/21/25

'Dangerous Times': Climate Scientist Warns Trump 'Censorship' Endangering Nat'l Security: 'BradCast' 5/21/25 And Then They Came for Members of Congress...: 'BradCast' 5/20/25

And Then They Came for Members of Congress...: 'BradCast' 5/20/25 'Green News Report' 5/20/25

'Green News Report' 5/20/25 Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25

Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25 Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World:

Mad World: 'Green News Report' 5/15/25

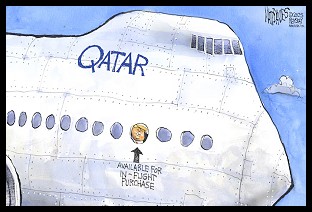

'Green News Report' 5/15/25 Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25

'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25 'Green News Report' 5/13/25

'Green News Report' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Sunday 'New Guy, Old Guy' Toons

Sunday 'New Guy, Old Guy' Toons Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 'Green News Report' 5/8/25

'Green News Report' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25

100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL