On today's BradCast: Tax cuts by executive fiat? It may depend on what the definition of "cost" is. Republicans used to pretend to oppose "Imperial Presidencies" --- at least when the President in question was Barack Obama --- but, hey, things change. [Audio link to show is posted below.]

On today's BradCast: Tax cuts by executive fiat? It may depend on what the definition of "cost" is. Republicans used to pretend to oppose "Imperial Presidencies" --- at least when the President in question was Barack Obama --- but, hey, things change. [Audio link to show is posted below.]

First up today, however, we begin with some good news for a change! The Michigan Supreme Court late on Tuesday, approved a wildly popular, non-partisan, grassroots anti-gerrymandering measure for this November's statewide ballot, after GOP opposition to the initiative. Michigan's Proposal 2 is just one of several encouraging election reforms that Michiganders will be able to vote for (or against) during this year's midterms. And, MI is just one of several states (along with Missouri, Utah, and Colorado) that will see citizen-driven initiatives to end the scourge of partisan redistricting on this year's ballot!

More good news: A U.S. court of appeals in California on Wednesday upheld a lower court ruling finding Donald Trump's executive order barring federal funds to so-called "sanctuary cities" as unconstitutional.

Then, several new studies find record corporate profits --- both before and after the Trump/GOP tax cuts to corporations and the wealthy late last year --- are being spent mostly on stock buybacks, rather than increased worker wages, as Republicans had pretended would be the case when they rammed last year's massive tax cuts through Congress. Those cuts have already raised the federal deficit above $1 trillion, rather than paying for themselves as promised.

At the same time, Trump's Dept. of Treasury is now said to be considering a controversial scheme to bypass Congress entirely in order to offer at least another $100 billion in tax cuts to the wealthiest Americans. We're joined today by ALEXANDRA THORNTON, former tax policy adviser to the U.S. Senate Finance Committee, now Senior Director of Tax Policy for Economic Policy at the Center for American Progress. She tells me: "We already have very low taxes on capital income, capital gains, and now they want to make it lower."

Thornton explains Treasury Secretary Steven Mnuchin's planned scheme that would reinterpret the word "cost" in the federal Revenue Act of 1918 in order to index the already very low tax rate on income earned via investment in stocks and real estate to inflation, and how doing so by executive branch fiat would most likely be unlawful. (At least the George W. Bush Administration found that to be the case when they considered a similar plan.)

"Here is this administration that's been talking about 'regulatory overreach' and wanting to get rid of all these regulations, and now they want to go beyond their authority to pass a regulation that gives this gigantic tax cut almost exclusively to the wealthy. It's incredibly hypocritical."

Thornton also debunks the long-held GOP "fairy tale" that tax cuts pay for themselves by growing the economy, rather than blowing holes in the national debt and deficit, and further helps explain why last year's tax cuts, as passed without any Democratic votes, may not be working quite as well as a campaign issue for Republicans before the midterms as they had hoped.

"This is all part of the conservative mantra that if we tax investment that'll slow down economic growth. There's really no evidence for that at all. Basically, what they say is that we need to cut taxes on any kind of income, and eventually that will mean that we'll be able to invest in more things in the economy which will make workers more productive, and when they become more productive their wages can go up and there will be more jobs. And it's a fairy tale. It's basically never happened. It doesn't work like that."

Finally today, Senate Majority Leader Mitch McConnell cancelled this year's August Senate recess in hopes of ramming through a bunch of Trump's federal judicial nominees and his pick for the U.S. Supreme Court, Brett Kavanaugh. His hope was to do so before Republicans potentially lose their slim majority in the U.S. Senate in the fall elections. But that plan may be facing an unexpected hurdle from Arizona's outgoing U.S. Senator Jeff Flake, who is currently in Africa observing the hand-counting of hand-marked paper ballots in Zimbabwe's historic election. He may not be returning to D.C. anytime soon, according to some Senate staffers, which could stymie the possibility of any nominees being voted out of the Senate Judiciary Committee (which is deadlocked at 10 to 10 without Flake's presence), and perhaps even prevent floor votes in a 49-49 Senate with both Flake and ailing fellow Arizona Senator John McCain both missing. Is Flake, who claims to be a Trump opponent (even while voting for most of his agenda anyway) finally taking some form of real action in response?...

(Snail mail support to "Brad Friedman, 7095 Hollywood Blvd., #594 Los Angeles, CA 90028" always welcome too!)

|

'Green News Report' 11/18/25

'Green News Report' 11/18/25

A Kaleidoscope of Trump Corruption: 'BradCast' 11/17/25

A Kaleidoscope of Trump Corruption: 'BradCast' 11/17/25  Sunday 'Back to Business' Toons

Sunday 'Back to Business' Toons Trump DOJ Takes Stand

Trump DOJ Takes Stand 'Green News Report' 11/13/25

'Green News Report' 11/13/25 Mamdani's 'Surprisingly Affordable' Afford-ability Agenda for NYC: 'BradCast' 11/12

Mamdani's 'Surprisingly Affordable' Afford-ability Agenda for NYC: 'BradCast' 11/12 After the Shutdown and Before the Next One: 'BradCast' 11/11/25

After the Shutdown and Before the Next One: 'BradCast' 11/11/25 'Green News Report' 11/11/25

'Green News Report' 11/11/25 Victories for Democracy in Election 2025; Also: 7 Dems, 1 Indie Vote to End Shutdown in Senate: 'BradCast' 11/10/25

Victories for Democracy in Election 2025; Also: 7 Dems, 1 Indie Vote to End Shutdown in Senate: 'BradCast' 11/10/25 Sunday 'Ass Kicking' Toons

Sunday 'Ass Kicking' Toons 'We Can See Light at the End of the Tunnel' After Election 2025: 'BradCast' 11/6/25

'We Can See Light at the End of the Tunnel' After Election 2025: 'BradCast' 11/6/25 'Green News Report' 11/6/25

'Green News Report' 11/6/25 BLUE WAVE! Dems Win Everything Everywhere All at Once: 'BradCast' 11/5/25

BLUE WAVE! Dems Win Everything Everywhere All at Once: 'BradCast' 11/5/25 Repub Thuggery As Americans Vote: 'BradCast' 11/4/25

Repub Thuggery As Americans Vote: 'BradCast' 11/4/25 Last Call(s) Before Election Day 2025: 'BradCast' 11/3/25

Last Call(s) Before Election Day 2025: 'BradCast' 11/3/25 A Pretty Weak 'Strongman': 'BradCast' 10/30/25

A Pretty Weak 'Strongman': 'BradCast' 10/30/25 Proposal for 'Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29

Proposal for 'Politically Viable Wealth Tax' Takes Shape in CA: 'BradCast' 10/29 Monster Storm, Endless Wars, Gamed Elections: 'BradCast' 10/28/25

Monster Storm, Endless Wars, Gamed Elections: 'BradCast' 10/28/25 Let's Play 'Who Wants to Be a U.S. Citizen?'!: 'BradCast' 10/27/25

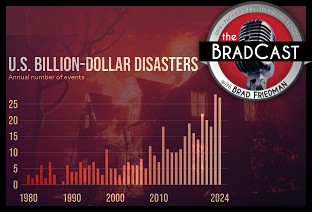

Let's Play 'Who Wants to Be a U.S. Citizen?'!: 'BradCast' 10/27/25 Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25

Exiled NOAA Scientists Resurrect Critical Disaster Database: 'BradCast' 10/23/25

VA GOP VOTER REG FRAUDSTER OFF HOOK

VA GOP VOTER REG FRAUDSTER OFF HOOK Criminal GOP Voter Registration Fraud Probe Expanding in VA

Criminal GOP Voter Registration Fraud Probe Expanding in VA DOJ PROBE SOUGHT AFTER VA ARREST

DOJ PROBE SOUGHT AFTER VA ARREST Arrest in VA: GOP Voter Reg Scandal Widens

Arrest in VA: GOP Voter Reg Scandal Widens ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC

ALL TOGETHER: ROVE, SPROUL, KOCHS, RNC LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States'

LATimes: RNC's 'Fired' Sproul Working for Repubs in 'as Many as 30 States' 'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States

'Fired' Sproul Group 'Cloned', Still Working for Republicans in At Least 10 States FINALLY: FOX ON GOP REG FRAUD SCANDAL

FINALLY: FOX ON GOP REG FRAUD SCANDAL COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION

COLORADO FOLLOWS FLORIDA WITH GOP CRIMINAL INVESTIGATION CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL

CRIMINAL PROBE LAUNCHED INTO GOP VOTER REGISTRATION FRAUD SCANDAL IN FL Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV

Brad Breaks PA Photo ID & GOP Registration Fraud Scandal News on Hartmann TV  CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM

CAUGHT ON TAPE: COORDINATED NATIONWIDE GOP VOTER REG SCAM CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM

CRIMINAL ELECTION FRAUD COMPLAINT FILED AGAINST GOP 'FRAUD' FIRM RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL

RICK SCOTT GETS ROLLED IN GOP REGISTRATION FRAUD SCANDAL VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV

VIDEO: Brad Breaks GOP Reg Fraud Scandal on Hartmann TV RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD

RNC FIRES NATIONAL VOTER REGISTRATION FIRM FOR FRAUD EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud

EXCLUSIVE: Intvw w/ FL Official Who First Discovered GOP Reg Fraud GOP REGISTRATION FRAUD FOUND IN FL

GOP REGISTRATION FRAUD FOUND IN FL