READER COMMENTS ON

"Rightwing Wall Street Blame Game Misfires at the Community Reinvestment Act"

(10 Responses so far...)

COMMENT #1 [Permalink]

...

markg8

said on 10/5/2008 @ 11:58 am PT...

I've been countering this crap at wingnut blogs all week. They're trying to blame Fannie and Freddie too and I have no doubt that they'll be quoting that NYT piece out today with Sen. Jack Reed pressuring Freddie's manager to buy more low income loans back in 2004. I also have no doubt the reporter found 5 Repub senators saying the same thing at that hearing but chose not to use it. Isn't that what the Republican "ownership society" was all about?

Some idiot at US News wrote an op-ed Friday suggesting McCain take it to Obama about Fannie and Freddie. About 100 wingnuts agreed whining McCain is being much too nice and has to attack, attack, attack! The problem for McCain is that he has 19 campaign advisers that have lobbied for Fannie and Freddie including his manager Rick Davis who only stopped receiving his $15,000 a mth from Freddie I think it is in August when the "communists" in the Bush adminstration nationalized it.

It's fun to write this stuff and watch their heads explode. You can almost see the little little starbursts coming through the screen and ricocheting around the living room. ;-}

COMMENT #2 [Permalink]

...

tbrown

said on 10/5/2008 @ 12:12 pm PT...

the meltdown has little to do with RACISM.The clear facts are that Fannie/Freddie had no real assests behind them and they continued on their mission of buying mortgages.Then lobbied and fought any oversight.This was done in 2003-2004.Just watch the C_SPAN tapes of those hearings where Congressmen like Maxine Waters,Barney Franks et al attack the AUDITOR(who is telling Congress that Fannie is 10.6 Billion in the red) and contend there is nothing wrong with Fannie/Freddie.

Your attempt to hide the above by raising a RACE isssue will lead us to not be able to FIX the problem.You should be ASHAMED

COMMENT #3 [Permalink]

...

tbrown

said on 10/5/2008 @ 12:27 pm PT...

One point for Brad to consider.It was 2004 when the Auditor made his findings to Congress showing the 10.6 billion lossess.In Jan 2005 Franklin Raines is forced to step down. (over the issues raised in the Audit)It is from this point on that Obama starts receiving his campaign contributions from Fannie/Freddie (appox 140,000).Oh yes Obama did write a letter to the Sec of Treas in late 2007 about compensation and accting issues.Sounds like an extension of Voting PRESENT or "if you need me just call".What an absolute JOKE

COMMENT #4 [Permalink]

...

Agent 99

said on 10/5/2008 @ 1:07 pm PT...

Just take out two hours and watch this movie. It will make a lot of things going on in the current "meltdown" clearer to you.

COMMENT #5 [Permalink]

...

Ancient

said on 10/5/2008 @ 1:59 pm PT...

Thanks Des, for carrying on in the war against ignorance...the only war I'll fight in!

COMMENT #6 [Permalink]

...

markg8

said on 10/5/2008 @ 2:07 pm PT...

"Then lobbied and fought any oversight." And all those lobbyists are now running McCain's campaign. Davis himself headed the Homeownership Alliance, the lobbying group formed by Fannie and Freddie in 2000 to fend off any oversight. From 2000 to 2005 his company received $35,000 a month for that work. Then when the FMs closed HA in 2005 Davis asked for and received $15,000 a month personally for nothing more than his access to McCain.

The people running McCain's campaign successfully fought off efforts to stop Fannie and Freddie from doing the same stupid unregulated deals as the now dead, absorbed, or floundering big five investment banks on Wall St.

Fannie and Freddie have lots of assets but like most of Wall St. so much of it is unsellable right now. Just like my deceased parents house my siblings and I inherited this spring. It's worth $400,000 but if no prospective buyers can get a mortgage in a frozen credit market we can't sell it anymore than Fannie can sell mortgage backed securities even if the mortgages backing them are 96% sound.

COMMENT #7 [Permalink]

...

DES

said on 10/5/2008 @ 6:24 pm PT...

TBrown, it helps to read the post before commenting; you are talking about mismanagement and debunked rumors relating to Fannie Mae and Freddie Mac, not the Community Reinvestment Act that is the subject of this post.

Secondly, the factual evidence, as excerpted in the post above and available elsewhere for anyone who chooses to look, shows that the CRA is not at fault in the meltdown on Wall St.

This industry report released in July 2008 shows that the majority of subprime-rate loans originated in 2006 were made to non-Hispanic Whites and upper-income borrowers.

To what would you ascribe the reasoning behind this demonstrably false accusation from the rightwing media, pointing to the CRA, if not thinly-veiled racism? Seriously, I'd like to know.

Thirdly, whether in reference to Fannie, Freddie, the CRA, or any other entity involved in the banking system, if you can find ONE CASE in which the lenders were FORCED by the law to give a bad loan that they otherwise would not have made, forced by law or "pressure" to endanger their own banks and their own jobs and ultimately the entire financial system, please by all means link to it here.

"Pressure" to increase investment in low-income and minority communities is simply not a plausible excuse for the lending industry to justify their utter abandonment of sound banking practices. The CRA is a convenient scapegoat.

COMMENT #8 [Permalink]

...

TEDEGER

said on 10/5/2008 @ 11:40 pm PT...

The culprit is plain GREED. Lots of lenders created that abominalion called the "Variable rate loan." Now, anyone with any sense KNOWS that a "Variable Rate" NEVER goes DOWN! People who could afford 5% and were making their payments watched as the interest rates doubled or worse, suddenly making the interest deadly. Had the lenders been willing to renegotiate much of the disaster could have been avoided, but the selfish greedy bastriches held out for loot, and lost it all. CRIME PAYS - but sometimes not very well.

COMMENT #9 [Permalink]

...

CLB

said on 10/6/2008 @ 2:01 pm PT...

The wingers have been targeting Obama through FM2 for months as an attack and dodge away from McCain's Keating involvements. And the notion that poor (black) folks who could not afford their loans are now looting taxpayers (like Reagan's non-existent welfare queens) is an attempt, as it was with Reagan, to fly in below overt attack levels.

COMMENT #10 [Permalink]

...

CambridgeKnitter

said on 10/9/2008 @ 7:24 pm PT...

Re Tedeger #8: Actually, variable rates have been known to go down. When I bought my house in 1984, all I could afford was a one year variable rate at 12-3/4% (this was the best rate available, even though I had good credit); fixed rates were over 13% at that time, and I just couldn't qualify at that rate. Every year my interest rate went down.

Until fairly recently, variable rate loans did have teaser rates, which were expected to go up. The most abusive ones were monthly variables, which went up the very next month after the closing, but the required payments only adjusted annually, creating negative amortization. With some of those, there was a cap on the amount by which the required payment could increase, with a provision for catching up with all of the negative amortization every five years. I'm guessing that could be really painful. When I used to be the lawyer closing these loans, I explained to the borrowers that, the way their loans were structured, if they only made the minimum monthly payments, they would owe more at the end of a year than they did at that moment.

These days, the variable rate mortgages I see have the opposite of teaser rates to start with. In other words, the initial rate is actually higher than it would be if you just added the margin (usually 2.75%) to the index (usually the one-year Treasury bill rate or sometimes the LIBOR). If conditions don't change, your rate will go down when it resets with one of these loans.

For what it's worth, based on my experience in the boom and bust of the late 1980s and early 1990s, with the accompanying foreclosures and bank failures all over the place, I predicted a similar meltdown when I saw the reappearance of negative amortization loans a few years ago. I was far too optimistic.

So-called "liar loans" are nothing new; we saw them back then, but we just called them no-doc loans. Even at the time I couldn't figure out why it would make any sense for a lender to agree not to verify any of the borrower's financial information as long as there was a 20% down payment if the lender then didn't confirm the actual existence of the down payment (sound at all familiar?). There was even a certain amount of securitization of various sorts of loans going on then as well (Twenty years ago I worked for a law firm that represented a well-known investment bank that went bankrupt a few years later, and I used to hear about securitization and tranches in the halls. Luckily, I never got closer to those deals than that.).

The differences now seem to be more a matter of degree than substance, as the mortgage industry has become much more a producer of "product", which is then sold, repackaged and divided up, so that the originator has no stake in whether the loan is actually paid back, creating what looks to me like giant institutional "liar loans". The no-doc loans of 20 years ago were also sold a lot of the time, but I don't believe they were repackaged and sliced up the way they are now, which made it easier back then to find someone to work things out with if the borrower got into trouble. It would be great to think that the financial industry and the government have finally learned their lesson, but I predict that greed and recklessness have become far too entrenched now for any New Year's resolutions to last much past January 2.

SCOTUS Ignores Own Prece-dents In Recent 'Emergency' Rulings: 'BradCast' 6/2/25

SCOTUS Ignores Own Prece-dents In Recent 'Emergency' Rulings: 'BradCast' 6/2/25 Sunday 'TACO Trump on Every Corner' Toons

Sunday 'TACO Trump on Every Corner' Toons Sunday 'Cutting Corners' Toons

Sunday 'Cutting Corners' Toons 'A World of Tyrants,

'A World of Tyrants, 'Green News Report' 5/22/25

'Green News Report' 5/22/25

Climate Scientist Warns Trump 'Censorship' Endangering NatSec: 'BradCast' 5/21/25

Climate Scientist Warns Trump 'Censorship' Endangering NatSec: 'BradCast' 5/21/25 And Then They Came for Members of Congress...: 'BradCast' 5/20/25

And Then They Came for Members of Congress...: 'BradCast' 5/20/25 'Green News Report' 5/20/25

'Green News Report' 5/20/25 Court Blocks Last Route for Voter Challenges Under VRA: 'BradCast' 5/19/25

Court Blocks Last Route for Voter Challenges Under VRA: 'BradCast' 5/19/25 Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World: 'BradCast' 5/15/2025

Mad World: 'BradCast' 5/15/2025 'Green News Report' 5/15/25

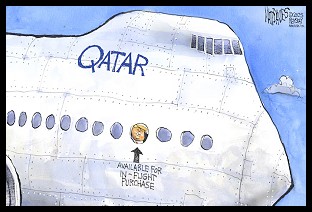

'Green News Report' 5/15/25 Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 GOP Proposes 'Deeply Evil' Cuts to Medicaid: 'BradCast' 5/13/25

GOP Proposes 'Deeply Evil' Cuts to Medicaid: 'BradCast' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL