Yesterday, nearly five years after President Barack Obama first assumed office, the U.S. Senate removed what has been described by some progressives as the "single largest obstacle to meaningful economic recovery" when it was finally allowed to vote for the confirmation of Rep. Mel Watt (D-NC) as the new Director of the Federal Housing Finance Agency (FHFA).

Yesterday, nearly five years after President Barack Obama first assumed office, the U.S. Senate removed what has been described by some progressives as the "single largest obstacle to meaningful economic recovery" when it was finally allowed to vote for the confirmation of Rep. Mel Watt (D-NC) as the new Director of the Federal Housing Finance Agency (FHFA).

In a vote allowed by a recent change to filibuster rules in the U.S. Senate, Watt will now replace Bush appointee Edward J. DeMarco, who was first appointed in 2008 and became the acting Director of the federal agency in 2009.

The FHFA oversees the government-sponsored mortgage giants, Fannie Mae and Freddie Mac, which collectively own 60% of all mortgages in the United States. The agency also oversees 12 Federal Home Loan Banks, which, according to the Washington Post, "serve as major sources of funding for hundreds of banks."

In a statement issued late yesterday, praising Watt's confirmation and chiding Senate Republicans for their obstructionism in holding up this and many other uncontroversial Presidential nominations, Rep. Xavier Becerra (D-CA), Chairman of the House Democratic Caucus, highlighted the importance of the FHFA's intended role in safe-guarding homeowners.

"Republicans in the U.S. Senate callously blocked the confirmation of the supremely qualified Congressman Mel Watt to be our nation's Director of the Federal Housing Finance Agency," Becerra said. "Today, by a bipartisan vote of 57 to 41, Rep. Watt is on his way to lead the FHFA as America's watchdog over the American Dream. What a difference a day makes when the Senate is free of the mischief of exploitive filibusters"...

The long-awaited up-or-down majority vote on Watt in the U.S. Senate comes in the wake of the change in the filibuster rules by the U.S. Senate Democratic majority just before the Thanksgiving recess last month. That change --- which ends the use of the filibuster for Executive appointees and non-Supreme Court jurists --- also allowed Democrats to approve two new D.C. Circuit Court of Appeal judges by a majority vote on Tuesday after Republicans had been blocking them for, literally, no reason at all other than they didn't want to allow this President of the United States to seat any of his own nominees to that court.

Watt finally replaces DeMarco, who, according to Nobel Prize winning economist Paul Krugman, has steadfastly defied the Obama Administration's effort to secure debt relief for the underwater homeowner victims of the 2008 collapse of the Wall Street casino, even after the U.S. Treasury Department offered to "pay up to 63 cents to the FHFA for every dollar of debt forgiven."

Sens. Richard Burr (R-NC) and Rob Portman (R-OH) joined Senate Democrats in voting to approve Watt's nomination.

University of Richmond Law Professor Carl Tobias offered up an historical context for the unprecedented Republican abuse of the filibuster that had kept DeMarco in office these past five years. He notes that if the Senate had not invoked what we described as the "democracy option," (others referred to it as the "nuclear option"), Watt would likely have been the first active member of Congress to be rejected for such a position since 1843.

But with confirmation comes responsibility. Watt, who avoided committing to a specific position on principal reduction when he testified before the Senate Banking Committee, will now have to both face that issue and decide whether he will reverse DeMarco's heavy-handed instruction to Fannie and Freddie, directing the two mortgage giants to "'limit, restrict or cease business activities' in any jurisdiction" that elects to use eminent domain as a debt relief tool.

Sunday 'Cutting Corners' Toons

Sunday 'Cutting Corners' Toons 'A World of Tyrants,

'A World of Tyrants, 'Green News Report' 5/22/25

'Green News Report' 5/22/25

'Dangerous Times': Climate Scientist Warns Trump 'Censorship' Endangering Nat'l Security: 'BradCast' 5/21/25

'Dangerous Times': Climate Scientist Warns Trump 'Censorship' Endangering Nat'l Security: 'BradCast' 5/21/25 And Then They Came for Members of Congress...: 'BradCast' 5/20/25

And Then They Came for Members of Congress...: 'BradCast' 5/20/25 'Green News Report' 5/20/25

'Green News Report' 5/20/25 Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25

Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25 Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World:

Mad World: 'Green News Report' 5/15/25

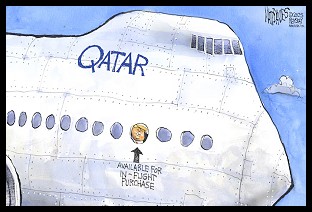

'Green News Report' 5/15/25 Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25

'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25 'Green News Report' 5/13/25

'Green News Report' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Sunday 'New Guy, Old Guy' Toons

Sunday 'New Guy, Old Guy' Toons Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 'Green News Report' 5/8/25

'Green News Report' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25

100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL