As Americans are being hoodwinked by a slick health insurance industry PR campaign, the time has come to carefully examine Medicare For All by separating myth from reality.

As Americans are being hoodwinked by a slick health insurance industry PR campaign, the time has come to carefully examine Medicare For All by separating myth from reality.

While morally repugnant, the privately-owned health insurance industry's deceptions are economically understandable. By the time Sen. Bernie Sanders (I-VT) introduced the Medicare for All Act of 2019 in the U.S. Senate --- two months after Rep. Pramila Jayapal (D-WA), co-chair of the Progressive Caucus, introduced H.R. 1384 - Medicare for All Act of 2019 in the House --- the industry realized that it faced an existential threat.

Medicare for All would create an entirely new single-payer healthcare system that, with limited exceptions (cosmetic surgery, home care nursing), would eliminate the need for anyone to purchase health insurance.

While the parasitic health insurance industry has faced-off against them in the past, single-payer advocates are better positioned to prevail in 2020 than at any time in the past 75 years. Sanders' single-payer healthcare legislation, S. 1129, was co-sponsored by 14 Senate Democrats. Those co-sponsors included several Presidential candidates --- Elizabeth Warren (D-MA), Kirsten Gillibrand (D-NY), Cory Booker (D-NJ) and Kamela Harris (D-CA). More than one-half of all Democrats in the House (112), co-sponsored Jayapal's version of the bill. Medicare for All is also supported by 63 national organizations. More importantly, a poll taken in 2018 --- prior to a barrage of pro-insurance industry propaganda --- found that Medicare for All was immensely popular. It was supported by a whopping 70% of all Americans, including 84% of Democrats and a mind-boggling 52% of Republicans.

With their very survival at stake, the health insurance profiteers, along with large hospitals and the pharmaceutical industry, created a new PR front-group, Partnership for America's Healthcare Future (PAHF), to wage their defensive. According to Wendell Potter, a former CIGNA executive and author of Deadly Spin: How PR is Killing Healthcare and Deceiving Americans (2011), PAHF is the industry's newest propaganda arm.

In addition to carefully-timed commercial advertising, PAHF acts in concert with industry-funded politicians and mainstream media pundits. Their goal is to erect an industry-friendly frame that serves to mask the blatant deficiencies of our inordinately expensive, yet woefully inefficient, subsidized "free market" healthcare system. This, as Julie Hollar of the media watchdog FAIR observed, has succeeded in turning some of the recent Democratic Presidential Debates into "over the top, industry-friendly spectacle[s]."

Potter, the recovering healthcare industry veteran, told Los Angeles Times columnist Michael Hiltzek: "Health insurers have been successful at two things: making money and getting the American public to believe they're essential." But, "the truth", argues Hiltzik, "is that private health insurers have contributed nothing to the American healthcare system."

Most Americans, he charges, "blindly tolerate" our inordinately expensive, yet dysfunctional private insurance system "because the vast majority...don't have a complex interaction with the healthcare system within a given year...[One percent] of patients account for more than one-fifth of all medical spending, and 10% account for two-thirds." Far too many Americans fail to appreciate the "inadequacies of our private insurance system" until those inadequacies are thrust upon them by an unexpected serious illness or injury, according to the Pulitzer Prize winning business columnist.

Hence, the need to separate healthcare insurance myth from fact-based reality...

Original Medicare is not single-payer

Medicare for All should not be confused with the existing Medicare system, whose coverage limitations opened the door to a lucrative and rapidly growing market for supplemental insurance known as "Medicare Advantage" ("MA"). After that supplemental market doubled in size over the span of a decade, MA allowed the private, for-profit insurance industry to capture $200 billion in MA premiums in a single year, 2017.

Our existing Medicare system does not eliminate all copays and deductibles. It can be especially costly for those who fall within the prescription medication coverage gap aka, the "donut hole".

Under Sanders proposed Medicare for All, annual out-of-pocket prescription drug expenses for each individual would be capped at $200 per year. Sen. Elizabeth Warren (D-MA) proposes a more modest $250/month prescription drug cap.

Unlike the current Medicare system, the new single-payer system set forth in the legislation now pending before Congress would fully cover vision, hearing, dental and long-term care. Medicare for All provides comprehensive coverage for everyone. No one would have to pay premiums, copays or deductibles.

Why Medicare for All?

The U.S. maintains an extraordinarily expensive, yet strikingly inefficient healthcare system that fails to measure up to systems offered by its single-payer counterparts. We spend nearly twice as much per capita for healthcare than the average per capita healthcare expenditures amongst the 34 single-payer nation-members of the Organization for Economic Cooperation and Development (OCED).

According to a 2014 Commonwealth Fund study, however, the U.S. healthcare delivery system ranked dead last amongst eleven industrial nations in terms of "quality, efficiency, access to care, and healthy lives." The U.S. "ranked last on infant mortality and on deaths that were potentially preventable." It also ranked "last on every measure of cost-related access." (Because access to healthcare in the U.S. is related to one's ability to pay, the inefficiencies of the system have a disparate impact upon people of color. Infant mortality amongst African-Americans, for example, is 2.3 times greater than it is amongst Non-Hispanic Whites.)

Inefficiencies remained a central problem even after key provisions of Barack Obama's Affordable Care Act ("ACA") went into effect. Citing its own healthcare efficiency index, Bloomberg reported in 2016 that the U.S. healthcare system is one of the world's "least-efficient", ranking 50th out of the 55 countries.

Our current subsidized, "free market" system is not just inefficient. It's deadly.

Where no one dies in single-payer countries due to lack of coverage, the death toll extracted by our "free market" system is nothing short of ghastly --- nearly 45,000 deaths per year, according to a 2009 Harvard Medical study. That pre-ACA study was issued at a time when 46.3 million Americans were uninsured, with 58.9 million uninsured for at least part of the year, according to the Centers for Disease Control and Prevention (CDC). By 2019, with the advent of the ACA, there were still 30.1 million Americans uninsured, according to the CDC. The decline in the number of uninsured suggests there has likely been a proportionate reduction in the current number of Americans who die each year for lack of insurance.

The 2009 Harvard Medical Study figure did not include the number of Americans who die every year because of insurance industry schemes to delay or deny authorizations for life sustaining treatment. Those schemes are by no means limited to "pre-existing conditions", which the ACA eliminated.

Although, the subsidized "free market" system ushered in by the ACA reduced the number of uninsured Americans, there are now 41 million underinsured adults [PDF] (ages 19 - 64) in the U.S. More than half (52%) of underinsured adults face medically induced financial debt.

In 2018, even after years of ACA implementation, more than 530,000 Americans filed for bankruptcy as a result of unpaid medical bills, according to a study published by the American Public Health Association. That figure includes many individuals who have insurance but can't afford exorbitant co-pays and deductibles. No one goes bankrupt by reason of unpaid medical bills in single-payer countries.

In states that have legalized physician-assisted suicides, patients faced with insurance-industry refusals to fully cover life-sustaining treatment have chosen death in order to avoid saddling their loved-ones with unpaid medical bills, according to a 2017 medical study.

Why eliminate insurers?

Together with an out-of-control pharmaceutical industry, for-profit insurers are a principal source of both exorbitant healthcare costs and inefficiencies in the United States.

In just one year (2017), Americans spent $812 billion, or 34% of our total healthcare expenditures, simply to cover administrative costs of its inefficient, multi-payer healthcare system, according to a newly released study published by the Annals of Internal Medicine (AIM). That's nearly $200 billion more than the U.S. spent on its global war machine during FY 2017.

That $812 billion administrative cost expenditure does not include the profits the insurance industry extracted from the system. In 2018, for example, the CEOs of the eight largest publicly-traded health insurance companies received a combined $145 million in total compensation. Those same companies reported $21.9 billion in profits.

The amount that the U.S. spends per capita on administrative costs ($2,497) is more than 4 ½ times greater than per capita administrative costs ($551) in Canada, a single-payer nation. By replacing our inefficient multi-payer system with a single-payer system, Americans could save $600 billion per year in administrative costs alone, according to the authors of the AIM study.

Inefficiency and waste are the principal reasons why single-payer advocates, like Wendell Potter, reject efforts to "reform" our existing multi-payer system via a "public option." During the 2009 healthcare debate in Congress, Potter supported calls to reform the existing "free market" system via the creation of a "public option", but only because it was the best that could be achieved at that time, given the political realities.

As we reported back then, both President Obama, who had met privately with health insurance executives, and the leadership of the then Democratically-controlled House essentially shut single-payer advocates out of the debate. The ACA, which was drafted by a former Wellpoint VP working in the office of Sen. Max Baucus (D-MT), would, as then predicted by Rep. Dennis Kucinich (D-OH), eventually move forward without the originally promised "public option."

Although it would have had a favorable impact with respect to "coverage", the core problem with a "public option", Potter asserts, is that it allows the private insurance industry to maintain its status as the principal gatekeeper of our dysfunctional and inefficient, profit-driven system.

Costs

The questions posed by CNN moderator Abby Phillip to Sanders and former VP Joe Biden during the Jan. 20, 2020 debate provide a paradigm example of how the corporate-owned mainstream media helps to control the public's perception of Medicare for All by filtering it through an insurance industry frame.

Whether deliberate or the result of failing to do her homework, the first part of that question was flat-out wrong.

In a Senate paper entitled, "Financing Medicare For All", the Vermont Senator laid out, in detail, multiple options to pay for Medicare for All without raising the deficit. These include, but are not limited to, the elimination of existing health tax expenditures, restoring a more progressive income tax, imposing a 70% top marginal rate for incomes over $10 million, imposing a 77% top inheritance tax rate on transfers of extreme wealth, and repealing the accounting gimmicks that have permitted the nation's largest corporations, not to mention multi-national corporations, to earn billions of dollars, yet not pay so much as one dime in federal income taxes. Sanders also mentions savings with respect to significant cuts in the military budget and by ending our forever, $6 trillion global "war on terror".

Sanders provided a direct and accurate answer to Philip's argumentative question: "Medicare for All...will cost substantially less than the status quo."

According the the Bi-Partisan Committee for a Responsible Budget, the ten-year estimated cost for a single-payer, Medicare for All system is approximately $28.32 trillion --- an enormous sum that would no doubt cause many Americans to mistakenly believe that Medicare for All is an unattainable pipe dream.

According to Sander's Senate paper filed in support of his Medicare for All Act of 2019, however, that ten-year, $28.32 trillion cost estimate to maintain a single-payer, Medicare for All system would be $18.68 trillion less than the $47 trillion the Center for Medicare & Medicaid Services ("CMS") estimated cost to maintain the ACA status quo during the period 2018 - 2027.

(According to a 11/30/18 study released by the UMass-Amherst Political Economy Research Institute (PERI), Medicare for All would save a more modest $5.1 trillion over ten years. A separate study performed by the ultra-conservative Koch-funded Mercatus Center estimated that Medicare for All would save $2 trillion over ten years. Both the Mercatus and PERI studies were cited by Sanders in his Senate paper. Both studies confirm Sanders assertion that "Medicare for All...will cost substantially less than the status quo.")

Phillip's line of questioning was a disservice to voters. Immediately after Sanders's reply, she failed to ask Biden whether it was indeed true that Medicare for All "will cost substantially less than the status quo." Instead, Phillip asked Biden: "Does Sen. Sanders owe voters a price tag on his healthcare plan?"

The CNN moderator was not alone in her disservice. Research fails to disclose a single instance over the course of seven Presidential Debates to date in which a moderator asked any of the candidates who advocate for the expansion of the ACA with a "public option" whether our current healthcare system costs more than the projected costs for Medicare for All. The "how much will it cost?" question has been reserved only for those candidates, like Sanders and Warren, who champion Medicare for All.

Taxes

The insurance industry's framing is also reflected by the degree to which Sanders and Warren have been hammered on the issue of the "taxes". What debate moderators overlook is the enormous sums, in taxes, that Americans are already paying, not for healthcare, but as subsidies to the for-profit insurance industry. Citing CMS National Health Data, Sanders' Senate paper noted that 55% of the $47 trillion ten-year cost to maintain the ACA status quo ($26 trillion) will be funded by the government.

In fairness, not all of that $26 trillion is paid as subsidies to the insurance industry under the ACA. Major portions of it currently fund Medicare and Medicaid. Nevertheless, it is troubling that debate moderators fail to press defenders of the ACA status quo on what Sanders described in "Financing Medicare for All" as the existing "healthcare tax" that he plans to eliminate.

According to Princeton University Economics Professors Anne Case and Angus Deaton, on average, Americans pay $8,000 more each year for healthcare than the citizens of any other nation. Like Sanders and Warren, they consider premiums, copays and deductibles a form of taxation, albeit, payable to the profitable private health insurance industry rather than to the government. The Princeton Professors likened the combination of the existing healthcare tax, premiums, copays and deductibles to a "tribute to a foreign power, though we're doing it to ourselves."

Sanders, proposes a modest increase in taxes paid to the federal government. He contends it would be more than offset by the elimination of premiums, copays and deductibles. After exempting the first $29,000 in income, he would impose a 4% individual income tax. In place of the monies employers now pay for group insurance coverage, Sanders, who exempts the first $2 million in payroll, would impose a 7.5% payroll tax on employers.

During one of the debates, Warren argued that Medicare for All could be fully funded without a middle-class increase in taxes paid to the government. She may well be right.

Currently, the top marginal tax rate for incomes over $510,301 is 37%. Both Sanders and Rep. Alexandria Ocasio-Cortez (D-NY) propose a 70% top marginal rate for incomes over $10 million. Curiously, when it comes to the top marginal rate, these two self-described "democratic socialists" are significantly more conservative than the former Republican President Dwight D. Eisenhower. During Ike's administration, the top marginal tax rate was 91%.

Given the degree of extreme income and wealth inequality, where one individual, Jeff Bezos, earns $215 million per day, a 91% top marginal tax rate seems reasonable. I doubt anyone would shed a tear if Bezos' take-home pay was reduced to just $2 million per day.

A 91% top marginal rate ought to be imposed on incomes over $5 million per year, as opposed to 70% on incomes over $10 million as proposed by Sanders and Ocasio-Cortez. That, and sharp cuts to our war budget, should significantly reduce, if not eliminate the need for even a modest increase in taxes the middle-class pays to the federal government.

Indeed, after treating premiums, copays and deductibles as taxes, Economics Professors Emanuel Saez and Gabriel Zuchman concluded that the adoption of the Medicare for All Act of 2019 would not only reduce middle-class taxes but would also lead to the biggest increase in take-home pay in a decade.

Ernest A. Canning is a retired attorney, author, and Vietnam Veteran (4th Infantry, Central Highlands 1968). He previously served as a Senior Advisor to Veterans For Bernie. Canning has been a member of the California state bar since 1977. In addition to a juris doctor, he has received both undergraduate and graduate degrees in political science. Follow him on twitter: @cann4ing

Ernest A. Canning is a retired attorney, author, and Vietnam Veteran (4th Infantry, Central Highlands 1968). He previously served as a Senior Advisor to Veterans For Bernie. Canning has been a member of the California state bar since 1977. In addition to a juris doctor, he has received both undergraduate and graduate degrees in political science. Follow him on twitter: @cann4ing

Sunday 'Random Acts of' Toons

Sunday 'Random Acts of' Toons From CA's 'Nuclear Deterrence' Map to Newsom's Trolling to Trump's 'Fascist Theatre' and Beyond: 'BradCast' 8/21/25

From CA's 'Nuclear Deterrence' Map to Newsom's Trolling to Trump's 'Fascist Theatre' and Beyond: 'BradCast' 8/21/25 'Green News Report' 8/21/25

'Green News Report' 8/21/25

On 'Americanism' and Trump's 'Stalinesque' Plot to Whitewash U.S. History: 'BradCast' 8/20/25

On 'Americanism' and Trump's 'Stalinesque' Plot to Whitewash U.S. History: 'BradCast' 8/20/25  Texas GOP Imprisons Dem State Lawmaker in State House Chamber: 'BradCast' 8/19/25

Texas GOP Imprisons Dem State Lawmaker in State House Chamber: 'BradCast' 8/19/25 'Green News Report' 8/19/25

'Green News Report' 8/19/25 Trump, Nazis and

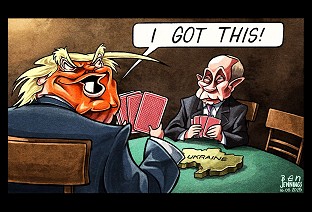

Trump, Nazis and  Sunday '

Sunday ' Newsom's 'Election Rigging Response Act'; FCC's License Renewal for Sock-Puppeting Sinclair: 'BradCast' 8/14/25

Newsom's 'Election Rigging Response Act'; FCC's License Renewal for Sock-Puppeting Sinclair: 'BradCast' 8/14/25 'Green News Report' 8/14/25

'Green News Report' 8/14/25 140 New House Reps?: Moving Beyond the Gerrymandering Wars: 'BradCast' 8/13/25

140 New House Reps?: Moving Beyond the Gerrymandering Wars: 'BradCast' 8/13/25 FCC Renews Sinclair TV Licenses Despite Complaint from Petitioner Who Died Waiting

FCC Renews Sinclair TV Licenses Despite Complaint from Petitioner Who Died Waiting It's Not About the Rule of Law, It's About Authoritarian Control: 'BradCast' 8/12/25

It's Not About the Rule of Law, It's About Authoritarian Control: 'BradCast' 8/12/25 'Green News Report' 8/12/25

'Green News Report' 8/12/25 After Vaccine Cancels, CDC Shooting, Former Officials Want RFK Out: 'BradCast' 8/11/25

After Vaccine Cancels, CDC Shooting, Former Officials Want RFK Out: 'BradCast' 8/11/25 Sunday 'All's Well' Toons

Sunday 'All's Well' Toons 'Green News Report' 8/7/25

'Green News Report' 8/7/25 Trump Wars Against Greem Energy, Democracy on VRA's 60th: 'BradCast' 8/7

Trump Wars Against Greem Energy, Democracy on VRA's 60th: 'BradCast' 8/7 Media Conglomerates Continue Trump Capitulation: 'BradCast' 8/6/25

Media Conglomerates Continue Trump Capitulation: 'BradCast' 8/6/25 Banana Republican: Trump Shoots the Labor Statistics Messenger: 'BradCast' 8/5/25

Banana Republican: Trump Shoots the Labor Statistics Messenger: 'BradCast' 8/5/25 All's Fair in Love, War and, Apparently, Part-isan Gerrymandering: 'BradCast' 8/4/25

All's Fair in Love, War and, Apparently, Part-isan Gerrymandering: 'BradCast' 8/4/25 The Art of the Corrupt, Phony, Unlawful, Pretend Trade Deal: 'BradCast' 7/31/25

The Art of the Corrupt, Phony, Unlawful, Pretend Trade Deal: 'BradCast' 7/31/25 Battle Begins Against Trump EPA Climate Regulations 'Kill Shot': 'BradCast' 7/30/25

Battle Begins Against Trump EPA Climate Regulations 'Kill Shot': 'BradCast' 7/30/25 A Pu Pu Platter of Trump Corruption: 'BradCast' 7/29/25

A Pu Pu Platter of Trump Corruption: 'BradCast' 7/29/25 'Catastrophic' GOP Cuts to Medicaid, Medicare, ACA: 'BradCast' 7/28/25

'Catastrophic' GOP Cuts to Medicaid, Medicare, ACA: 'BradCast' 7/28/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL