READER COMMENTS ON

"New GOP 'Capitalism': Privatize Profits, Socialize Losses"

(10 Responses so far...)

COMMENT #1 [Permalink]

...

Phil

said on 9/18/2008 @ 1:42 pm PT...

COMMENT #2 [Permalink]

...

Phil

said on 9/18/2008 @ 1:44 pm PT...

ps you need a bradblog.com/links where we can copy cool code like that little bitty white and green "donate to bradblog" link.... just sayin..

Comeon bamboo, call me..

COMMENT #3 [Permalink]

...

MarkH

said on 9/18/2008 @ 3:30 pm PT...

Great comic. Gets right to the heart of our current politics.

COMMENT #4 [Permalink]

...

DES

said on 9/18/2008 @ 4:02 pm PT...

Some funny commentary:

• Lehman Brothers was like the little kid pulling the tail of a dog. You know the kid is going to get hurt eventually, and so no one is surprised when the dog turns around and bites the kid. But the kid only hurts himself, so no one really cares that much.

• Bear Stearns is the little pyro --- the kid who was always playing with matches. He could harm not only himself, but burns his own house down, and indeed, he could have burnt down the entire neighborhood. The Fed stepped in not to protect him, but the rest of the block.

• AIG is the kid who accidentally stumbled into a bio-tech warfare lab . . . finds all these unlabeled vials, and heads out to the playground with a handful of them jammed into his pockets.

And not so funny:

Is Financial Innovation just another word for excessive and reckless leverage?

Apparently so.

As we learn this morning via Julie Satow of the NY Sun, special exemptions from the SEC are in large part responsible for the huge build up in financial sector leverage over the past 4 years --- as well as the massive current unwind

Satow interviews the above quoted former SEC director, and he spits out the blunt truth: The current excess leverage now unwinding was the result of a purposeful SEC exemption given to five firms.

You read that right --- the events of the past year are not a mere accident, but are the results of a conscious and willful SEC decision to allow these firms to legally violate existing net capital rules that, in the past 30 years, had limited broker dealers debt-to-net capital ratio to 12-to-1.

Instead, the 2004 exemption --- given only to 5 firms --- allowed them to lever up 30 and even 40 to 1.

Who were the five that received this special exemption? You won't be surprised to learn that they were Goldman, Merrill, Lehman, Bear Stearns, and Morgan Stanley.

As Mr. Pickard points out that "The proof is in the pudding — three of the five broker-dealers have blown up."

COMMENT #5 [Permalink]

...

oneguy

said on 9/18/2008 @ 5:03 pm PT...

Comrades,

why fault the system, they were just being "Good Capitalists"

COMMENT #6 [Permalink]

...

oneguy

said on 9/18/2008 @ 5:05 pm PT...

I hope their is enough cow dung to burn so I can stay warm this winter.

soon the wait for TP will be like going to the DMV.

COMMENT #7 [Permalink]

...

Cantinero

said on 9/18/2008 @ 7:51 pm PT...

"Privatize profits, socialize losses" is a de facto definition of fascism (or Crony Capitalism, if you will). Socialism entails government ownership of the means of production (as does Communism). Free Market Capitalism is the private ownership of the means of production along with the assumption of the risk associated with doing business.

Obviously we have been barreling headlong into fascism for quite some time. Now, with the nationalization of everything from mortage banks to insurance companies (the auto industry as well?), it appears that we are now moving to embrace embrace Socialism. Should we be surprised that the NEOconservatives have reverted to their Trotskyite roots?

COMMENT #8 [Permalink]

...

Bamboo Harvester

said on 9/19/2008 @ 8:48 pm PT...

Wilber ~

How does it feel to be paying top dollar for brass tacked leather bound bankers furniture that you'll never get to see at let alone sit in . . .

COMMENT #9 [Permalink]

...

lottakatz

said on 9/21/2008 @ 1:47 pm PT...

It is so much wors that anything that we could have imagined. A couple of new puzzle pieces fell into place and I've commented on it elsewhere but it needs repeating.

The Treasury, through the bail out bill, is being turned into a true fourth branch of the government with the ability to spend any way it so wishes and the decisions will not be reviewable by any other branch of government or even by a court. A blank-check Agency. Terrifying. Link to a full quote of the relevant section and discussion:

http://www.dailykos.com/...20/153952/268/395/603713

Several talk-show commentators have said (in the last 2 days) that the test for a bail out seems to be weather or not an institution is large enough to topple foreign institutions if it fails as AIG would. Smaller institutions that would have only a domestic impact would be allowed to fail but it wasn't in any-ones interest to destabilize the economy of many countries so that would be prevented. Smaller domestic failures (and there will be many of them in the coming year) will just be tolerated.

The authority to mitigate foreign damage is now in the process of being expanded to directly bailing out foreign institutions weather they operate on American soil or not.

We are now poised through this bill to start directly bailing out failing institutions in other countries. This is the ultimate act of Republican cronyism and corruption, the wholesale looting of America and the indentured servitude of her workers for a generation. Link below:

http://rawstory.com/news...tries_to_forge_0921.html

As noted by a quote from DES, this was not an accident or a process with an unforseen end; this was deliberate inflation and profit-taking facilitated by a willing Administration and when needed, Congress.

This bill in relevant parts, needs to be stopped. Folks need to be calling their Representatives and Senators.

[Ed Note: For stricken text, see correction below. --99]

COMMENT #10 [Permalink]

...

lottakatz

said on 9/21/2008 @ 3:45 pm PT...

CORRECTION and Apology for mis-information:

I wrote in a posting above "The authority to mitigate foreign damage is now in the process of being expanded to directly bailing out foreign institutions weather they operate on American soil or not." ... "We are now poised through this bill to start directly bailing out failing institutions in other countries"

That is incorrect. Paulson's plan is to intercede for foreign institutions operating on American soil. To protect their American workers.

I apologize for the mis-information.

And Then They Came for Members of Congress...: 'BradCast' 5/20/25

And Then They Came for Members of Congress...: 'BradCast' 5/20/25 'Green News Report' 5/20/25

'Green News Report' 5/20/25

Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25

Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25 Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World:

Mad World: 'Green News Report' 5/15/25

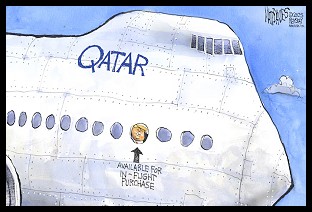

'Green News Report' 5/15/25 Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25

'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25 'Green News Report' 5/13/25

'Green News Report' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Sunday 'New Guy, Old Guy' Toons

Sunday 'New Guy, Old Guy' Toons Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 'Green News Report' 5/8/25

'Green News Report' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25

100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL