Today, President Obama offered an address to mark the fifth anniversary of the Lehman Brothers bankruptcy and the beginning of the 2008 collapse of the Wall Street casino or, as the President described it, "the worst economic crisis of our lifetimes." (He also spoke briefly, at the top of his remarks, on our latest mass shooting rampage which took place at the Washington D.C. Navy Yard this morning, reportedly resulting, in the deaths of at least 12 people at the military installation.)

Today, President Obama offered an address to mark the fifth anniversary of the Lehman Brothers bankruptcy and the beginning of the 2008 collapse of the Wall Street casino or, as the President described it, "the worst economic crisis of our lifetimes." (He also spoke briefly, at the top of his remarks, on our latest mass shooting rampage which took place at the Washington D.C. Navy Yard this morning, reportedly resulting, in the deaths of at least 12 people at the military installation.)

"It was five years ago, this week, that the financial crisis rocked Wall Street, and sent an economy already into recession, into a tail spin," Obama reminded us. "And it's hard sometimes to remember everything that happened during those --- those months, but in a matter of a frightening few days and weeks, some of the largest investment banks in the world failed, stock markets plunged, banks stopped lending to families and small businesses, our auto industry --- the heartbeat of American manufacturing --- was flat-lining."

The President went on to tout the reforms and the recovery that have taken place since that time, arguing that "we’ve cleared away the rubble from the financial crisis and we’ve begun to lay a new foundation for economic growth and prosperity," while conceding "we are not yet where we need to be."

"Most of the gains have gone to the top one-tenth of 1 percent," Obama correctly noted. "So, in many ways, the trends that have taken hold over the past few decades of a winner-take-all economy, where a few do better and better and better, while everybody else just treads water or loses ground, those trends have been made worse by the recession."

Over the weekend, the 40-year old advocacy group, Public Citizen, marked the same occasion of the fifth anniversary of the 2008 crash with an email blast highlighting a few numbers the President did not highlight in his remarks today, including a few jarring stats that remind us how and why, despite the modest recovery and incredibly tepid reforms of the past five years, the "too big to fail" foxes still remain firmly in charge of America's economic hen house...

- Amount the crash cost the U.S. economy: $22 trillion

- Assets of the four biggest banks in America --- JPMorgan Chase, Bank of America, Citigroup and Wachovia/Wells Fargo --- when they were “too big to fail” in 2008: $6.4 trillion

- Assets of those four banks today: $7.8 trillion

- Of the 63 former Lehman Brothers employees identified by a bankruptcy examiner as being aware of an accounting scheme Lehman used to mask its true finances, number who are employed in senior financial services positions today: 47

- Number of the 25 banks responsible for the bulk of risky subprime loans leading up to the crash that are back in the mortgage business: 25

- Chances that an American voter thinks that regulating financial products and services is "important" or "very important": 9 in 10

- Amount spent in 2012 by Wall Street and other finance industry behemoths on lobbying to roll back, water down and weasel out of the Dodd-Frank Wall Street Reform and Consumer Protection Act: $487 million

- Number of registered financial industry lobbyists in 2012: 2,429

- Number of lawsuits filed as of April of this year by Eugene Scalia, son of U.S. Supreme Court Justice Antonin Scalia, to hold up implementation of Dodd-Frank rules on legal technicalities: 7

- Rank of finance industry among all corporate election spending by sector in 2011 and 2012: 1

Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World:

Mad World: 'Green News Report' 5/15/25

'Green News Report' 5/15/25

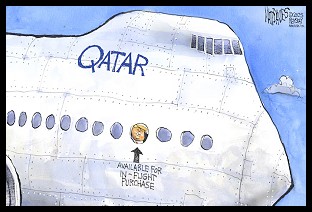

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25

'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25 'Green News Report' 5/13/25

'Green News Report' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Sunday 'New Guy, Old Guy' Toons

Sunday 'New Guy, Old Guy' Toons Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 'Green News Report' 5/8/25

'Green News Report' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25

100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL