On today's BradCast: Don't believe a word you are being told by the Administration or Wall Street. Actual facts and data suggest its almost entirely all bullshit. [Audio link to show follows below.]

On today's BradCast: Don't believe a word you are being told by the Administration or Wall Street. Actual facts and data suggest its almost entirely all bullshit. [Audio link to show follows below.]

The economic outlook in the U.S. continues to quickly degrade in light of the coronavirus pandemic, with another record 6.6 million applying for unemployment benefits last week. That brings the total number of jobless claims to an unheard of 17 million or so in the past three weeks alone, with millions more unable to even apply for benefits due to still-overloaded websites and continuously busy phone lines at states across the country. The all-time weekly record for jobless claims, until three weeks ago, was 695,000. Over the past three weeks it has been 3.2 million, followed by 6.6 million, followed again by another 6.6 million.

The numbers are stultifying. For example, that 17 million figure is more than the total number of jobs added since 2013; far more than the total number of jobs in the 20 smallest U.S. states combined; and far more than every single job in the state of Texas, which has the 2nd largest state workforce in the country. The unemployment rate, believed to now be at least 12%, goes far beyond the worst days of the Great Recession and are now in Great Depression territory, with some independent economists refering to what we are now looking at as "Great Depression II". (Check out the two gobsmacking charts in WaPo's coverage today.)

And, yet, despite those data, and still climbing coronavirus cases and deaths, we are getting a whole lot of happy talk from the Administration. And not just from our desperate, pathetic Liar-in-Chief, from whom we'd expect it, but from folks like Treasury Secretary Steven Mnuchin, who absurdly suggested today on CNBC that America "could be open for business" by May! Donald Trump's Federal Reserve Chairman Jerome Powell assured the Brookings Institution that the "strong economic footing" before the COVID-19 crisis will support a "robust" recovery, as if we could expect one any day now! All of which was enough to continue the recent Wall Street rally that resulted in the biggest weekly jump in the S&P 500 since 1974!

Everything must be going great! But, of course, it isn't. At least not back here in Realityville, where the "irrational exuberance" (as long-ago Fed Chair Alan Greenspan once described it) of the Administration and Wall Street is nowhere near seeing its way to Main Street. That, even though the Fed announced $2.3 trillion in new funding schemes --- creating money out of nowhere (no Congress needed, thanks!) --- in hopes of offsetting the impact of the pandemic on the economy. The Fed initiative includes something they are calling the "Main Street Lending Program" to shovel money to "Main Street" companies with up to 10,000 workers and less than $2.5 billion in revenue. Ya know, like most of those business on your friendly local "Main Street".

At the same time, none of the promised, measly $1,200 checks for individuals from the $2.2 trillion CARES Act have made their way to Americans yet (Mnuchin says "next week!"), and the $350 billion Paycheck Protection Program (PPP) from the same emergency relief package adopted by Congress two weeks ago is still said to be mired in bureaucratic red tape at the commercial banks tapped to hand out the money (and take a cut in the bargain). There is little if any money actually getting to people and small businesses that need it most at the moment, even as Congress was bickering again on Thursday about adding another $250 billion to the program which will still be woefully underfunded even then.

But, somehow, Wall Street and the Administration are sending the message that all will be well, with America "back in business" as early as May! Don't count on it.

Investigative financial journalist DAVID DAYEN, Executive Editor of The American Prospect and author of its daily and indispensable "Unsanitized" report (which warned about all of these matters before they happened today and were only then picked up by the corporate mainstream media) joins us again to help unpack the details on all of the above, more related failures, and a few that we should be expecting in the days ahead, as the dire situation gets worse and the irrational exuberance and happy talk from D.C. and Wall Street continues impotently.

"John Edwards used to talk about the 'Two Americas'," Dayen notes. "Those two sets of statistics couldn't be starker about the Two Americas. Investors are letting the good times roll, while ordinary Americans are losing their jobs in numbers with a speed that we have never seen before."

"The difference between 2008 and today is that, in 2008, the institutions that were getting this largess were largely responsible for the downturn, whereas these businesses pretty much aren't responsible for the coronavirus. When you look at the proportionality of the response --- when you look at the neighborhood pizza shop or the neighborhood dry cleaner, and what they have to go through to survive in this Second Depression --- and you look at a 'main street' business with 10,000 workers, or the airlines, or some other large businesses, the velvet rope service they are getting, it is obviously very disproportional," he tells me.

"So let's not say nobody has been helped. We sped relief where we could, to the people who this bill was for, and that's investors on Wall Street."

Finally today, we're joined by Desi Doyen with the latest Green News Report, with some actual good news --- even if it is paired, as usual, with her usual dose of much less than good news...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25

Appeals Court Blocks Last Route for Voters to Challenge Violations of the VRA: 'BradCast' 5/19/25 Sunday 'Now Hoarding' Toons

Sunday 'Now Hoarding' Toons Mad World:

Mad World: 'Green News Report' 5/15/25

'Green News Report' 5/15/25

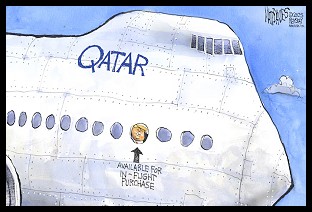

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25

Plane Corruption and the Future of the DOJ: 'BradCast' 5/14/25 'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25

'Deeply Evil': GOP Proposes Largest Medicaid Cuts in History: 'BradCast' 5/13/25 'Green News Report' 5/13/25

'Green News Report' 5/13/25 And Then They Came for the Mayors...: 'BradCast' 5/12/25

And Then They Came for the Mayors...: 'BradCast' 5/12/25 Sunday 'New Guy, Old Guy' Toons

Sunday 'New Guy, Old Guy' Toons Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25

Blowing Smoke. At the Vatican and White House: 'BradCast' 5/8/25 'Green News Report' 5/8/25

'Green News Report' 5/8/25 SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25

SCOTUS Weighs Public Funding of Religious Schools: 'BradCast' 5/7/25 Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25

Trump Judge Blocks NC GOP Theft of 2024 Supreme Court Seat: 'BradCast' 5/6/25 Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25

Prosecutors Quit After U.S Attny Strikes Deal With Felon Cop: 'BradCast' 5/5/25 Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25

Trump Losing Streak Continues into SECOND Hundred Days: 'BradCast' 5/1/25 100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25

100 Daze (w/ Digby and Driftglass): 'BradCast' 4/30/25 Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25

Campaign to 'Impeach Trump Again' Gains Fresh Momentum: 'BradCast' 4/29/25 And Then They Came for the Judges...: 'BradCast' 4/28/25

And Then They Came for the Judges...: 'BradCast' 4/28/25 Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

Trump EPA Guts Enviro Justice Office: 'BradCast' 4/24/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL